- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Is IPO Uncertainty and Regulatory Scrutiny Reshaping the Investment Case for Fannie Mae (FNMA)?

Reviewed by Sasha Jovanovic

- Recent news has spotlighted Federal National Mortgage Association (Fannie Mae) as reform proposals and regulatory scrutiny shape the outlook for the government-sponsored mortgage giant.

- High-profile investor commentary on IPO timing and ongoing investigations into the Federal Housing Finance Agency have heightened uncertainty for Fannie Mae's future structure and regulatory environment.

- We’ll explore how renewed discussions on Fannie Mae’s IPO process and regulatory attention impact the company’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Federal National Mortgage Association's Investment Narrative?

To be comfortable owning Fannie Mae, an investor needs to believe that the company’s potential IPO, regulatory status, and leadership changes can unlock value despite persistent risks. The latest news injects even more uncertainty into the story, with prominent investor Bill Ackman urging caution on IPO timing and proposing major reforms, while investigations into the Federal Housing Finance Agency threaten additional oversight and reputational issues. This comes at a time when Fannie Mae’s earnings are down year-on-year, management turnover has picked up, and share price volatility has increased. While pre-news analysis flagged IPO progress and regulator actions as top catalysts, and governance stability as a key risk, these catalysts now hinge more on the evolving regulatory debate and Fannie Mae’s ability to maintain operational stability amid external pressures. Recent moves in the company’s share price suggest that the market is responding directly to this changing risk profile and the possibility of delays or changes to the IPO.

However, questions remain about the impact of ongoing investigations on Fannie Mae’s long-term structure.

Exploring Other Perspectives

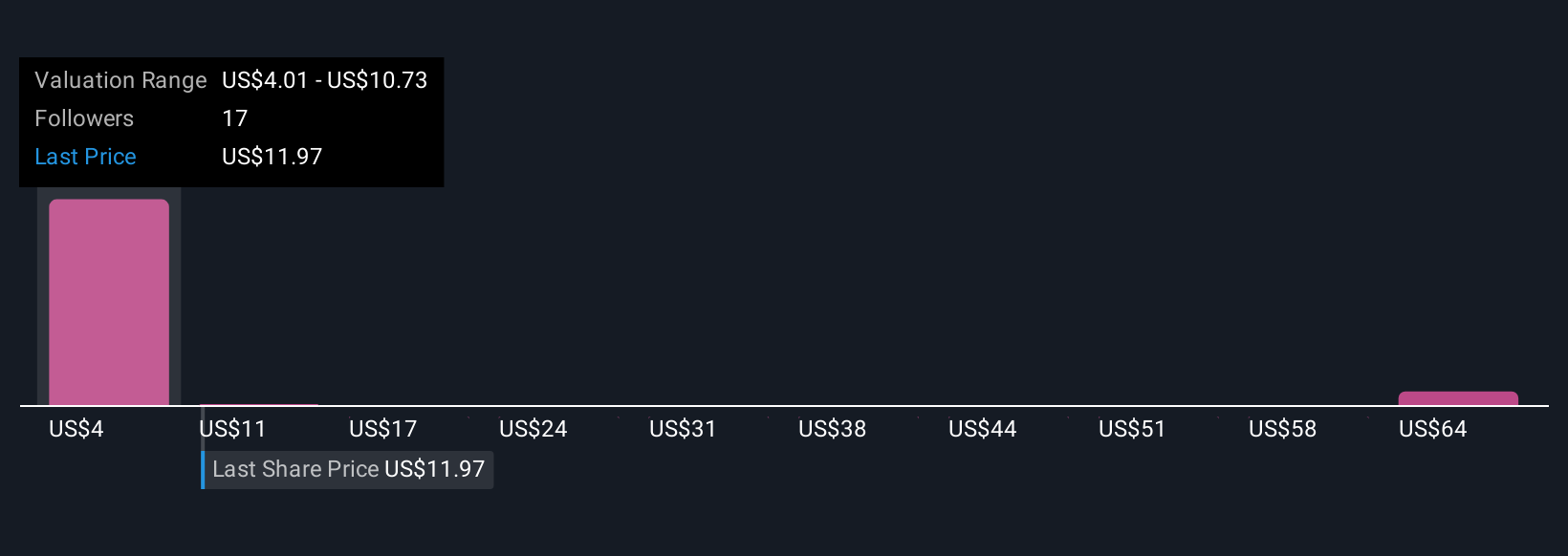

Explore 12 other fair value estimates on Federal National Mortgage Association - why the stock might be worth less than half the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives