- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Is Fannie Mae’s Valuation Justified After 185% 2024 Rally and Regulatory Headlines?

Reviewed by Bailey Pemberton

- Wondering if Federal National Mortgage Association is truly an undervalued opportunity or if the recent buzz has already been priced in? Let’s take a closer look at how the market and latest developments line up for anyone seeking insight on FNMA’s value story.

- After an electrifying rally with the share price soaring 185.2% year-to-date and 210.4% over the past 12 months, the stock has recently cooled off, falling 13.8% in the last week and 15.0% over the last month.

- Much of this recent volatility has been driven by ongoing discussions about regulatory changes impacting the mortgage market and news articles highlighting shifts in government oversight. These developments are raising both hopes and questions about FNMA’s long-term growth potential and risk exposure.

- On valuation checks, Federal National Mortgage Association scores a 3 out of 6, which puts it at a crossroads. There are factors arguing both for and against its value case. Up next, we’ll dig into how these scores are calculated and why there might be an even smarter way to assess FNMA’s true worth.

Approach 1: Federal National Mortgage Association Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors gauge whether a stock might currently be undervalued or overvalued, based purely on its expected ability to generate cash in the years ahead.

For Federal National Mortgage Association, the most recent Free Cash Flow (FCF) reported is $5.6 billion. Based on analyst estimates and forward-looking projections, the company’s FCF for the next decade is expected to decline significantly, reaching $974 million by 2035. Analysts provide direct estimates for up to five years. Projections beyond that rely on historical trends.

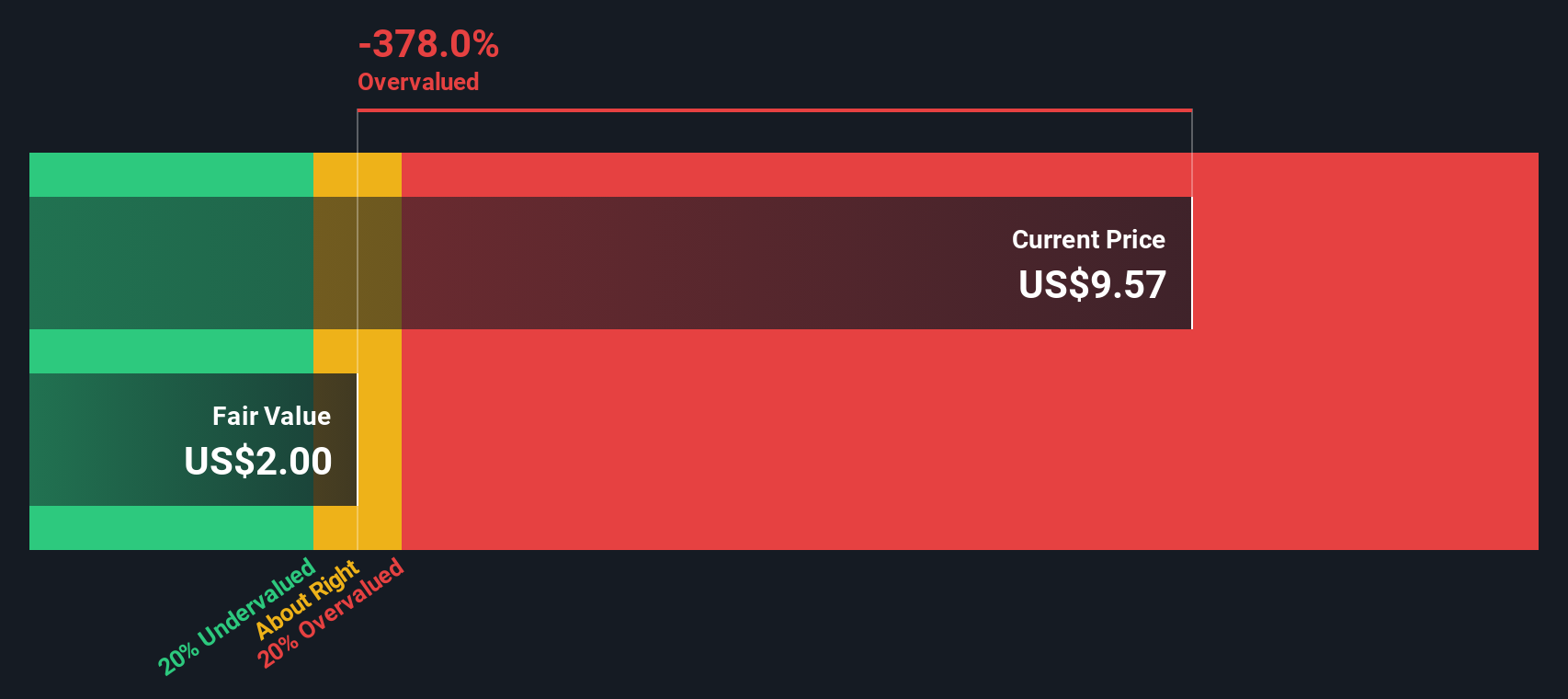

Using these projections, the DCF model estimates an intrinsic fair value of $2.00 per share. At current trading levels, this results in a steep implied discount of -390.0%, indicating the market is pricing Federal National Mortgage Association far above what the DCF model suggests is justified by its future cash flow prospects.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Federal National Mortgage Association may be overvalued by 390.0%. Discover 925 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Federal National Mortgage Association Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation multiple for companies where profits are volatile or inconsistent, as it focuses on revenue rather than earnings. Since Federal National Mortgage Association operates in a complex, highly regulated industry where profits can fluctuate, the P/S ratio offers a clear lens for comparing its value to peers and the broader market.

Typically, companies with higher growth prospects and lower risk profiles tend to warrant higher P/S ratios. Conversely, elevated risks, weak margins, or slow growth might suggest a company should trade at a lower P/S. Assessing Federal National Mortgage Association’s current ratio provides useful market context about expectations and sentiment.

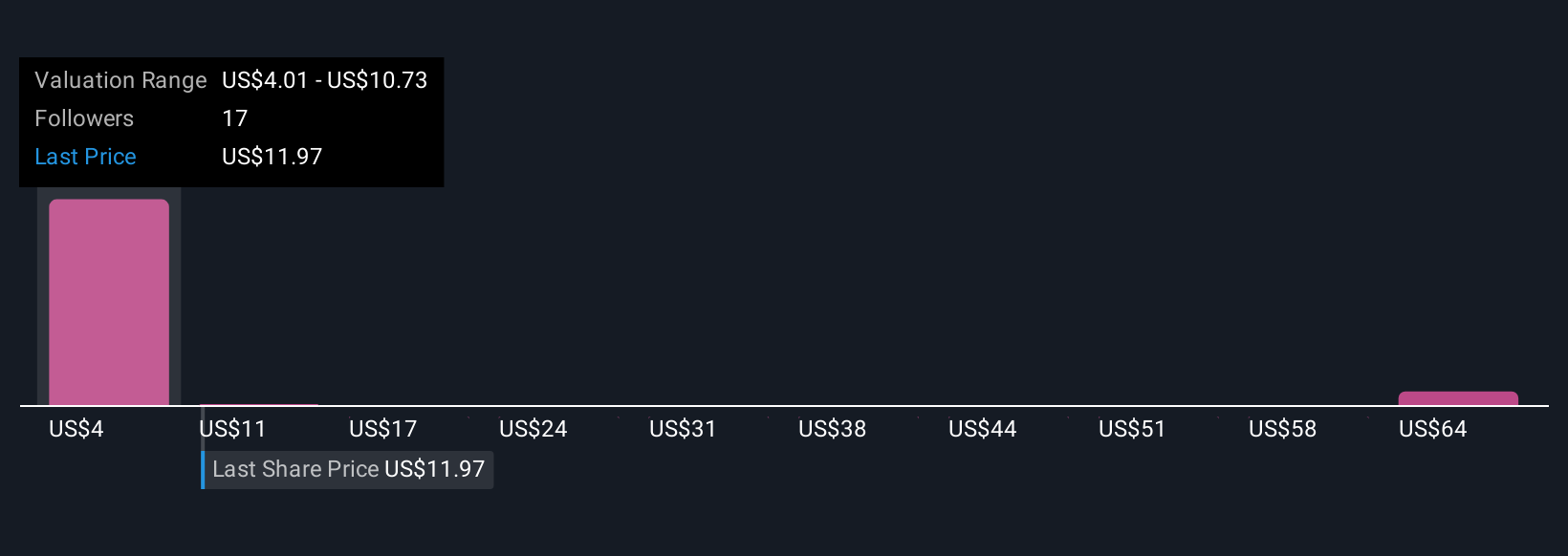

Currently, Federal National Mortgage Association trades at a P/S ratio of 1.98x, placing it below both the Diversified Financial industry average of 2.52x and the peer group average of 4.05x. However, Simply Wall St’s proprietary Fair Ratio model, which adjusts for factors like growth, risk profile, profit margins, and market cap, suggests a fair P/S of 6.65x for FNMA.

Unlike simple peer or industry comparisons, the Fair Ratio offers a more comprehensive valuation benchmark by taking into account the company’s unique qualities and context. Since FNMA’s actual P/S multiple is significantly lower than its Fair Ratio, this indicates a potential undervaluation based on the company’s fundamentals and prospects.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federal National Mortgage Association Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story investors create that connects their views on a company’s future, such as where revenue or profit margins are headed, with a clear fair value. Think of Narratives as blending your personal perspective with the numbers, making sense of not just where the stock has been, but where it could go.

Available right on Simply Wall St's Community page, Narratives are used by millions to make investment decisions more accessible and interactive. They help investors decide whether to buy, hold, or sell Federal National Mortgage Association by letting you compare Fair Value, based on your own story, with the current Price. Whenever fresh information hits the market, Narratives automatically update, keeping your outlook relevant and up to date.

For example, some investors see Federal National Mortgage Association’s fair value as high as $5.00 per share, while others, with a more cautious view, estimate it as low as $1.25. This range shows how Narratives capture different stories, letting every investor choose what matters most to them.

Do you think there's more to the story for Federal National Mortgage Association? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success