- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Has Fannie Mae’s Recent Policy News Created a Hidden Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Federal National Mortgage Association is a hidden bargain or just riding the hype? Let's take a closer look at what might be driving its value right now.

- The stock price has surged an impressive 165.4% year-to-date and 1832.1% over the last three years. However, there have been pullbacks of -17.9% in the past week and -14.2% over the last month.

- In recent weeks, the market has responded to headlines about shifting government policies in the mortgage industry and renewed speculation over the company's long-term role in U.S. housing finance. These news items have created both excitement and uncertainty, making price moves even more dramatic.

- When it comes to valuation, Federal National Mortgage Association scores a 3 out of 6 on our checklist of undervalued factors (see full score). We will dig into the different ways you can value the company and share an even more insightful method at the end of this article.

Approach 1: Federal National Mortgage Association Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to their present value. This approach helps uncover what the business may truly be worth, based on how much cash it can generate in the years ahead.

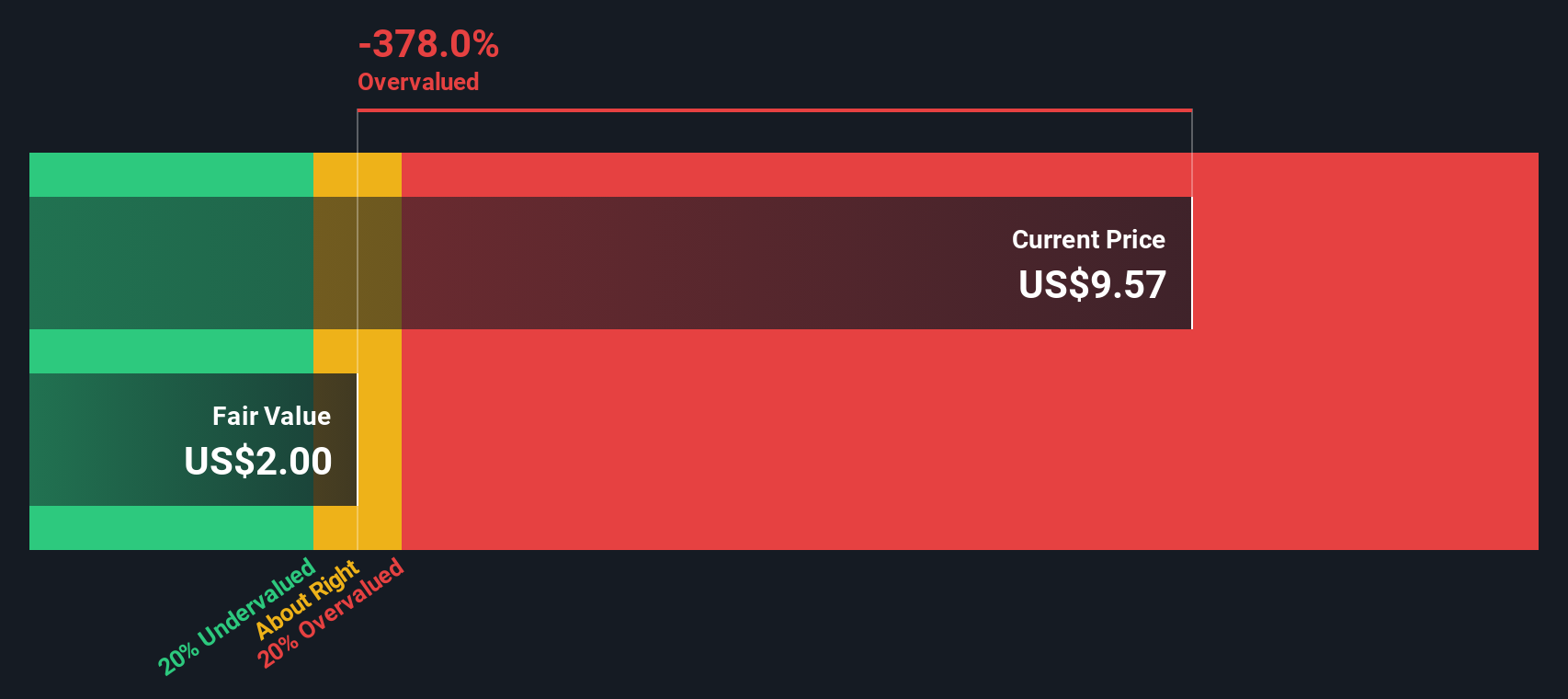

For Federal National Mortgage Association, analysts estimate Free Cash Flow (FCF) for the last twelve months at $5.6 Billion. Over the next five years, FCF is expected to decline, dropping as low as an estimated $1.8 Billion in 2027, according to available projections. Beyond that, FCF continues to decrease slightly, with figures for 2035 extrapolated at just under $1 Billion. These longer-term estimates rely on Simply Wall St's models, since analysts only forecast out about five years.

Discounting all future projected cash flows results in an intrinsic value per share of $2.00. Compared to the current market price, this suggests the stock is dramatically overvalued by around 356.1%.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Federal National Mortgage Association may be overvalued by 356.1%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Federal National Mortgage Association Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for companies like Federal National Mortgage Association that may not be consistently profitable but generate significant revenue. This ratio helps investors value the company relative to its sales, which can offer a clearer picture when profits fluctuate or are negative, as is currently the case for FNMA.

Growth prospects and business risks play a big part in determining what a fair P/S ratio should be. Companies with higher expected growth or lower risk typically trade at higher multiples, while those with greater uncertainty or slower growth see discounted multiples.

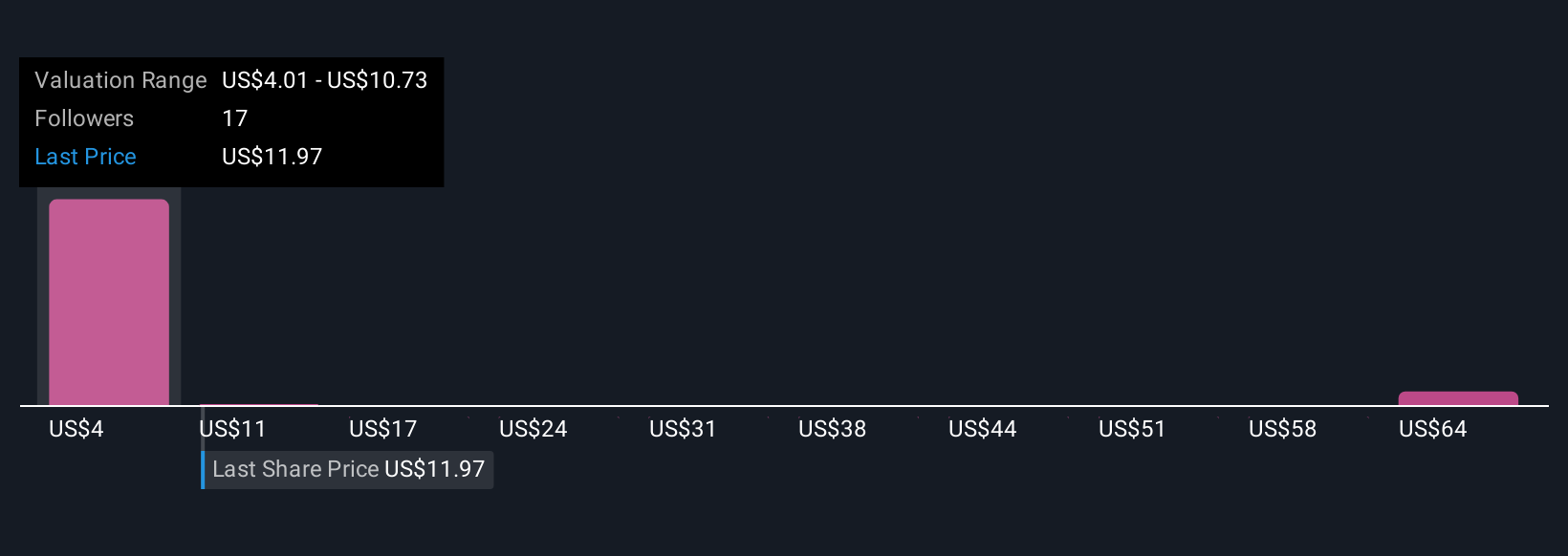

Federal National Mortgage Association has a current P/S ratio of 1.84x. This compares to an industry average of 2.43x and a peer average of 3.68x, suggesting the stock trades at a discount to both its sector and similar companies.

However, Simply Wall St’s “Fair Ratio” goes beyond these surface comparisons. Calculated at 6.81x for FNMA, the Fair Ratio incorporates growth expectations, risk profile, profit margin, industry effects, and market capitalization. This proprietary approach is designed to provide a more tailored benchmark, reflecting all key factors affecting the company’s true value potential.

Looking at the Fair Ratio of 6.81x versus the current P/S of 1.84x, the stock appears deeply undervalued based on this comprehensive measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federal National Mortgage Association Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company’s future. It is where you combine your own assumptions for things like fair value, future revenue, earnings, and profit margins, and create a story that explains why you believe those numbers make sense.

A Narrative connects the dots from the company’s story, through your financial forecast, and all the way to a clear estimate of fair value. This approach makes it far easier and more intuitive to see how your beliefs drive your investment decisions.

Available right on Simply Wall St’s Community page (used by millions of investors), Narratives empower you to decide when to buy or sell by comparing your Fair Value to the current market price. They are always up-to-date and automatically recalculate as soon as fresh news, earnings, or analyst estimates are released.

For example, some investors might see Federal National Mortgage Association’s potential turnaround and set their Fair Value far above the current price, while others may remain cautious and estimate a much lower value based on risk.

Do you think there's more to the story for Federal National Mortgage Association? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives