- United States

- /

- Diversified Financial

- /

- OTCPK:FMCC

Is Now the Right Time to Reassess Freddie Mac After 173% Price Rally in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Federal Home Loan Mortgage’s impressive price run means you’ve missed out on value, or if there’s still an opportunity hiding in plain sight?

- The stock has been anything but quiet this year, with a staggering 173.6% gain year-to-date and a 194.6% rise over the past 12 months. Short-term moves have been choppy, with a 10.1% drop in the past 7 days and a 15.0% decline in the last month.

- Recent news coverage has focused on the evolving regulatory landscape for mortgage giants like Federal Home Loan Mortgage. Industry-wide changes could affect access to capital and risk management. These stories have fueled both excitement and caution among investors, adding further twists to the stock's recent moves.

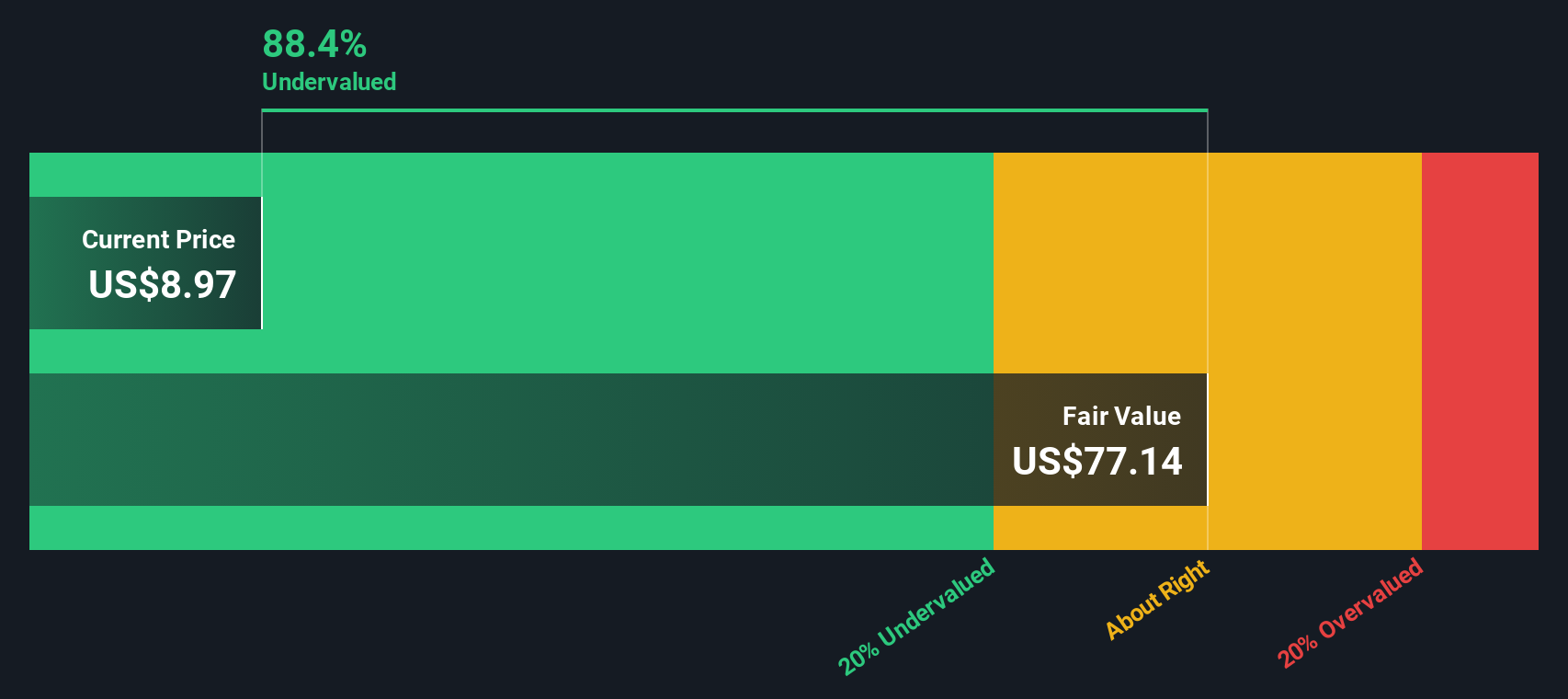

- When it comes to valuation, Federal Home Loan Mortgage scores a solid 5 out of 6 using the standard undervaluation checks. We will break down these approaches in detail and explore another insightful way to assess if the stock’s current price is fair.

Approach 1: Federal Home Loan Mortgage Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors understand the value of a business based on its ability to generate cash in the future.

For Federal Home Loan Mortgage, the analysis starts with the company’s last twelve months’ Free Cash Flow (FCF) of $15,895 Million. Using a 2 Stage Free Cash Flow to Equity Model, cash flows are projected over the next decade. By 2026, analysts expect FCF to reach approximately $21.3 Billion, growing at a rate of about 34% per year before slowing to 4.5% by 2035, when projected FCF is $53.3 Billion. While analysts provide solid estimates for the first five years, the later years use reasonable extrapolations to map out the long-term outlook.

The resulting intrinsic value for Federal Home Loan Mortgage using DCF is $119.21 per share. With the current share price significantly lower, the model implies the stock is trading at a 92.3% discount to its fair value. This suggests the market may be greatly undervaluing future cash flows and growth potential for this mortgage giant.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Federal Home Loan Mortgage is undervalued by 92.3%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

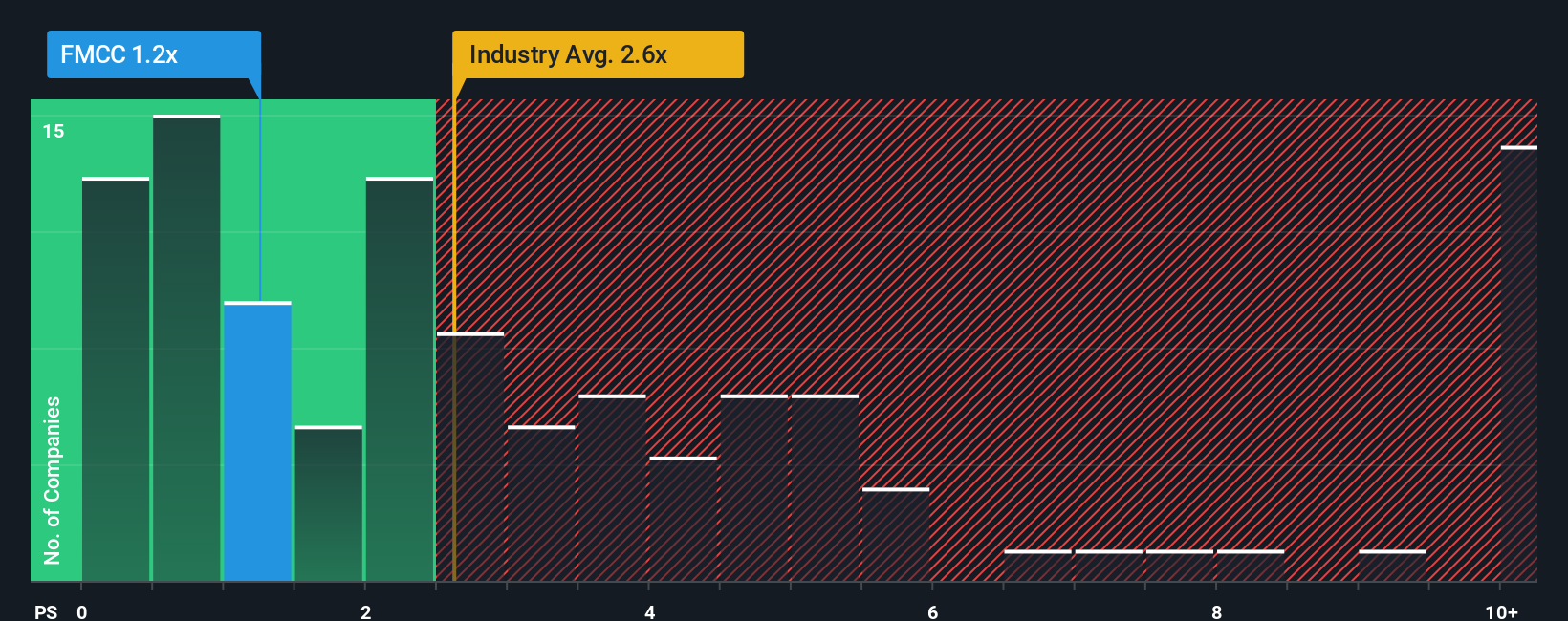

Approach 2: Federal Home Loan Mortgage Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation metric for companies like Federal Home Loan Mortgage, especially when earnings can be volatile due to one-off events or cyclical factors. It works by comparing a company’s market value to its total sales, making it useful for evaluating financial institutions where top-line revenue is a strong indicator of business scale and performance.

When assessing what a "normal" or "fair" P/S ratio should be, investors often consider factors such as a company’s growth prospects and risk profile. Higher growth companies or those with very stable revenues are often rewarded with higher P/S ratios. Riskier or slower-growing businesses typically trade at lower multiples.

Currently, Federal Home Loan Mortgage trades at a P/S ratio of 1.32x. This is notably below the Diversified Financial industry average of 2.52x and also lower than the peer average of 4.11x. However, Simply Wall St’s proprietary Fair Ratio, which accounts for the company’s unique fundamentals such as profit margins, growth rates, risk factors, and market capitalization, is calculated to be 5.69x.

The Fair Ratio offers a more tailored benchmark than general peer or industry comparisons because it evaluates Federal Home Loan Mortgage’s valuation in light of its specific strengths and risks, not just broad market trends. This makes it a more insightful guide for retail investors seeking a true sense of value.

Comparing the Fair Ratio of 5.69x with the actual P/S of 1.32x, Federal Home Loan Mortgage appears significantly undervalued based on this method.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federal Home Loan Mortgage Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story or perspective behind a company’s numbers, where you can explain the assumptions you believe are most likely, such as future revenue, margins, earnings, and ultimately a fair value.

With Narratives, you connect the company’s unique story directly to its financial forecast, translating your outlook into a fair value that you can compare with today’s market price. Narratives are simple and available on the Simply Wall St platform, used by millions of investors, on the Community page, making them accessible to anyone.

This tool helps you decide when to buy or sell by clearly showing how your fair value stacks up against the current price, and it dynamically adjusts as new earnings or news are released. For example, two investors might have very different views, one believing Federal Home Loan Mortgage’s fair value is $150 per share based on strong growth, while another might see it at just $83 considering higher risks, which leads to individualized, informed decisions.

Do you think there's more to the story for Federal Home Loan Mortgage? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMCC

Federal Home Loan Mortgage

Operates in the secondary mortgage market in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success