- United States

- /

- Diversified Financial

- /

- OTCPK:FMCC

A Look at Freddie Mac’s (FMCC) Valuation Following Rollout of Quality Control Advisor Plus Platform and Housing Sector Tailwinds

Reviewed by Simply Wall St

Federal Home Loan Mortgage (FMCC) is rolling out its Quality Control Advisor Plus platform, unifying quality control systems to help lenders cut loan defects and speed up processing. This move comes at a time of lower mortgage rates and strong pending home sales data.

See our latest analysis for Federal Home Loan Mortgage.

Federal Home Loan Mortgage’s share price has soared recently, climbing 4.56% in just one day and 186.05% year-to-date, with a staggering 1-year total shareholder return of 210.97%. Momentum has been building as investors respond to a string of operational improvements, including the rollout of its Quality Control Advisor Plus platform, resilient housing demand, and new multifamily lending initiatives.

If you’re interested in what else might be gaining ground, this is a timely moment to expand your search and discover fast growing stocks with high insider ownership

With such strong gains and ongoing operational enhancements, the real question now is whether Federal Home Loan Mortgage shares remain undervalued or if the current rally has already factored in all the future growth potential for investors.

Price-to-Sales Ratio of 1.4x: Is it justified?

Federal Home Loan Mortgage is currently trading at a price-to-sales ratio of 1.4x, suggesting the market is valuing its revenues more conservatively than its industry peers. The last close was $9.64, putting the stock well below both the peer average and estimated “fair” sales multiples.

The price-to-sales ratio shows how much investors are willing to pay for each dollar of company sales and is widely used for financial institutions with unpredictable or negative earnings. For a company like Federal Home Loan Mortgage, which has not posted consistent profits, this multiple helps anchor valuation in actual revenue generation rather than future expectations.

Compared to the US Diversified Financial industry, with an average price-to-sales ratio of 2.5x, FMCC is trading at a noticeable discount. The peer group average is even higher at 3.6x, indicating that the market is significantly discounting FMCC’s stock. In addition, the estimated “fair” price-to-sales ratio of 5.7x highlights considerable implied upside if market sentiment shifts. This discrepancy signals that, relative to both peers and an objective fair value target, FMCC is notably undervalued on this metric.

Explore the SWS fair ratio for Federal Home Loan Mortgage

Result: Price-to-Sales Ratio of 1.4x (UNDERVALUED)

However, persistent negative net income and the potential for slower revenue growth could present challenges to the positive outlook for Federal Home Loan Mortgage shares.

Find out about the key risks to this Federal Home Loan Mortgage narrative.

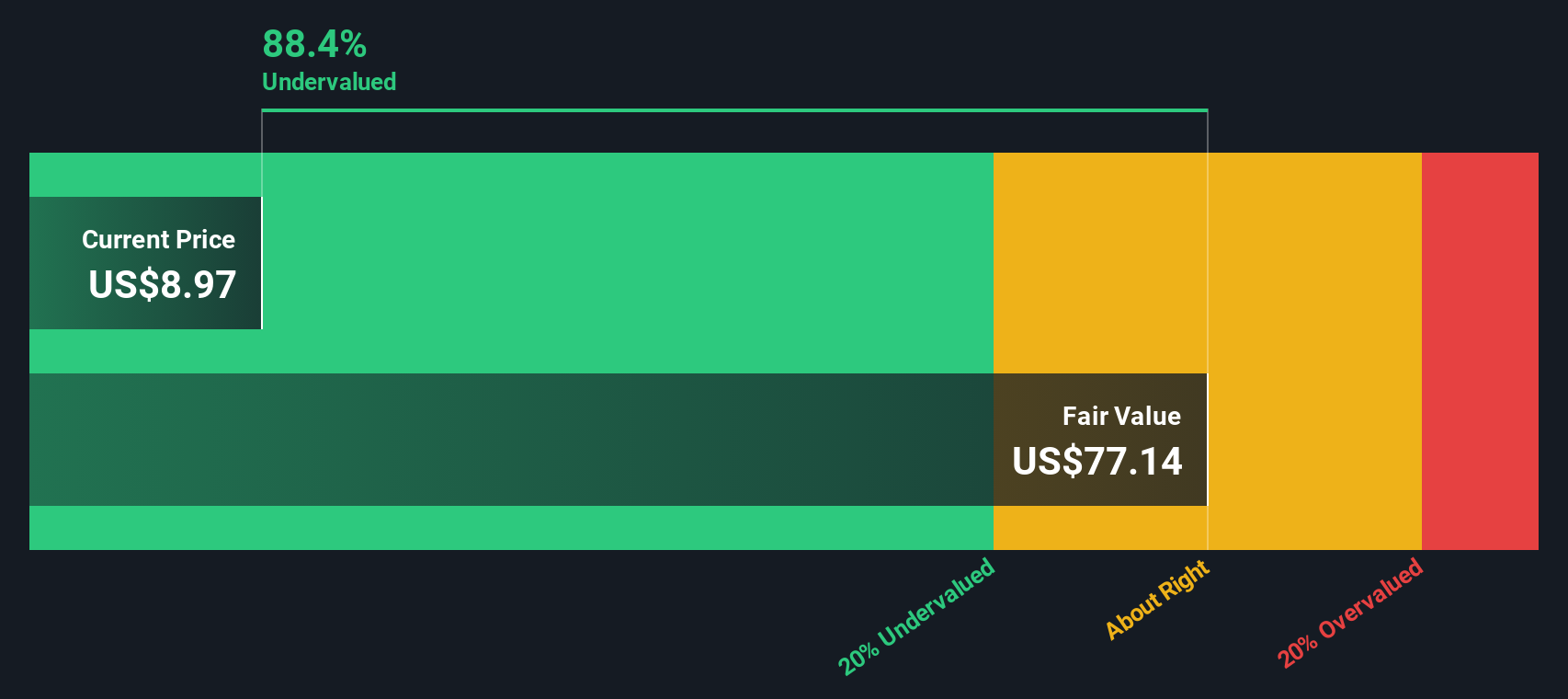

Another View: SWS DCF Model Shows Even Deeper Discount

Looking through the lens of our SWS DCF model, Federal Home Loan Mortgage appears dramatically undervalued. While the price-to-sales ratio is already signaling a bargain, our DCF estimate places fair value far above the current price. This suggests an even wider margin of upside. Could this be a value trap, or has the market overlooked long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Home Loan Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Home Loan Mortgage Narrative

If you see things differently or want to dive into your own research and build your own story, you can easily do so in just a few minutes. Do it your way.

A great starting point for your Federal Home Loan Mortgage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Your next opportunity could be just a click away. Use the power of the Simply Wall Street Screener to unlock promising stocks before the rest of the market catches on.

- Profit from future breakthroughs by identifying industry pioneers. Jump into these 25 AI penny stocks offering exciting advancements in artificial intelligence, automation, and digital transformation.

- Spot potential bargains for growth by checking out these 913 undervalued stocks based on cash flows, featuring strong cash flow companies currently trading below their true worth.

- Strengthen your portfolio with regular income by tapping into these 15 dividend stocks with yields > 3%, highlighting stocks that offer consistent yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMCC

Federal Home Loan Mortgage

Operates in the secondary mortgage market in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026