- United States

- /

- Diversified Financial

- /

- OTCPK:FMCC

A Fresh Look at Freddie Mac (FMCC) Valuation After Recent Share Gains and Volatility

Reviewed by Simply Wall St

Federal Home Loan Mortgage (FMCC) shares moved slightly higher today, catching the attention of investors looking for value in the mortgage sector. After a modest daily gain, the stock’s momentum invites a closer look at recent performance.

See our latest analysis for Federal Home Loan Mortgage.

After a sharp rally this year, with a year-to-date share price return of 141.25%, Federal Home Loan Mortgage has experienced some turbulence lately. This is shown by a 16.1% drop over the past week. Still, long-term investors have been rewarded, with a three-year total shareholder return of over 1,500%. This suggests momentum has been building despite short-term volatility.

If you want to see what other fast-moving opportunities are out there, now's a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such dramatic gains and recent volatility, investors now have to ask: Is Federal Home Loan Mortgage’s valuation still compelling, or has the market already priced in the company’s next chapter of growth?

Price-to-Sales of 1.2x: Is it justified?

Federal Home Loan Mortgage trades at a price-to-sales ratio of 1.2x, which suggests its shares are priced much lower than both peers and the industry average at the last close price of $8.13.

The price-to-sales (P/S) ratio compares a company's market value to its total revenues, making it especially relevant for firms that are not currently profitable. It is often used for financial businesses like FMCC, where earnings can be volatile or negative, but revenues provide a consistent baseline for comparison.

At 1.2x, FMCC’s P/S is well below the peer group average of 3.7x and the US Diversified Financial industry average of 2.4x. This indicates that investors are paying much less for each dollar of revenue generated by the firm. Relative to our estimated fair price-to-sales ratio of 5.5x, the current multiple is extremely discounted. This suggests that there is substantial room for re-rating if business fundamentals stabilize or improve.

Explore the SWS fair ratio for Federal Home Loan Mortgage

Result: Price-to-Sales of 1.2x (UNDERVALUED)

However, weak revenue growth and a recent net loss highlight ongoing challenges that could temper investor enthusiasm, even though the stock appears to be trading at a discounted valuation.

Find out about the key risks to this Federal Home Loan Mortgage narrative.

Another View: Our DCF Model’s Take

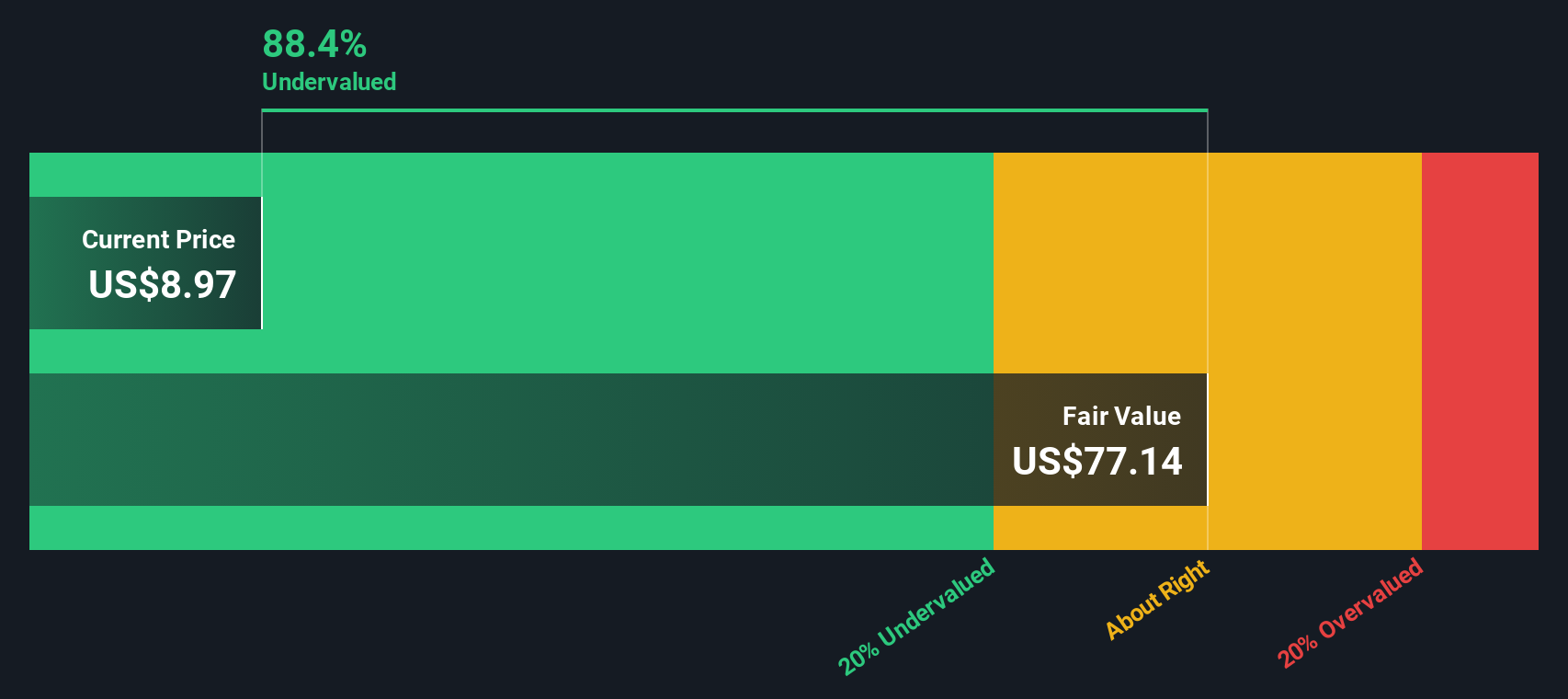

While the price-to-sales ratio hints at deep value, our SWS DCF model comes to a similar conclusion, estimating FMCC’s fair value at $119.21, which is significantly higher than the current price of $8.13. However, DCF models rely on future cash flow assumptions, and these can change quickly. Could the real value be hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Home Loan Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Home Loan Mortgage Narrative

If you see things differently, or prefer to dig into the numbers yourself, you can build your own story in just a few minutes. Do it your way

A great starting point for your Federal Home Loan Mortgage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to a single opportunity when a world of unique stocks awaits. Now is the time to act and spot the next outlier before others do.

- Uncover exciting growth potential by jumping into these 24 AI penny stocks, which feature strong momentum and groundbreaking technologies transforming industries.

- Lock in steady income streams by checking out these 16 dividend stocks with yields > 3%, offering attractive yields and proven financial discipline.

- Seize undervalued gems trading below fair value with these 885 undervalued stocks based on cash flows, and give your portfolio an edge on the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMCC

Federal Home Loan Mortgage

Operates in the secondary mortgage market in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives