- United States

- /

- Capital Markets

- /

- ARCA:VOO

Vanguard S&P 500 ETF (VOO): Exploring Current Valuation After Sustained Strong Performance

Reviewed by Simply Wall St

When it comes to deciding what to do next with Vanguard Index Funds, specifically the Vanguard S&P 500 ETF (VOO), investors may be wondering if recent moves point to something new. Even outside of big headlines, shifts in the share price and valuations can trigger a fresh look at what this ETF really offers for those seeking long-term US market exposure. While there might not be a single headline-making event sparking attention right now, moments like these often serve as useful checkpoints in evaluating what’s driving value and if there’s untapped potential beneath the surface.

Over the past year, VOO has posted a total return of 20%, exceeding its 11% gain since January, and momentum appears to be holding steady into recent months. This comes after a strong three-year climb, with investors benefiting from a 65% return during that time frame. Although news flow for index-tracking ETFs is rarely as eventful as for single stocks, ongoing interest in broad US equities and steady price gains keep VOO in focus for both growth and stability seekers.

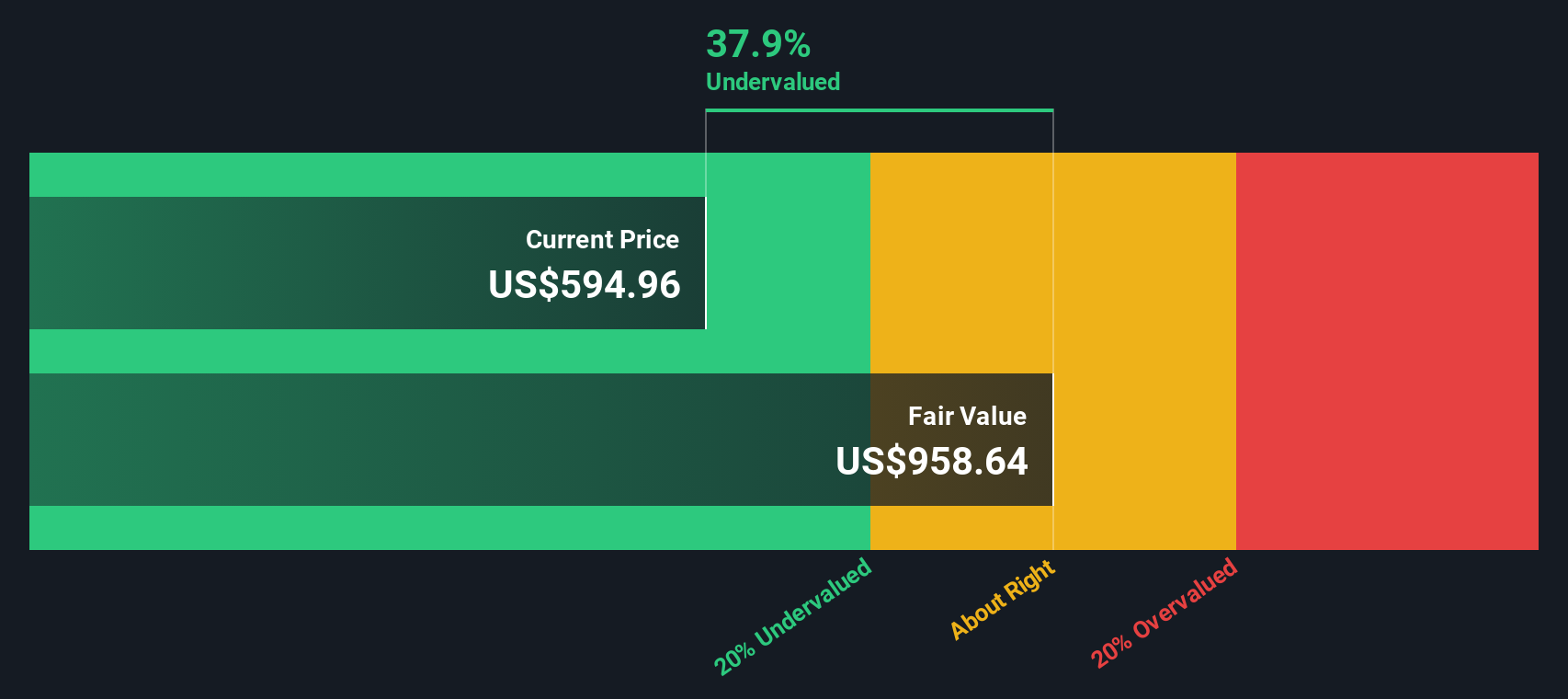

The big question now, after this steady performance and near 38% intrinsic discount, is whether VOO represents a true buying opportunity or if the market has already built future growth into today’s price.

Price-to-Earnings of 9.2x: Is it justified?

VOO currently trades at a price-to-earnings (P/E) ratio of 9.2x, which appears undervalued compared with the US Capital Markets industry average of 26.7x. This suggests the ETF may offer better value for investors seeking cost-efficient exposure to the broad US stock market.

The price-to-earnings ratio reflects what investors are willing to pay today for one dollar of earnings. It is a useful measure for ETFs tracking broad indices, as it can indicate whether the fund is valued attractively relative to sector peers or the wider market.

Industry participants may see this low P/E as a sign the market is underpricing VOO’s earnings potential, especially given its alignment with large-cap US stocks. Whether this discount persists depends on future profit growth and investor sentiment around index-tracking products.

Result: Fair Value of $957.05 (UNDERVALUED)

See our latest analysis for Vanguard Index Funds - Vanguard S&P 500 ETF.However, unforeseen macroeconomic shifts or sudden changes in investor sentiment could challenge VOO’s undervaluation and impact future returns.

Find out about the key risks to this Vanguard Index Funds - Vanguard S&P 500 ETF narrative.Another View: What Does the SWS DCF Model Say?

While the market's current pricing looks favorable when compared with industry averages, our DCF model offers a different lens on VOO's value. This approach also points to the fund being undervalued. Does this second positive signal reinforce the opportunity, or is there something the models might be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vanguard Index Funds - Vanguard S&P 500 ETF Narrative

If you see things differently or want to dig deeper, you can put together your perspective in just a few minutes, your way: Do it your way.

A great starting point for your Vanguard Index Funds - Vanguard S&P 500 ETF research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock new ways to build your portfolio by uncovering fresh opportunities beyond the usual choices. The smartest investors make bold moves. See what you could be missing.

- Spot early-stage companies primed for growth when you penny stocks with strong financials unlocking potential before the crowd catches on.

- Boost your passive income strategy by hunting for dividend stocks with yields > 3% that have strong yields and solid track records.

- Tap into tomorrow’s breakthroughs and follow healthcare AI stocks making real progress in medicine and AI-driven healthcare innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ARCA:VOO

Vanguard Index Funds - Vanguard S&P 500 ETF

An exchange traded fund launched and managed by The Vanguard Group, Inc.

Adequate balance sheet and fair value.

Market Insights

Community Narratives