- United States

- /

- Capital Markets

- /

- ARCA:VOO

Does Recent US Tech Rally Signal More Room for Vanguard S&P 500 ETF in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Vanguard Index Funds - Vanguard S&P 500 ETF and wondering whether now is the time to jump in, you are definitely not alone. The ETF has been grabbing attention as it continues a steady climb, up 1.4% in just the past week, and a robust 4.5% over the last month. Year-to-date, we have seen an impressive 14.5% gain, stacking up to a 19.4% rise over the past year. For long-term holders, it gets even better, with returns over three and five years standing at 87.3% and 109.6%, respectively. These numbers point to growth potential that is hard to ignore, even when the market gets cloudy.

Recent market developments have helped shape the perception of risk and reward for broad U.S. equity exposure. Factors like resilient consumer spending, ongoing shifts in the tech sector, and evolving inflation expectations have all played their part in fueling confidence in index-based investments. Vanguard’s flagship ETF is often considered a bellwether for investor sentiment, tracking all the twists and turns with uncanny accuracy.

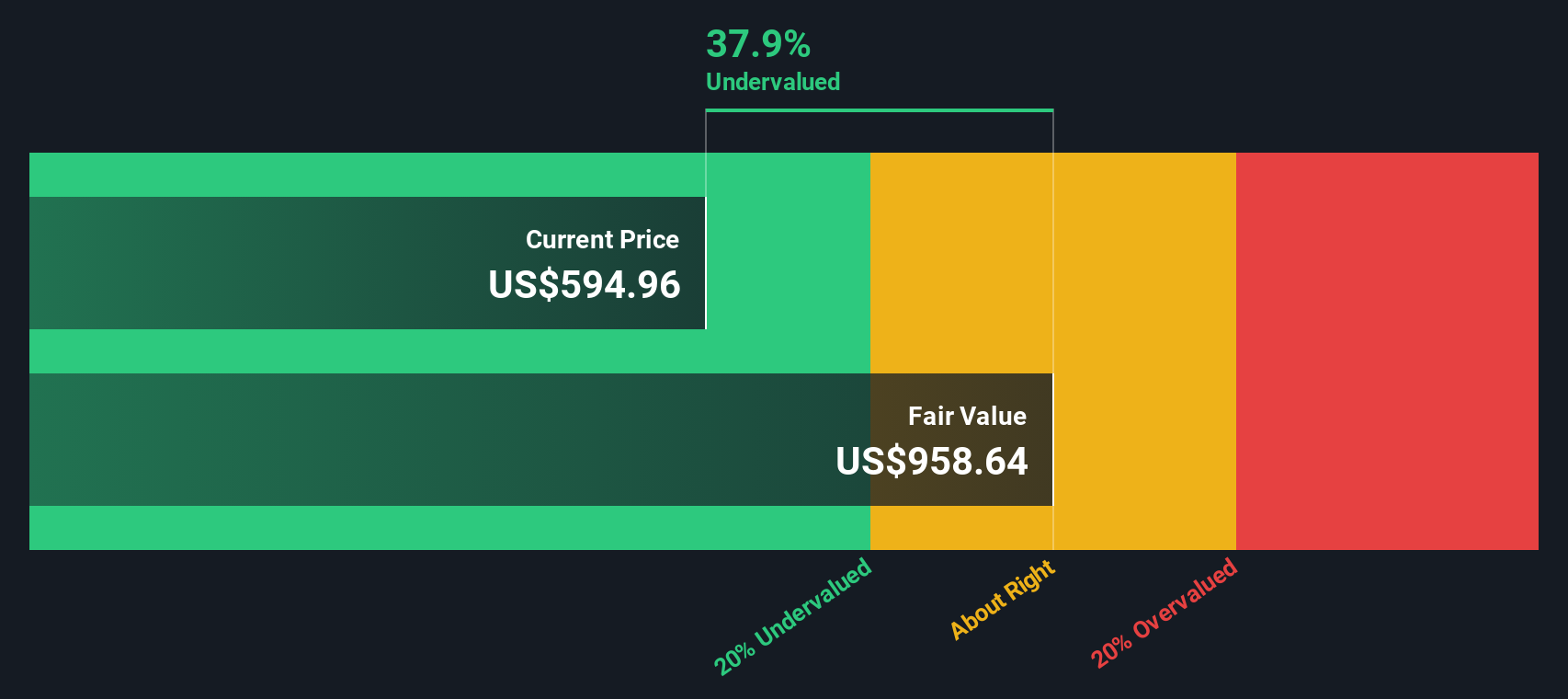

But underneath those headline returns lies a crucial question: is the ETF fairly valued right now? Based on a set of six classic valuation checks, Vanguard Index Funds - Vanguard S&P 500 ETF gets a value score of 3, meaning it is undervalued on half of those checks, which suggests there may still be room for optimism.

Let’s unpack what goes into that valuation score and how each method tells part of the story. In addition, here is a deeper, more holistic way to judge if this ETF fits your investment game plan.

Why Vanguard Index Funds - Vanguard S&P 500 ETF is lagging behind its peers

Approach 1: Vanguard Index Funds – Vanguard S&P 500 ETF Excess Returns Analysis

The Excess Returns model assesses whether a stock delivers returns above its cost of equity by examining how effectively shareholder funds are used to generate profits. For Vanguard Index Funds – Vanguard S&P 500 ETF, this means evaluating its historical and stable book value and earnings, alongside the required cost of equity for investors.

According to the model, the ETF has a Book Value of $505.29 per share and a Stable EPS of $75.24 per share, based on the median return on equity over the past five years. The cost of equity sits at $37.82 per share, while the excess return, or the surplus profit generated above that cost, amounts to $37.42 per share. Over five years, the fund has delivered an average Return on Equity of 19.44%, highlighting disciplined capital allocation. The Stable Book Value, calculated using the median from the past five years, stands at $386.96 per share.

This approach yields an estimated intrinsic value of $945.96 per share. With the current share price implying a 35.0% discount to this valuation, the ETF appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Excess Returns analysis suggests Vanguard Index Funds - Vanguard S&P 500 ETF is undervalued by 35.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Vanguard Index Funds / Vanguard S&P 500 ETF Price vs Earnings

For profitable companies like Vanguard Index Funds / Vanguard S&P 500 ETF, the price-to-earnings (PE) ratio remains a reliable way to gauge valuation. The PE ratio compares the current share price to earnings per share, showing how much investors are willing to pay for each dollar of earnings. Growth expectations and perceived risks play a central role in deciding what a fair PE ratio should be, with higher growth or lower risk often justifying a higher multiple.

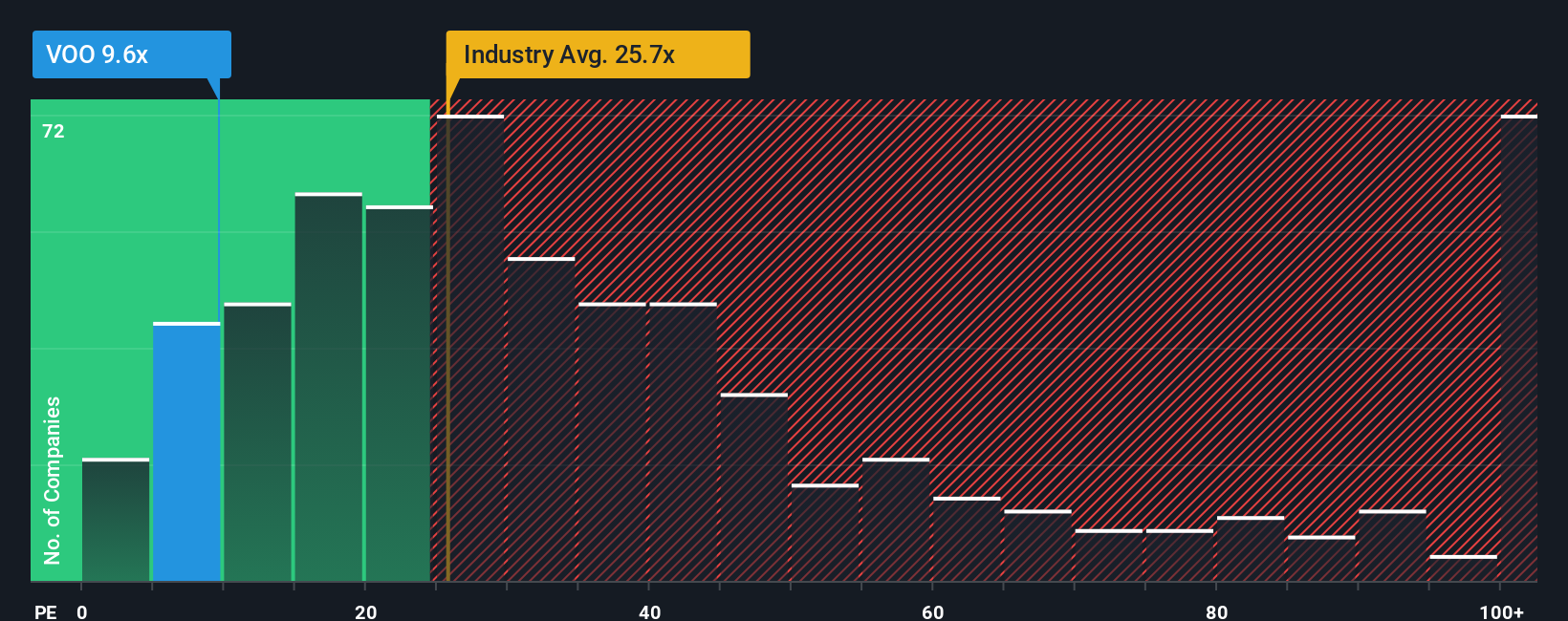

Currently, Vanguard Index Funds / Vanguard S&P 500 ETF trades at a PE ratio of 9.5x, which is well below the Capital Markets industry average of 26.2x. While this suggests the ETF is relatively cheap compared to its peers, simple comparisons do not account for important factors like the fund’s profit margins, size, or risk profile.

This is where the Simply Wall St "Fair Ratio" comes into play. Unlike straightforward industry or peer comparisons, the Fair Ratio is proprietary and blends considerations such as future earnings growth, profitability, risk, sector trends, and market capitalization. By factoring these in, it provides a more customized benchmark for fair value.

Comparing the current PE of 9.5x with the calculated Fair Ratio reveals that the ETF’s valuation is ABOUT RIGHT, taking into account all of these qualitative and quantitative factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vanguard Index Funds - Vanguard S&P 500 ETF Narrative

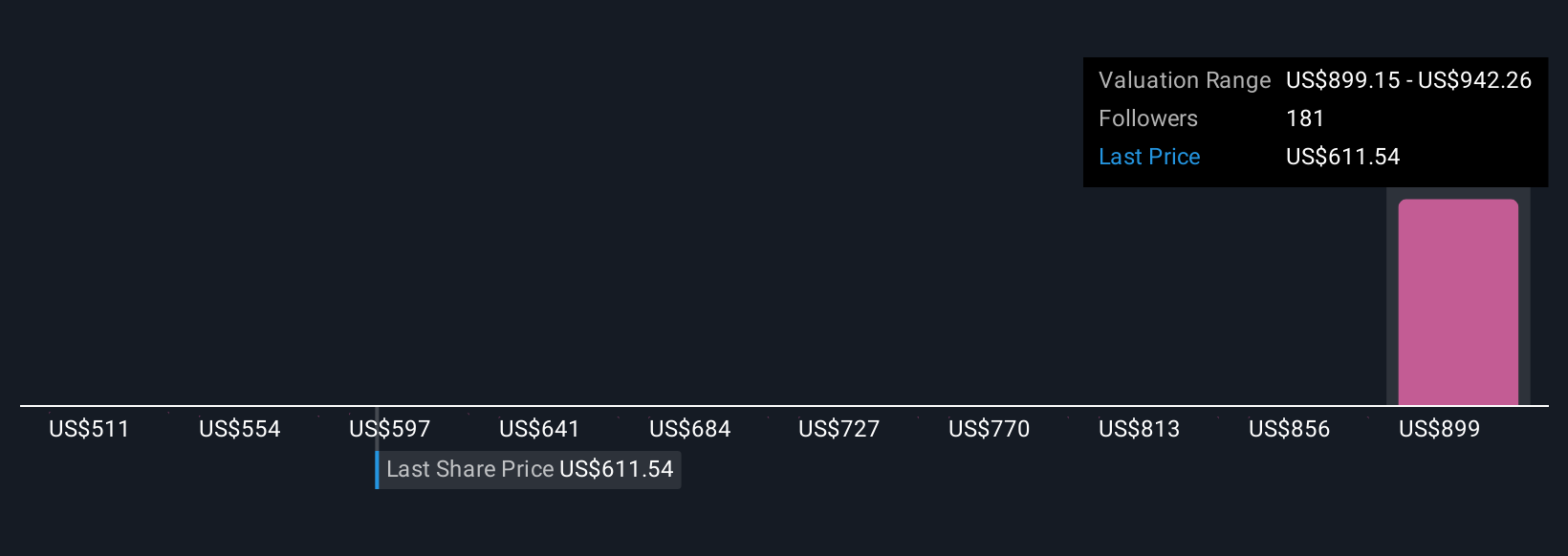

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your way to connect the story behind Vanguard Index Funds - Vanguard S&P 500 ETF to the numbers you see, combining your view on its future with estimates of fair value, revenue, earnings, and profit margins. Narratives link a company’s unique story and your expectations directly to a financial forecast, making it easier to see how your perspective drives real numbers and a personal fair value. Available right on Simply Wall St's Community page, Narratives give millions of investors an accessible place to share, shape, and compare their outlooks in real time.

With Narratives, you can continuously decide if it is time to buy or sell by matching your Fair Value with the current market Price. When news or earnings drop, your Narrative updates automatically. For example, some investors might see Vanguard Index Funds - Vanguard S&P 500 ETF as fairly valued at the highest end, while others assign their lowest estimates based on more conservative forecasts. This proves that every Narrative tells a different financial story.

Do you think there's more to the story for Vanguard Index Funds - Vanguard S&P 500 ETF? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ARCA:VOO

Vanguard Index Funds - Vanguard S&P 500 ETF

An exchange traded fund launched and managed by The Vanguard Group, Inc.

Adequate balance sheet and fair value.

Market Insights

Community Narratives