- United States

- /

- Capital Markets

- /

- ARCA:VOO

Do High Valuations Challenge VOO's Role in Diversifying Growth and Value Exposures?

Reviewed by Simply Wall St

- Recent news has spotlighted the Vanguard S&P 500 ETF for its broad diversification, low fees, and close tracking of 500 leading US stocks amid concerns over historically high S&P 500 valuations.

- This event has prompted investors to compare the ETF with value-focused options like the Vanguard Value ETF, reflecting a wider debate about balancing growth and value exposures during periods of potential market volatility.

- We'll explore how heightened scrutiny of S&P 500 valuations influences the investment narrative for Vanguard S&P 500 ETF going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Vanguard Index Funds - Vanguard S&P 500 ETF's Investment Narrative?

Being a shareholder in the Vanguard S&P 500 ETF means believing in the long-term resilience and growth of major US companies, backed by the ETF’s broad diversification and market-cap-weighted approach. The recent news highlighting concerns about the S&P 500’s high valuations has the potential to sharpen focus on risks related to market concentration, especially in technology sectors that make up a significant portion of the index. While the ETF’s rock-bottom fees and effort to closely track the index remain core strengths, heightened scrutiny may shift investor sentiment in the short term and prompt more comparison with value-oriented alternatives. Dividend increases and recent strong financials reinforce its core appeal, but unique one-off gains and slower profit growth signal the need for careful monitoring if elevated valuations translate into sharper returns volatility. Overall, these recent events may spur greater debate on portfolio balance but do not materially alter the current catalysts or risks facing the ETF at this stage.

But concentration risk at high index valuations is something investors should keep on their radar.

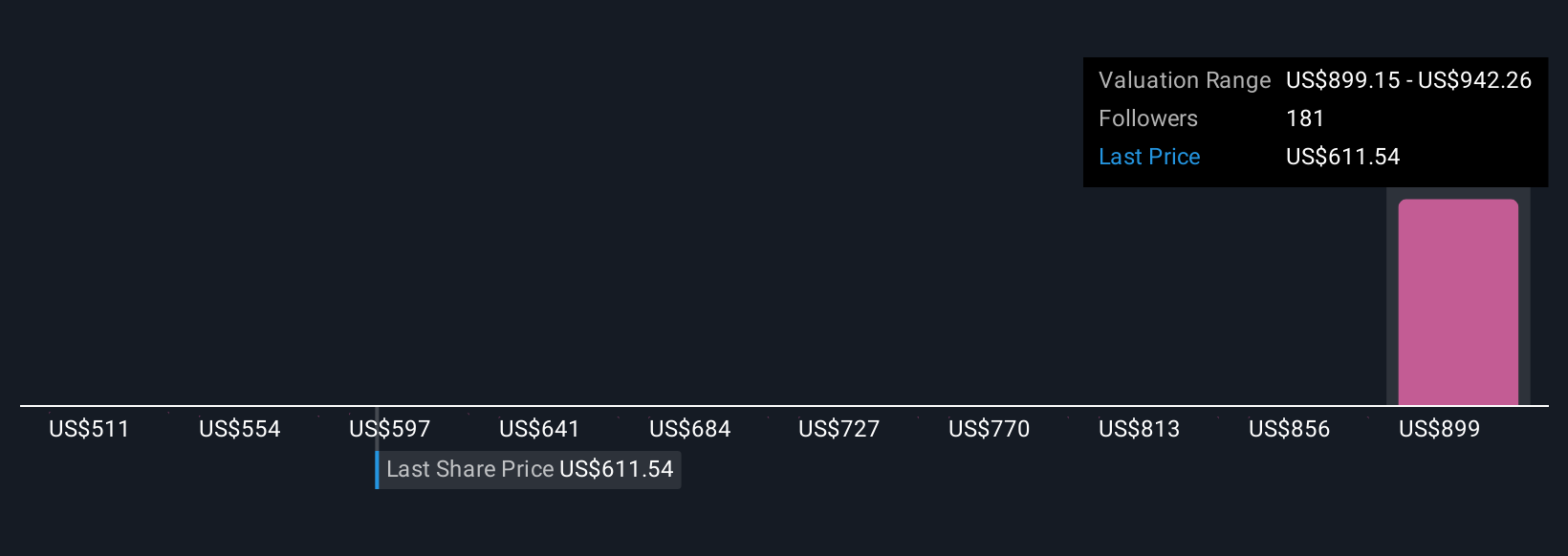

Vanguard Index Funds - Vanguard S&P 500 ETF's shares have been on the rise but are still potentially undervalued by 35%. Find out what it's worth.Exploring Other Perspectives

Explore 9 other fair value estimates on Vanguard Index Funds - Vanguard S&P 500 ETF - why the stock might be worth as much as 54% more than the current price!

Build Your Own Vanguard Index Funds - Vanguard S&P 500 ETF Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vanguard Index Funds - Vanguard S&P 500 ETF research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Vanguard Index Funds - Vanguard S&P 500 ETF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vanguard Index Funds - Vanguard S&P 500 ETF's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ARCA:VOO

Vanguard Index Funds - Vanguard S&P 500 ETF

An exchange traded fund launched and managed by The Vanguard Group, Inc.

Adequate balance sheet and fair value.

Market Insights

Community Narratives