- United States

- /

- Consumer Finance

- /

- NYSE:YRD

Investors Who Bought Yirendai (NYSE:YRD) Shares A Year Ago Are Now Down 38%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While it may not be enough for some shareholders, we think it is good to see the Yirendai Ltd. (NYSE:YRD) share price up 16% in a single quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 38% in the last year, well below the market return.

View our latest analysis for Yirendai

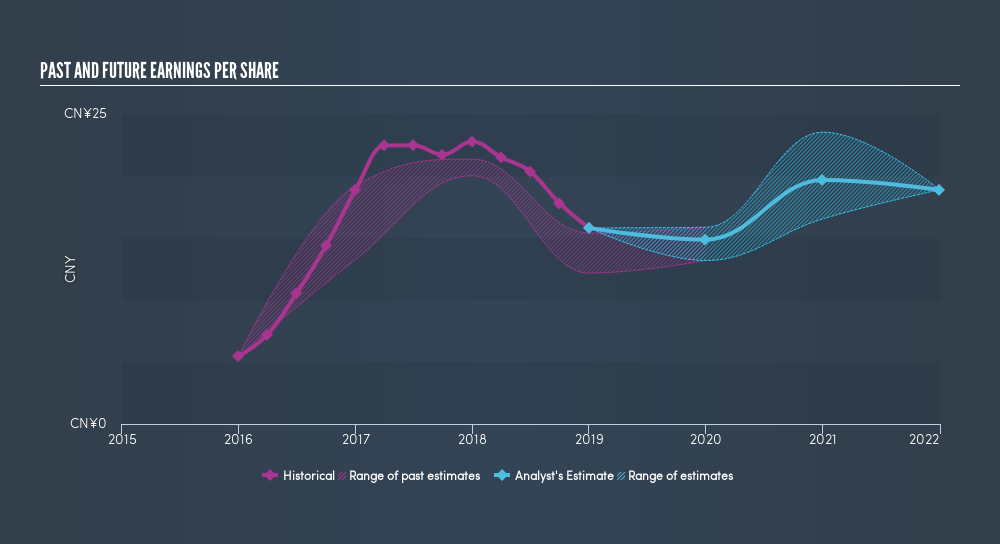

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Yirendai reported an EPS drop of 31% for the last year. The share price decline of 38% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The less favorable sentiment is reflected in its current P/E ratio of 6.44.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Yirendai has grown profits over the years, but the future is more important for shareholders. This free interactive report on Yirendai's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Yirendai's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Yirendai's TSR, at -38% is higher than its share price return of -38%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Over the last year, Yirendai shareholders took a loss of 38%. In contrast the market gained about 3.1%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 2.1% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Is Yirendai cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Yirendai may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:YRD

Yiren Digital

Provides financial services through an AI-powered platform in China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives