- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

The Bull Case For Block (SQ) Could Change Following New Grubhub Partnership and Cash App Pay Integration

Reviewed by Sasha Jovanovic

- Block, Inc. recently announced a wide-ranging partnership with Grubhub, integrating Square’s point-of-sale system and enabling Cash App Pay as a checkout option for Grubhub users, with the aim of streamlining restaurant operations and expanding payment flexibility.

- This collaboration not only broadens restaurants’ customer reach on Grubhub but also highlights Block’s push to unify fintech and commerce, helping businesses manage orders and payments more efficiently across digital platforms.

- We’ll explore how Square’s integration with Grubhub and Cash App Pay could reshape Block’s investment narrative and its presence in restaurant technology.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Block Investment Narrative Recap

Block’s investment case rests on believing the company can turn product innovation and platform integration, especially across Square and Cash App, into durable network effects and revenue streams, even as competition intensifies. The partnership with Grubhub sharpens Block’s edge in restaurant technology and digital payments but does not materially shift the short-term focus, which remains on sustaining high Cash App user growth amid market saturation and managing ongoing crypto-related volatility.

Recently, Block also launched its most significant expansion of Square’s food and beverage platform to date, offering enhanced operational tools for restaurants of all sizes. This update directly complements the Grubhub partnership, as both serve to deepen adoption within the hospitality sector and could support further engagement and revenue from payment and commerce solutions.

Yet, amid these growth moves, investors should be equally mindful of rising customer acquisition and marketing costs, as if profit growth cannot keep pace with these expenses...

Read the full narrative on Block (it's free!)

Block's outlook anticipates $32.8 billion in revenue and $2.4 billion in earnings by 2028, implying an annual revenue growth rate of 11.3%. This represents a $0.6 billion decrease in earnings from the current $3.0 billion level.

Uncover how Block's forecasts yield a $87.17 fair value, a 16% upside to its current price.

Exploring Other Perspectives

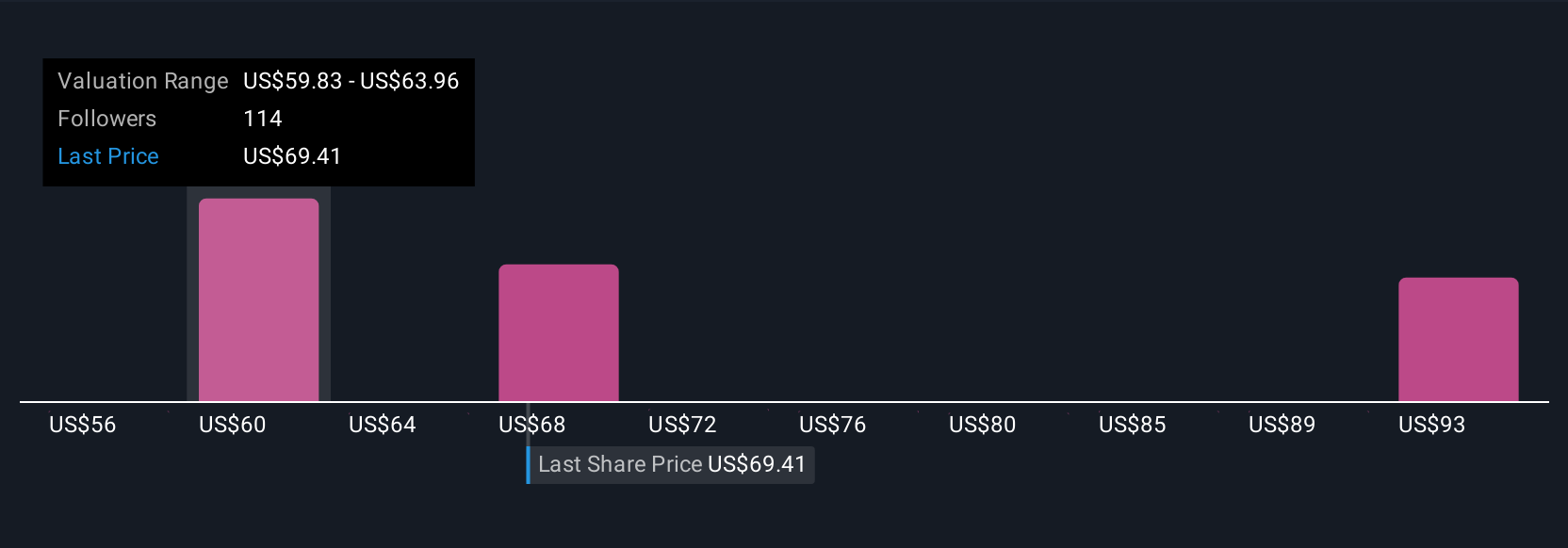

Fair value estimates from 20 Simply Wall St Community members range from US$55.70 to US$104, underscoring a wide spectrum of outlooks. As you compare these perspectives, remember the company’s expansion into new commerce tools could strengthen its position but increasing marketing costs remain top of mind for many.

Explore 20 other fair value estimates on Block - why the stock might be worth 26% less than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives