- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Block (SQ): Evaluating Valuation After Upbeat Profit Guidance and Major Enterprise Client Wins

Reviewed by Kshitija Bhandaru

Investor sentiment in Block has picked up after the company revised its full-year profit forecast upward and secured significant new clients such as Katz’s Delicatessen and the JMHG Group. These wins highlight Block’s momentum in enterprise payments and commerce.

See our latest analysis for Block.

Block’s recent run of major enterprise wins helped boost sentiment, even as the stock’s YTD share price return remains slightly negative. Still, a 1-year total shareholder return of nearly 15% and strong gross payment volume momentum suggest investors see real growth potential ahead.

If you’re looking to broaden your opportunity set, this could be the perfect time to discover fast growing stocks with high insider ownership

With analyst price targets above current levels and Block’s double-digit profit outlook, the question for investors is clear. Does recent upside leave more room for shares to run, or is future growth already factored into today’s price?

Most Popular Narrative: 11.7% Undervalued

Block's leading narrative estimates fair value meaningfully above its last closing price, signaling that recent momentum might not yet be fully priced in by the market. As excitement builds, a closer look at the reasoning reveals just how ambitious expectations are for the company's evolving business mix.

Accelerated product launches, embedded banking, and cryptocurrency integration are driving user growth, deeper engagement, and expansion into higher-margin revenue streams. Innovation in business tools and aggressive international and upmarket expansion boost Block's relevance and market share, supporting long-term revenue and margin growth.

Curious what Block’s future valuation is actually riding on? This narrative peels back the curtain on a crucial set of assumptions about revenue expansion, customer engagement, and where margins might go next. Think you know what’s behind that bullish price target? The full story might just surprise you.

Result: Fair Value of $87.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing Cash App user growth and greater exposure to potential credit losses could quickly make the outlook less optimistic for Block investors.

Find out about the key risks to this Block narrative.

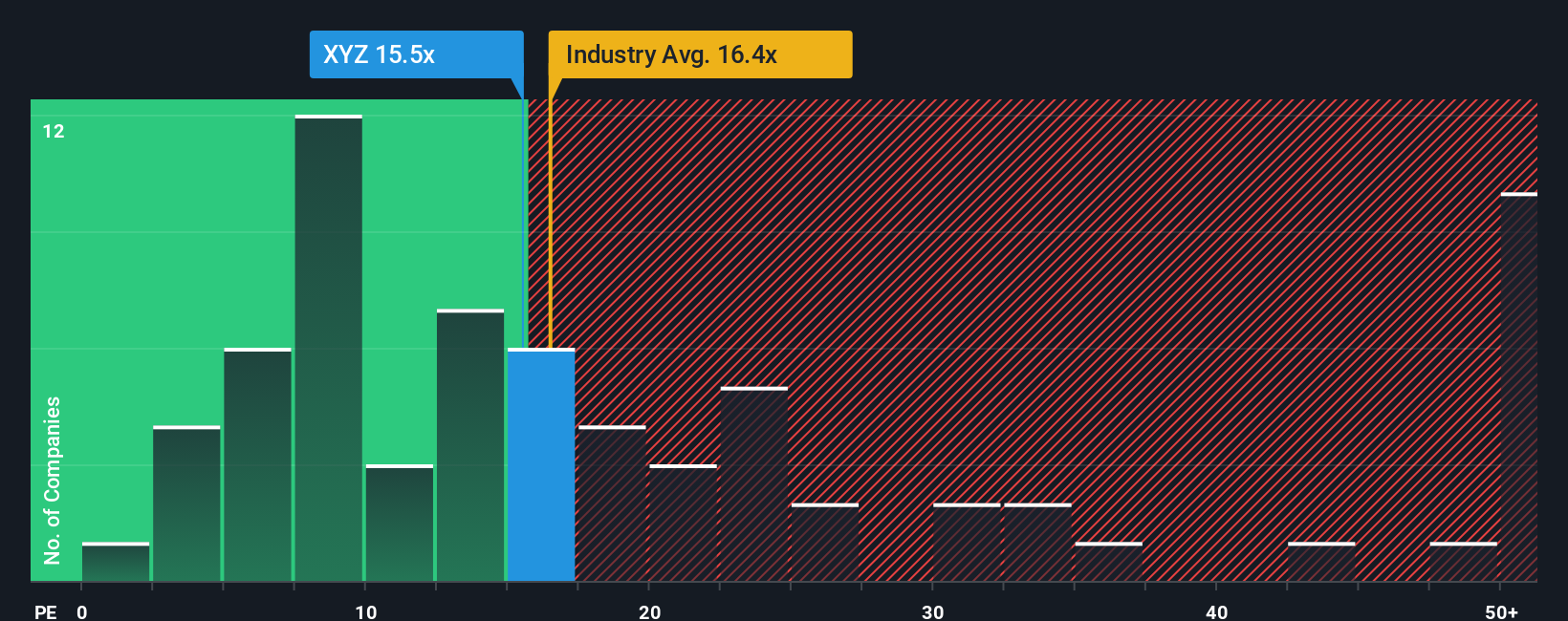

Another View: Multiples Tell a Different Story

Looking at valuation through earnings multiples, Block trades at a ratio of 15.9x, which is below both the US market average (19.3x) and its industry peers (17.1x). This discount could suggest an opportunity if Block’s growth prospects hold, but it also flags caution in case expectations falter. Could the market be underestimating the risks, or is further upside waiting to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If you want to dig deeper or chart your own course using the latest figures, you can shape your perspective in just a few minutes. Do it your way

A great starting point for your Block research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. The market often rewards those who act early and support strong trends. Your next winning idea could be just a click away.

- Spot under-the-radar companies trading below true worth when you tap into these 893 undervalued stocks based on cash flows for stocks with big upside potential.

- Unlock ongoing income with these 19 dividend stocks with yields > 3% featuring strong yield plays that can help support your long-term returns.

- Ride the AI boom and discover innovators shaping tomorrow’s economy by starting with these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives