- United States

- /

- Diversified Financial

- /

- NYSE:WU

The Bull Case For Western Union (WU) Could Change Following New Digital Payments Alliance With dLocal In Latin America

Reviewed by Simply Wall St

- dLocal and Western Union previously announced an alliance to bring digital payment methods, such as cards and bank transfers, to Western Union’s online platforms across Latin America, aiming to enhance agility and align with local customer preferences in countries including Chile, Mexico, Peru, Panama, Argentina, and Brazil.

- This move addresses the growing trend of digital remittances in the region, where nearly half of record-breaking US$161 billion in 2024 remittance flows were already processed through digital channels.

- We’ll examine how this collaboration with dLocal may shape Western Union’s investment narrative by expanding its digital customer reach in Latin America.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Western Union Investment Narrative Recap

To be a shareholder in Western Union today, you need to believe that the company’s digital transformation can offset pressures from declining retail volumes and rising competition from purely digital rivals. The new alliance with dLocal is a step toward regaining momentum in digital customer growth, potentially bolstering Western Union’s most important near-term catalyst: stabilizing transaction volumes in core Latin American corridors. However, the competitive threat from fast-moving fintech disruptors remains a significant risk and the impact of this partnership on reversing share loss will take time to assess.

Among recent announcements, Western Union’s partnership with Penny Pinch to power global money transfers directly in a digital wallet app is especially relevant. This move echoes the theme of the dLocal alliance, highlighting a continued effort to grow digital touchpoints and address evolving customer preferences across multiple markets, critical in supporting the digital revenue catalyst amid sector disruption.

By contrast, investors should be aware that despite digital growth initiatives like these, Western Union faces an ongoing risk if digital gains cannot fully compensate for...

Read the full narrative on Western Union (it's free!)

Western Union's narrative projects $4.3 billion revenue and $543.0 million earnings by 2028. This requires 1.3% yearly revenue growth and a decrease of $353.1 million in earnings from $896.1 million today.

Uncover how Western Union's forecasts yield a $9.32 fair value, a 14% upside to its current price.

Exploring Other Perspectives

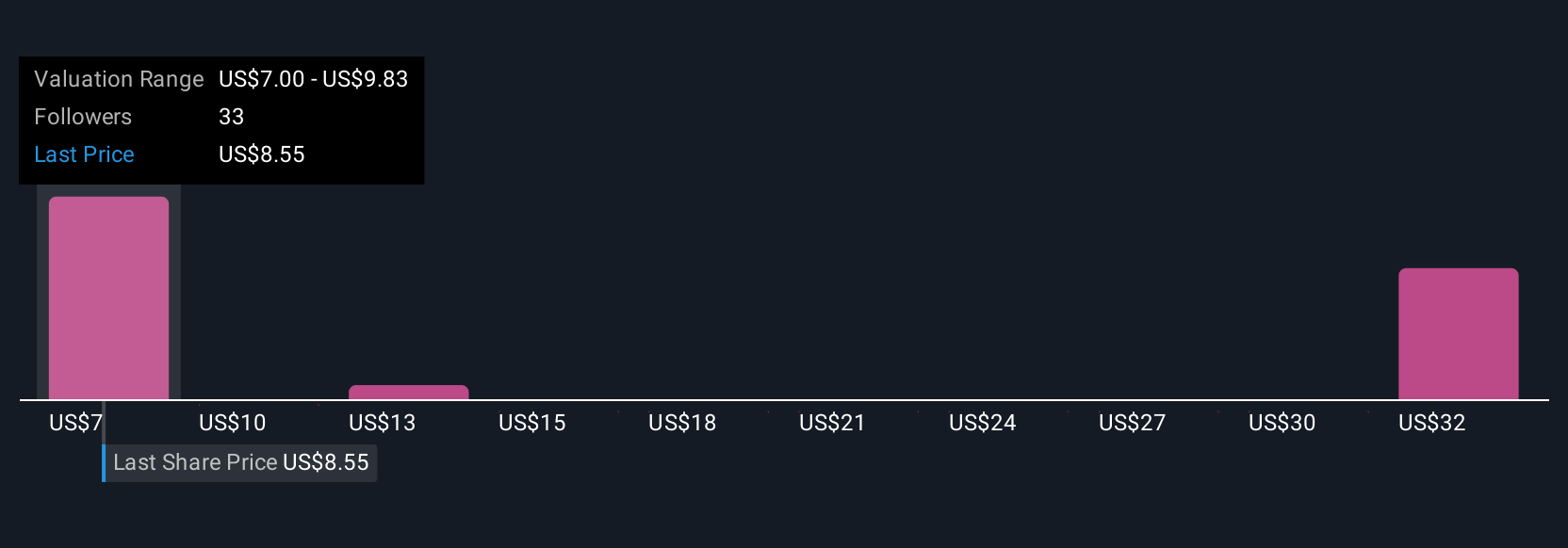

Nine separate fair value estimates from the Simply Wall St Community range from US$7 to US$35.62 per share, reflecting broad disagreement. With new digital initiatives seeking to address market share loss, your outlook can depend greatly on how you weigh the company's ability to counter digital-first challengers.

Explore 9 other fair value estimates on Western Union - why the stock might be worth over 4x more than the current price!

Build Your Own Western Union Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Western Union research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Union's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WU

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives