- United States

- /

- Diversified Financial

- /

- NYSE:WEX

WEX (WEX): Valuation Check After DriverDash Expansion to Thousands of New Sunoco Fueling Locations

Reviewed by Simply Wall St

WEX (WEX) just widened the lane for its DriverDash mobile payment app, adding thousands of Sunoco stations and pushing its digital fueling reach to nearly 40,000 locations across the United States.

See our latest analysis for WEX.

That backdrop helps explain why, even with a roughly 10 percent 1 month share price return and today’s 150.03 dollars share price, WEX still carries a negative 1 year total shareholder return. This suggests recent product wins are only starting to rebuild momentum.

If this kind of digital payments story has your attention, it might be worth scanning high growth tech and AI stocks to spot other platforms using technology to reshape how everyday transactions work.

Yet with shares still lagging their five year performance and models pointing to a steep intrinsic discount versus today’s price, is WEX quietly mispriced, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 15.2% Undervalued

With WEX last closing at 150.03 dollars against a narrative fair value of about 176.89 dollars, the valuation case leans firmly toward upside and hangs on a few powerful growth levers.

The recent signing of a long term agreement with BP, including both new card sales and the future conversion of BP's existing commercial fleet portfolio, will expand WEX's reach across core fueling segments and is expected to add 0.5 percent to 1 percent to company revenue in the first full year post conversion, catalyzing revenue acceleration in 2026 and beyond, as digital and card based payments adoption grows across fleet operations.

Curious how steady, mid single digit revenue growth, expanding margins, and a lower future earnings multiple can still point to meaningful upside? The narrative breaks down the math, step by step, and shows exactly how earnings power and share count assumptions combine to justify that higher fair value.

Result: Fair Value of $176.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying fintech competition and the long term shift toward electric vehicles could pressure WEX’s traditional fuel card economics and slow its growth trajectory.

Find out about the key risks to this WEX narrative.

Another Angle on Valuation

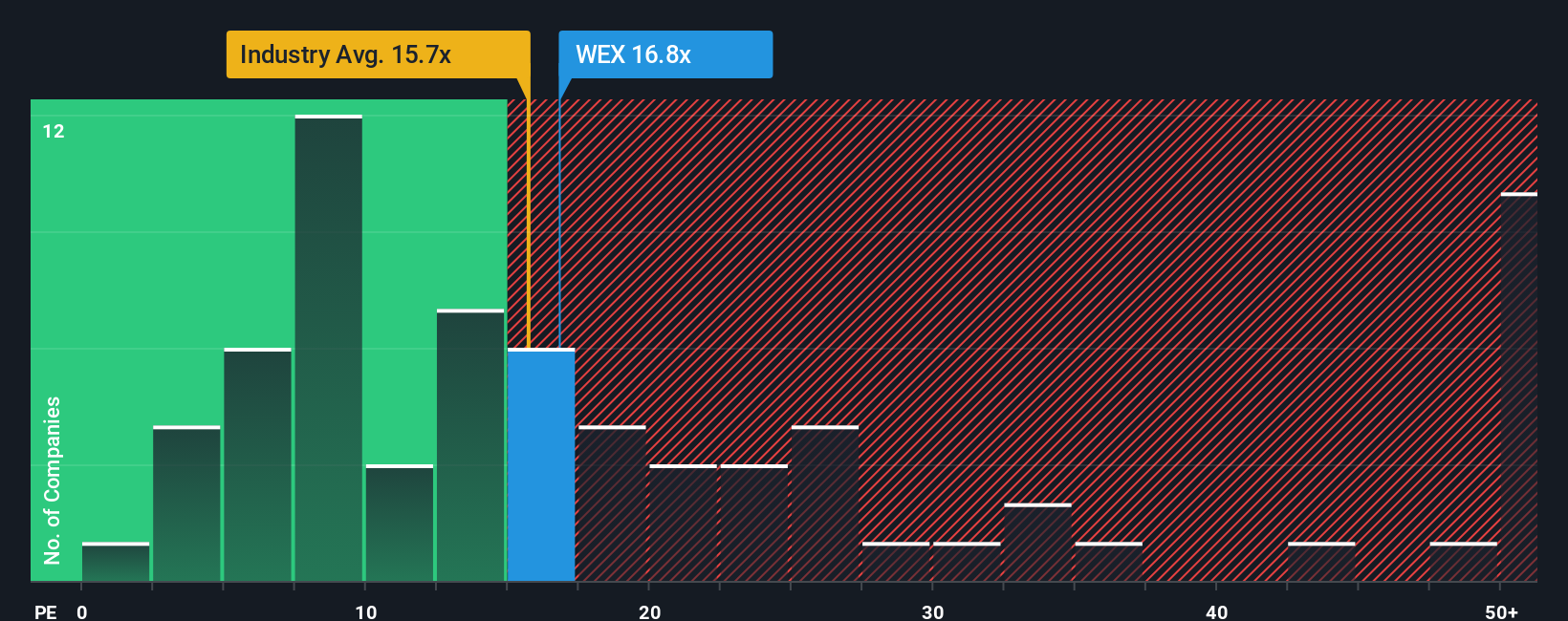

While the narrative points to upside, the earnings multiple tells a tougher story. WEX trades at about 18.1 times earnings versus 13.6 times for the US Diversified Financial industry and 16.4 times for peers, and even above its 17.9 times fair ratio. That premium suggests less margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEX Narrative

If you see the story differently or want to stress test your own assumptions, you can build a customized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WEX.

Ready for more investment ideas?

WEX may look compelling, but the market will not wait; use the Simply Wall St Screener now to uncover your next high conviction opportunity before others do.

- Capture early momentum in smaller names by scanning these 3640 penny stocks with strong financials that already back their stories with solid balance sheets and improving fundamentals.

- Position yourself for the next wave of innovation by targeting these 26 AI penny stocks building real products around artificial intelligence, automation, and data driven decision making.

- Lock in potential mispricings by filtering for these 908 undervalued stocks based on cash flows that strong cash flow models suggest the market has yet to fully recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEX

WEX

Operates a commerce platform in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion