- United States

- /

- Diversified Financial

- /

- NYSE:WD

Walker & Dunlop (WD): Revisiting Valuation After a Steep 1-Month and 1-Year Share Price Decline

Reviewed by Simply Wall St

Walker & Dunlop (WD) has had a rough stretch recently, with the stock down about 21% over the past month and nearly 40% over the past year, raising questions about whether sentiment has overshot fundamentals.

See our latest analysis for Walker & Dunlop.

The latest slide, including a roughly 21% 30 day share price return and a 39.8% one year total shareholder return decline, suggests momentum is clearly fading as investors reassess commercial real estate risks and near term earnings power.

If Walker & Dunlop’s recent pullback has you rethinking your exposure to property linked names, this could be a useful moment to explore fast growing stocks with high insider ownership.

With shares now trading well below analyst targets despite double digit revenue and earnings growth, the key question is simple: is Walker & Dunlop being mispriced, or is the market already discounting its future recovery?

Most Popular Narrative Narrative: 31.6% Undervalued

With Walker & Dunlop last closing at $63.23 versus a narrative fair value of $92.50, the current share price sits well below projected fundamentals.

The structural shortage and unaffordability of single family housing, along with record apartment absorption and high multifamily occupancy (96%), are expected to drive up rents and property values, leading to increased demand for multifamily financing, higher origination fees, and a larger servicing portfolio all supporting both revenue and earnings expansion.

Curious how this play on housing shortages, scaling margins, and richer earnings power turns into that valuation gap? The narrative’s math may surprise you.

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting office demand and prolonged rate volatility could curb deal activity, squeeze margins, and delay the earnings and valuation recovery investors are banking on.

Find out about the key risks to this Walker & Dunlop narrative.

Another Angle on Valuation

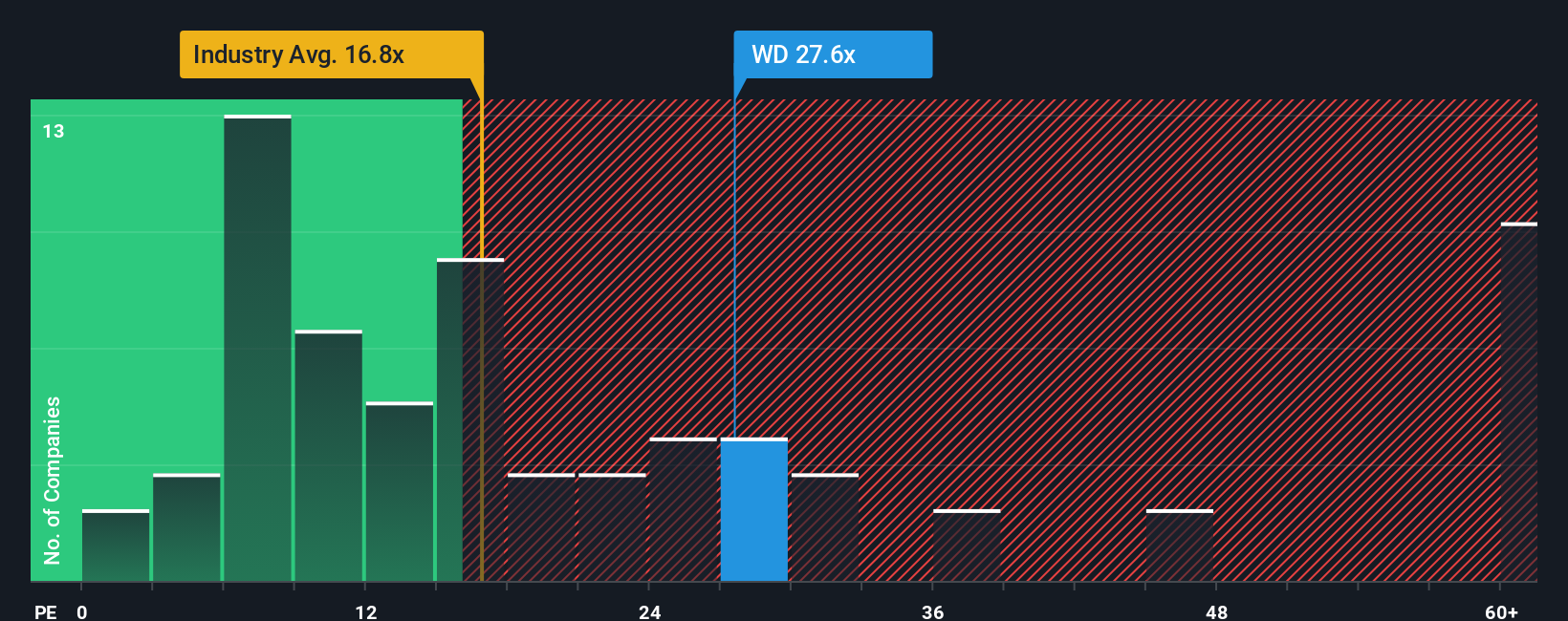

Analysts see upside to $92.50, but our fair ratio work tells a tougher story. At 19.2 times earnings versus a 17.2 fair ratio, 13.8 for the industry and 8.8 for peers, Walker & Dunlop screens expensive, not cheap. This raises the question: who is right here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walker & Dunlop Narrative

If this take does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, starting with Do it your way.

A great starting point for your Walker & Dunlop research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider identifying your next potential opportunity by using the Simply Wall Street Screener to uncover fresh, data backed ideas across the market.

- Explore potential turnaround opportunities with these 906 undervalued stocks based on cash flows that trade below their estimated cash flow value before the broader market responds.

- Target innovation by scanning these 26 AI penny stocks that are positioned to benefit from the adoption of artificial intelligence across industries.

- Look for ways to strengthen your income stream through these 15 dividend stocks with yields > 3% that aim to deliver yields above 3% while supporting long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026