- United States

- /

- Diversified Financial

- /

- NYSE:WD

Walker & Dunlop (WD): Assessing Valuation After Securing $110M in Refinancing and Expanding Multifamily Deals

Reviewed by Kshitija Bhandaru

Walker & Dunlop (WD) just gave investors a fresh reason to pay attention: the company has secured refinancing deals topping $110 million for high-profile properties, while also arranging financing for over a thousand multifamily units across the Southeast and Texas. Both announcements highlight Walker & Dunlop’s active presence in capital markets and reinforce its reputation as a key player in high-growth real estate segments. For anyone considering what to do with WD stock, these moves demonstrate management’s focus on both scale and high-quality relationships in its pipeline.

Despite these sizable wins, the market’s response over the past year has been cautious. Walker & Dunlop’s share price is down 23% in twelve months, even as its three-year return remains positive and the latest quarter achieved an 18% gain. However, those achievements follow a period of declining momentum earlier this year. In the background, annual revenue and net income continue to grow, indicating the company is navigating industry challenges with some success.

Now that the share price has lagged while business is showing signs of improvement, some may be considering whether WD presents an opportunity for value hunters, or whether the market has already factored in the positive developments around future growth.

Most Popular Narrative: 9.9% Undervalued

The most widely followed narrative sees Walker & Dunlop as moderately undervalued based on analysts’ forward-looking assumptions and market dynamics.

The structural shortage and unaffordability of single-family housing, along with record apartment absorption and high multifamily occupancy (96%), are expected to drive up rents and property values. This could lead to increased demand for multifamily financing, higher origination fees, and a larger servicing portfolio, all supporting both revenue and earnings expansion.

Curious how surging demand for multifamily properties and a transforming market landscape factor into this valuation? The core of this narrative rests on ambitious projections for business growth in key areas, as well as margin shifts that could catch the market off guard. Want to uncover which specific numbers propel that attractive fair value? The next section of the full narrative reveals the actual drivers behind this assessment.

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high interest rates or regulatory changes that impact government-backed lending could challenge the optimistic outlook that currently supports Walker & Dunlop’s valuation.

Find out about the key risks to this Walker & Dunlop narrative.Another View: What Does the SWS DCF Model Say?

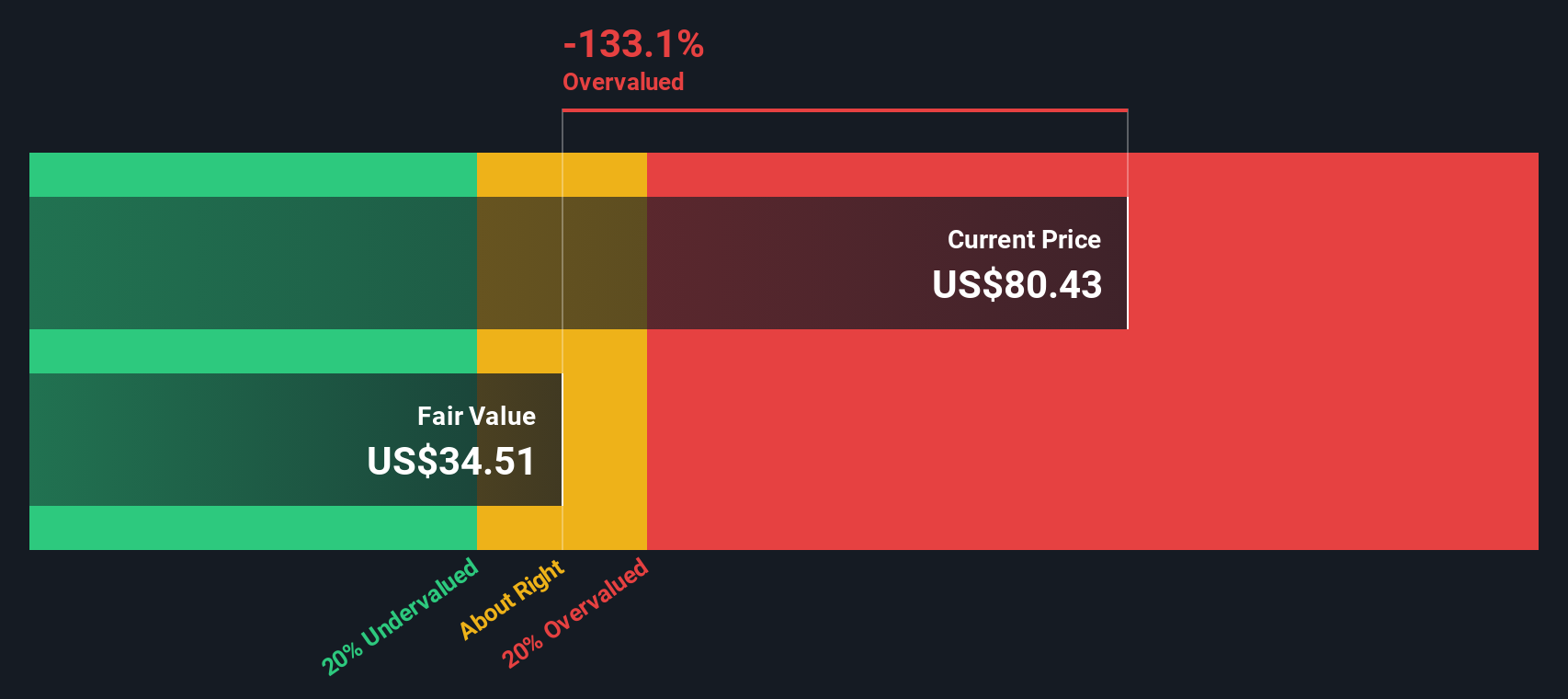

While the analyst consensus relies on future earnings and revenue projections, our DCF model offers a very different take and sees Walker & Dunlop as overvalued compared to its long-term cash flows. Could the market be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Walker & Dunlop Narrative

If you see things differently or prefer to dig into the numbers yourself, you can quickly build your own personal take on Walker & Dunlop’s outlook in just a few minutes. Do it your way

A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Smart investors never settle for just one opportunity. If you’re hungry for your next edge, see how these unique strategies can uncover tomorrow’s top-performing stocks before the crowd rushes in.

- Target companies with serious upside by tapping into undervalued stocks based on cash flows, focusing on businesses that look attractively priced based on robust cash flows.

- Catch the wave of innovation and growth in the medical space using healthcare AI stocks, your shortcut to firms revolutionizing patient care and AI-powered health solutions.

- Lock in recurring returns while the market fluctuates by securing picks with dividend stocks with yields > 3%, featuring stocks offering yields above 3% for steady income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives