- United States

- /

- Diversified Financial

- /

- NYSE:WD

Walker & Dunlop (NYSE:WD) Eyes Growth with GSE Financing and Tech Integration Despite Revenue Challenges

Reviewed by Simply Wall St

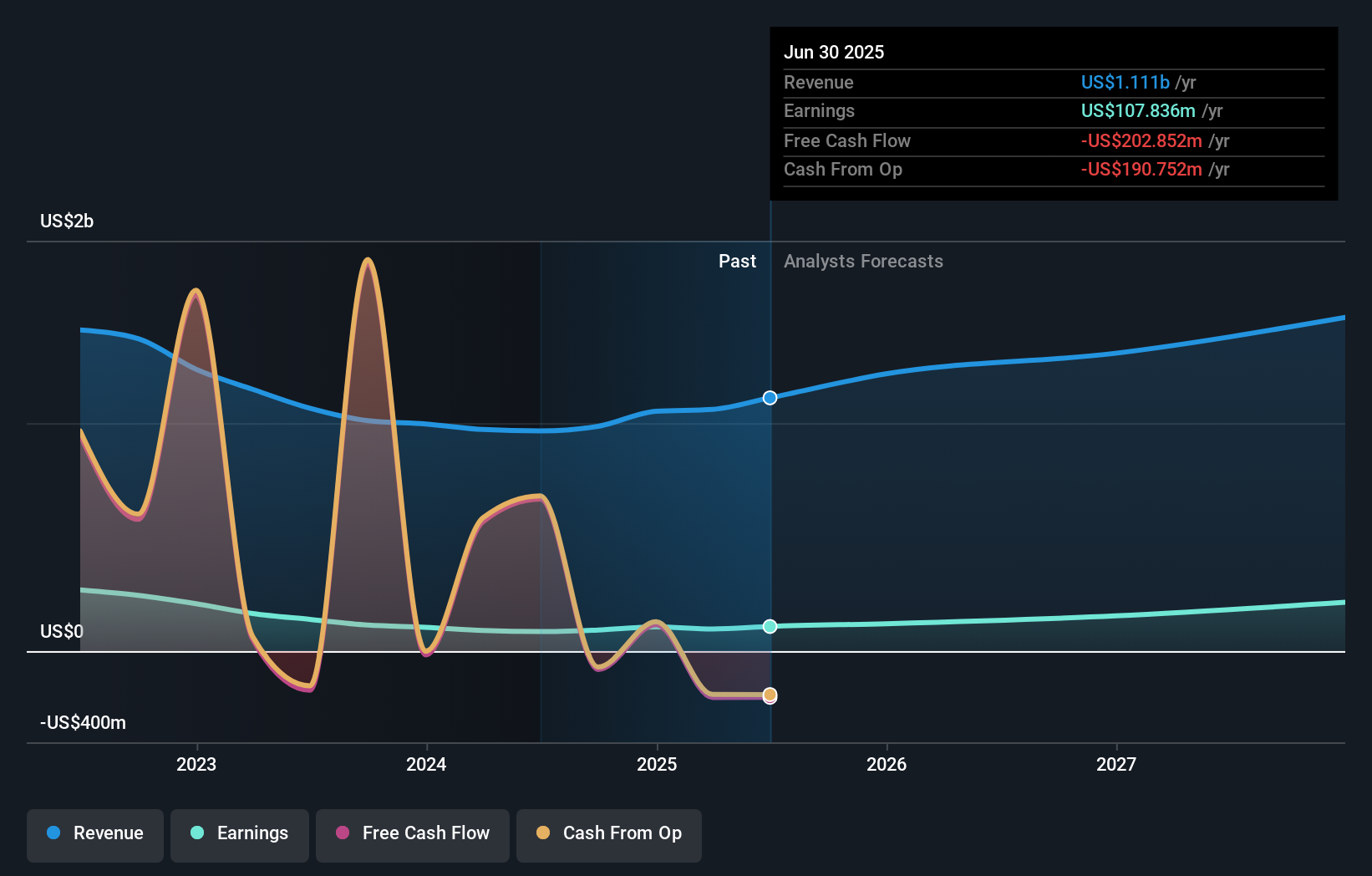

Walker & Dunlop (NYSE:WD) has demonstrated strong growth, closing $11.6 billion in transactions in Q3 2024, a 36% increase year-over-year, fueled by strategic expansion in GSE financing. However, challenges such as a lagging revenue growth of 9% and a decline in affordable equity revenues indicate areas needing strategic focus. This report will explore key areas including financial performance, growth opportunities in affordable housing, and the impact of external factors like interest rate volatility and regulatory changes.

Click here to discover the nuances of Walker & Dunlop with our detailed analytical report.

Core Advantages Driving Sustained Success for Walker & Dunlop

With significant transaction volume growth, Walker & Dunlop has closed $11.6 billion in Q3 2024, marking a 36% increase from the previous year. This surge underscores the company's adeptness in navigating an improving market. CEO Willy Walker highlighted the strategic expansion in GSE financing, closing $3.5 billion in loans, which positions the company for continued growth. The strong financial performance is further evidenced by a 33% year-over-year increase in diluted earnings per share to $0.85, bolstered by a 7% rise in both adjusted EBITDA and core EPS. These achievements reflect the leadership's effective management and strategic foresight, contributing to high-quality earnings projected to grow at 28.4% per year. The company's valuation, with a Price-To-Earnings Ratio of 39.3x, suggests a premium over industry peers, indicating investor confidence in its growth trajectory.

Internal Limitations Hindering Walker & Dunlop's Growth

Despite the impressive transaction volume, Walker & Dunlop faces challenges with revenue growth, which lagged at 9%, hinting at potential issues in revenue mix or pricing strategies. Analyst Steven Delaney noted this discrepancy, suggesting the need for a strategic reevaluation. The decline in affordable equity revenues by 37% due to reduced tax credit syndications and asset dispositions further strains the company's financial health. Additionally, the net profit margin has decreased to 9.4% from the previous year's 11.3%, while the return on equity remains low at 5.1%. The high net debt to equity ratio of 90.5% and a dividend payout ratio of 91.9% indicate financial strains, raising concerns about sustainability and operational efficiency.

Growth Avenues Awaiting Walker & Dunlop

Opportunities abound as the focus on affordable housing by Fannie, Freddie, and HUD presents significant growth potential, evidenced by a 200% increase in HUD lending volumes. The integration of technology and AI to enhance operational efficiency and scale, particularly in valuation and loan processing, is a strategic move that could redefine the company's competitive edge. CEO Walker's anticipation of increased M&A activity in commercial real estate suggests a promising avenue for expanding transaction volumes and enhancing investment sales and financing services. These initiatives, coupled with a forecasted revenue growth of 11% per year, position Walker & Dunlop to capitalize on emerging market opportunities.

External Factors Threatening Walker & Dunlop

Interest rate volatility remains a significant threat, potentially impacting transaction volumes and market stability. However, the company is prepared to navigate various rate environments. Political and regulatory changes, particularly those affecting GSEs, could also impact operations, though current discussions indicate a positive outlook for GSE reform. Moreover, the company has recognized a $3 million provision for credit losses, highlighting ongoing management of credit risk and loan defaults. CFO Greg Florkowski assures that the credit quality of their $61 billion at-risk portfolio remains strong, yet these factors underscore the need for vigilant risk management.

Conclusion

Walker & Dunlop's impressive transaction volume growth and strategic expansion in GSE financing highlight its ability to capitalize on market improvements, positioning it for sustained earnings growth projected at 28.4% annually. However, the company faces internal challenges, such as lagging revenue growth and declining profit margins, which necessitate strategic reevaluation to ensure financial sustainability. The focus on affordable housing and integration of technology present significant growth opportunities, yet interest rate volatility and regulatory changes pose external risks that require vigilant management. Despite these challenges, the company's high Price-To-Earnings Ratio of 39.3x, compared to industry peers, reflects investor confidence in its growth trajectory, though it also indicates that the stock may be trading above its estimated fair value, suggesting potential future adjustments in market perception.

Taking Advantage

- Is Walker & Dunlop part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives