- United States

- /

- Diversified Financial

- /

- NYSE:WD

Should Walker & Dunlop’s (WD) Central Texas Transaction Surge Influence Investor Perspectives on Revenue Growth?

Reviewed by Sasha Jovanovic

- Walker & Dunlop, Inc. announced in late September 2025 that it completed over US$820 million in sales and financings across Central Texas between January and August.

- This performance reflects the company's ongoing effectiveness in matching capital with real estate opportunities amid Central Texas' continued job and population growth.

- We'll explore how Walker & Dunlop’s execution of US$820 million in transactions may impact its revenue growth and future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Walker & Dunlop Investment Narrative Recap

To be a Walker & Dunlop shareholder, you need to believe demand for multifamily and commercial real estate financing will remain strong enough to support growth, even as the industry adjusts to changing interest rates and capital availability. The recent announcement of US$820 million in Central Texas deals shows the company’s resilience in sourcing and closing transactions, yet this news does not materially change the short-term risk: sustained high or volatile interest rates could continue to suppress overall transaction and refinancing volumes, directly impacting revenues and margins.

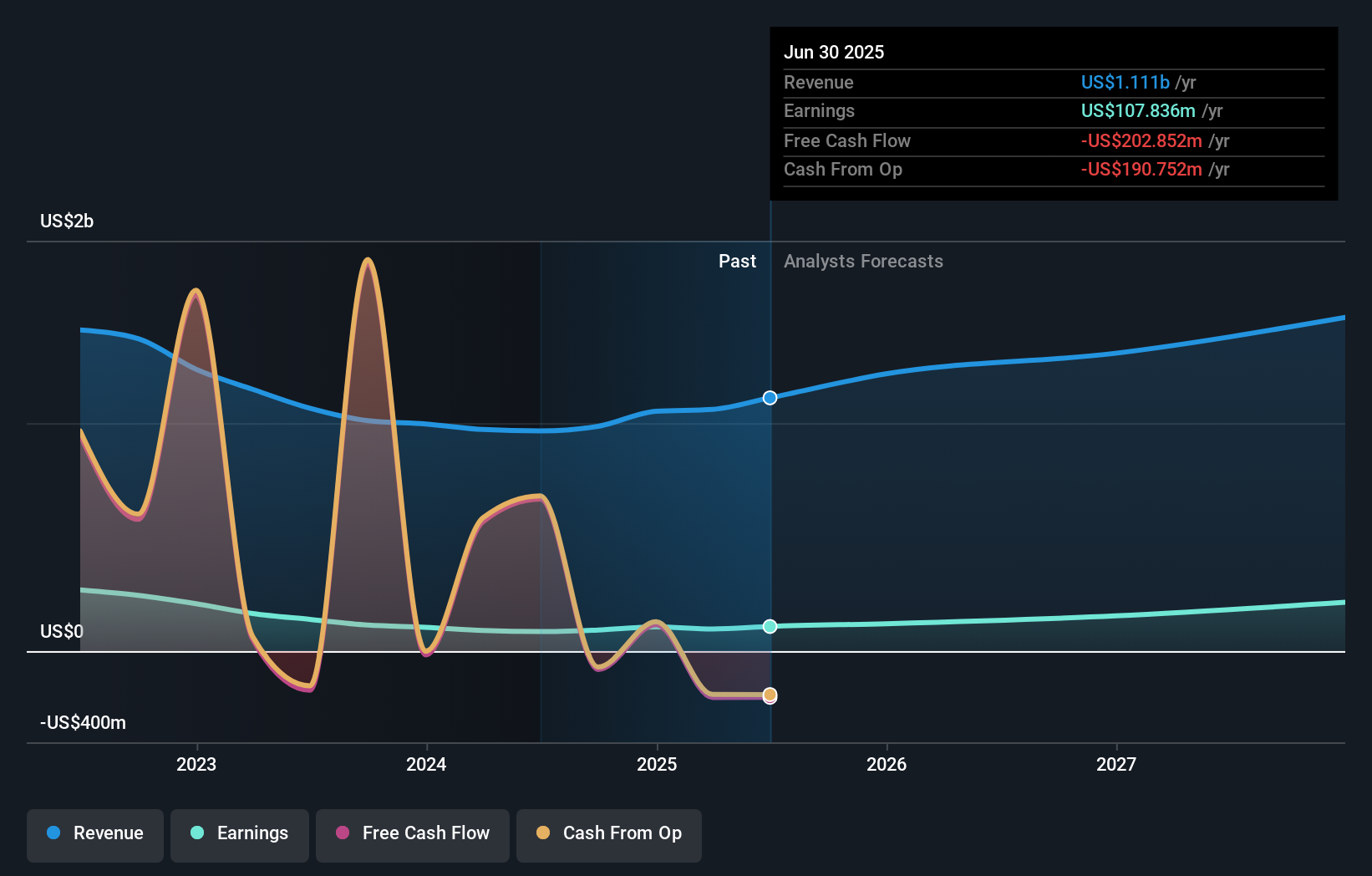

Of the company’s recent developments, the Q2 2025 earnings report is especially relevant in this context. With revenues at US$319.24 million (up year over year) and net income of US$33.95 million, the firm’s performance indicates some support from transaction activity, but also highlights the challenge of translating volume into profitable growth when origination margins may remain tight due to external rate pressures.

However, investors should be aware that even with robust transaction headlines, risks linked to rising or unpredictable interest rates and their effect on margins remain...

Read the full narrative on Walker & Dunlop (it's free!)

Walker & Dunlop's narrative projects $1.5 billion revenue and $233.2 million earnings by 2028. This requires 11.2% yearly revenue growth and a $125.4 million earnings increase from $107.8 million currently.

Uncover how Walker & Dunlop's forecasts yield a $92.50 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$34.61 to US$92.50, illustrating high variability in investor outlooks. In contrast, keep in mind that broader market interest rate trends remain a key driver that could continue shaping Walker & Dunlop’s revenue and earnings prospects, so it’s worth considering several viewpoints.

Explore 3 other fair value estimates on Walker & Dunlop - why the stock might be worth as much as 10% more than the current price!

Build Your Own Walker & Dunlop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Walker & Dunlop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Walker & Dunlop's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives