- United States

- /

- Diversified Financial

- /

- NYSE:WD

A Look at Walker & Dunlop’s Valuation Following Leadership Expansion in EMEA

Reviewed by Kshitija Bhandaru

Walker & Dunlop (NYSE:WD) has expanded its Europe and Middle East operations by bringing in Aaron Knight as senior managing director and co-head of Capital Markets for its EMEA office. Knight’s experience in commercial real estate debt products aligns with the firm’s strategy to build out its London-based business.

See our latest analysis for Walker & Dunlop.

Walker & Dunlop’s expansion into EMEA comes at a time when its stock has been steady, with the latest share price at $83.97 and a modest 1-year total shareholder return of -0.2%. While momentum has not picked up meaningfully yet, the strategic moves in London suggest long-term growth potential for patient investors.

If forward-looking moves like this have you thinking about untapped market opportunities, consider broadening your search and discover fast growing stocks with high insider ownership

With recent performance trailing broader markets, the question is whether Walker & Dunlop’s subdued valuation signals an attractive entry point for investors or if the market is already accounting for the firm’s growth ambitions abroad.

Most Popular Narrative: 9.2% Undervalued

Walker & Dunlop’s most widely followed narrative places its fair value at $92.50, about 9% higher than the recent closing price of $83.97. This highlights a gap between current sentiment and analyst-driven growth expectations.

Investments in technology platforms (small balance lending, appraisal, Galaxy, Client Navigator) are resulting in higher client acquisition (17% of YTD volume from new clients), increased operational efficiency, and improved margins. These factors suggest longer-term enhancement of net margins and top-line growth.

Curious what bold financial leaps underpin the case for a higher valuation? The secret sauce is a blend of rapid earnings acceleration, smarter technology bets, and margin expansion forecasts. Discover the details behind this profit surge driving analysts’ optimism and see how it could impact the share price.

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued high interest rates or setbacks in office real estate demand could quickly challenge these positive growth projections.

Find out about the key risks to this Walker & Dunlop narrative.

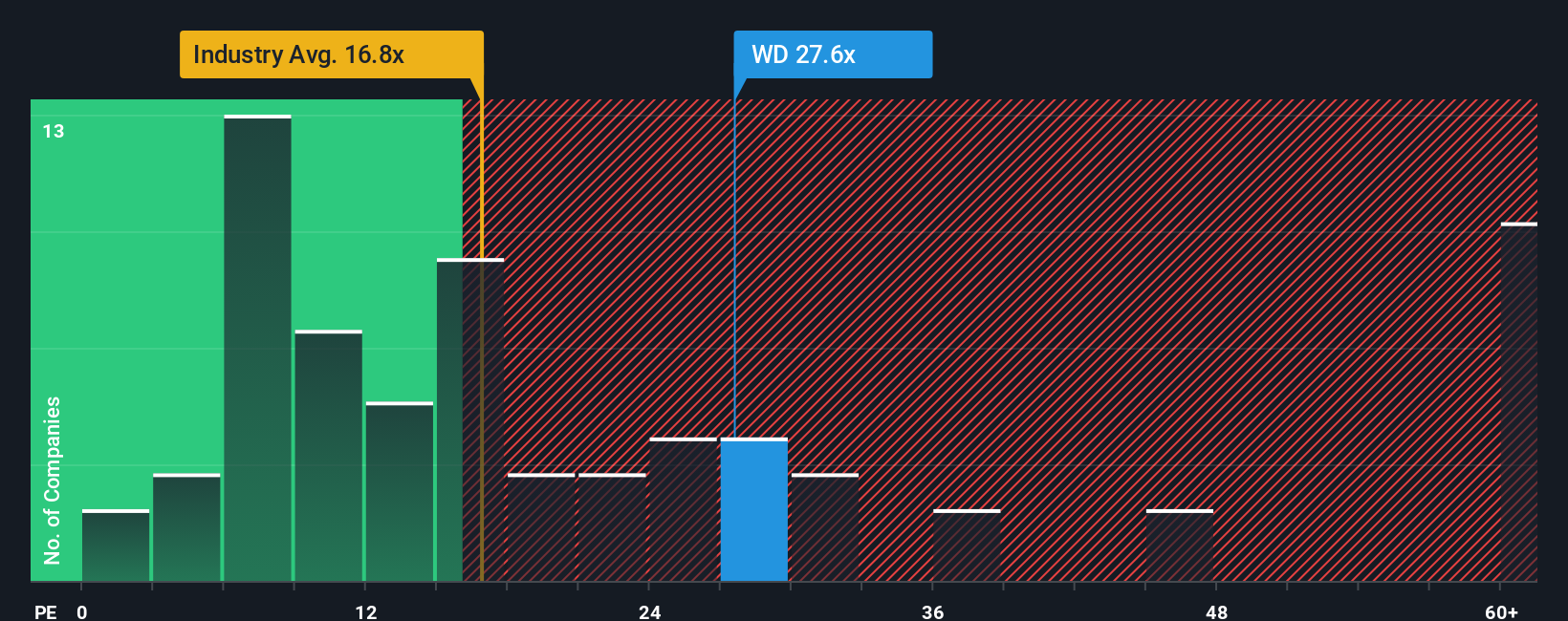

Another View: Market Ratios Challenge Growth Story

While analyst forecasts point to impressive growth and margin expansion, one market measure sends a different signal. Walker & Dunlop trades at a price-to-earnings ratio of 26.5x, noticeably higher than the industry average of 16.5x and a fair ratio of 17.5x. This substantial gap suggests that the stock could be richly valued based on today’s profits, raising questions about how much future growth is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walker & Dunlop Narrative

If you see a different story in the numbers or would rather chart your own path, you can craft a personal narrative from scratch in just minutes, so why not Do it your way

A great starting point for your Walker & Dunlop research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let the next big opportunity pass you by. Use the Simply Wall Street Screener to confidently spot fast movers, breakthrough innovators, and compelling values today.

- Capture untapped growth by zeroing in on these 3568 penny stocks with strong financials with strong financials. These could be tomorrow’s standout winners.

- Maximize your yield and build your income portfolio using these 19 dividend stocks with yields > 3% that offer yields above 3%.

- Get ahead in the tech race and unearth breakthrough opportunities by targeting these 25 AI penny stocks at the forefront of advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker & Dunlop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WD

Walker & Dunlop

Through its subsidiaries, originates, sells, and services a range of multifamily and other commercial real estate financing products and services for owners and developers of real estate in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives