- United States

- /

- Diversified Financial

- /

- NYSE:VOYA

Voya Financial (VOYA): Assessing Valuation Following Strategic Partnership With Workday Wellness

Reviewed by Simply Wall St

If you have been tracking Voya Financial (VOYA), this latest strategic move might catch your eye. The company just unveiled a new collaboration with Workday Wellness, a platform known for delivering AI-powered health benefits insights. By integrating its Employee Benefit Supplemental Health and Retirement solutions with Workday’s system, Voya is aiming to give both employers and plan sponsors a deeper, more practical experience in benefits management. This development aligns well with Voya’s mission to simplify how workplace benefits are delivered and used.

The market’s reaction has been encouraging. Voya shares are up more than 4% in the past month and nearly 16% over the past quarter. Although the gain so far this year is a solid 12%, the stock’s 3% total return over the past year shows that momentum is picking up only recently. In the longer view, with cumulative returns approaching 80% over five years, investors have seen meaningful value creation. However, most of that outperformance has occurred in prior years as the company’s growth engine has been uneven at times. Recent business wins and the partnership announcement appear to be reigniting interest among investors eager for growth.

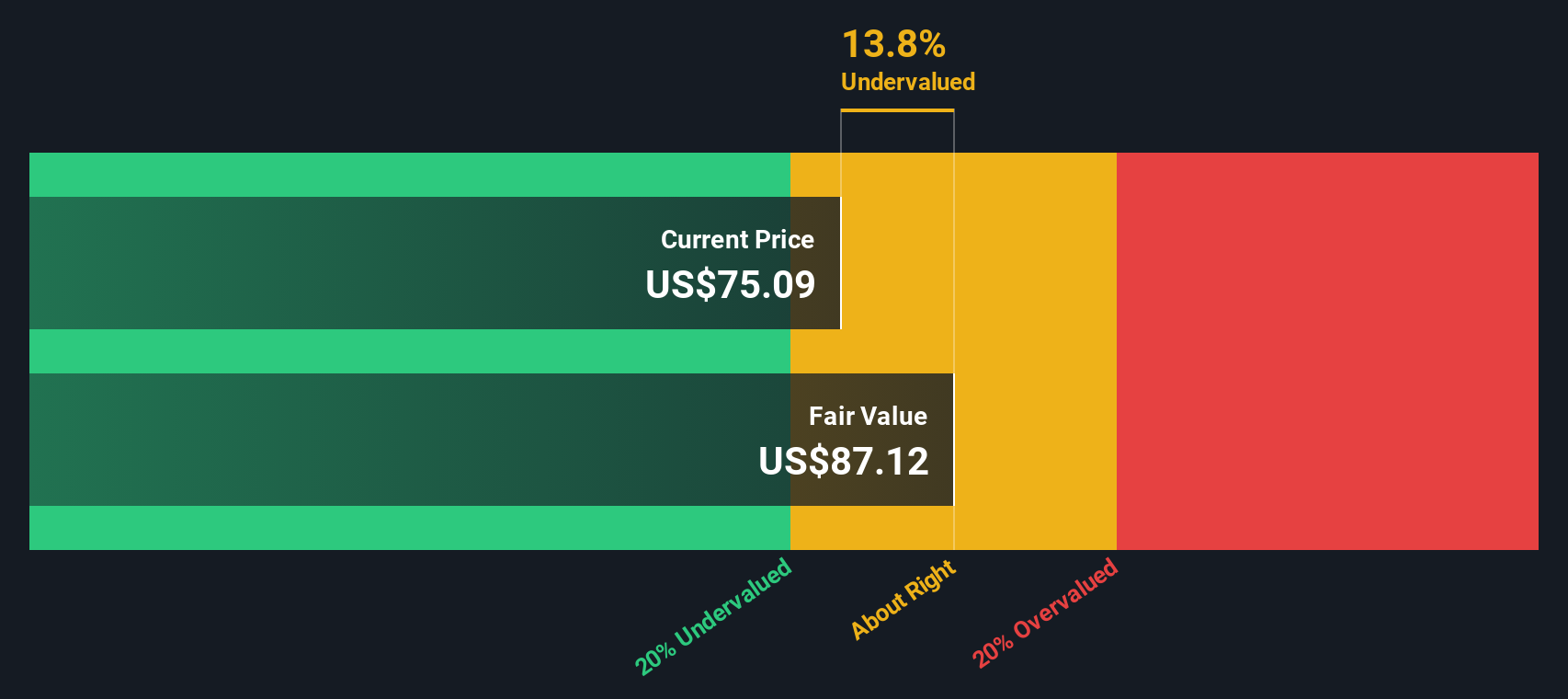

After this renewed run-up, the key question is whether Voya is trading at a bargain given its future growth potential or if the current price already reflects the next phase of its transformation. Are investors getting ahead of themselves, or is this a buying opportunity?

Most Popular Narrative: 7% Undervalued

According to the most widely followed narrative, Voya Financial is currently seen as undervalued by about 7% compared to its fair value. The narrative is driven by long-term growth expectations in revenue, margins, and earnings, set against a discount rate of just under 9%.

The rapidly growing and aging U.S. population is increasing demand for workplace retirement plans, asset management, and annuity products. Voya has surpassed $1 trillion in assets and nearly 10 million participant accounts in retirement, with strong organic net flows and new client wins. This suggests continued topline (revenue) growth and expanding assets under management.

What is the secret math behind that 7% fair value gap? The core assumptions hinge on a powerful mix of rising profitability, steady revenue gains, and a major earnings surge in just a few years. The catch is that analysts are betting on margin expansion and future growth rates rarely seen outside industry disruptors. Want to know which financial milestones the narrative is counting on to justify this price target? The full breakdown might surprise you.

Result: Fair Value of $83.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing fee pressure and rising medical claims volatility could threaten Voya's improving margins and challenge the bullish outlook if trends shift unexpectedly.

Find out about the key risks to this Voya Financial narrative.Another View: DCF Model Perspective

Looking through the lens of our DCF model, the valuation paints a similarly positive picture. This suggests Voya could be trading below its true worth. However, does this approach capture all the risks ahead, or is it missing key shifts in the business?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Voya Financial Narrative

If you want to dive deeper than these perspectives or challenge the current consensus, you can assemble your own outlook from the available data in under three minutes. Do it your way

A great starting point for your Voya Financial research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one idea. Seize the momentum and find other stocks that could supercharge your portfolio with Simply Wall Street’s powerful screeners.

- Uncover companies redefining Artificial Intelligence by checking out the potential game changers featured under AI penny stocks for tomorrow’s tech breakthroughs.

- Boost your passive income plans when you review handpicked picks for solid yield in our list of dividend stocks with yields > 3% that reward investors with consistent payouts.

- Spot hidden value others might miss by searching among stocks that may be priced below their true potential, all surfaced with our collection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VOYA

Voya Financial

Provides workplace benefits, and savings solutions and technologies in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives