- United States

- /

- Diversified Financial

- /

- NYSE:VEL

Is Now The Time To Put Velocity Financial (NYSE:VEL) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Velocity Financial (NYSE:VEL), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Velocity Financial

How Fast Is Velocity Financial Growing Its Earnings Per Share?

In the last three years Velocity Financial's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Velocity Financial's EPS shot up from US$0.91 to US$1.24; a result that's bound to keep shareholders happy. That's a fantastic gain of 36%.

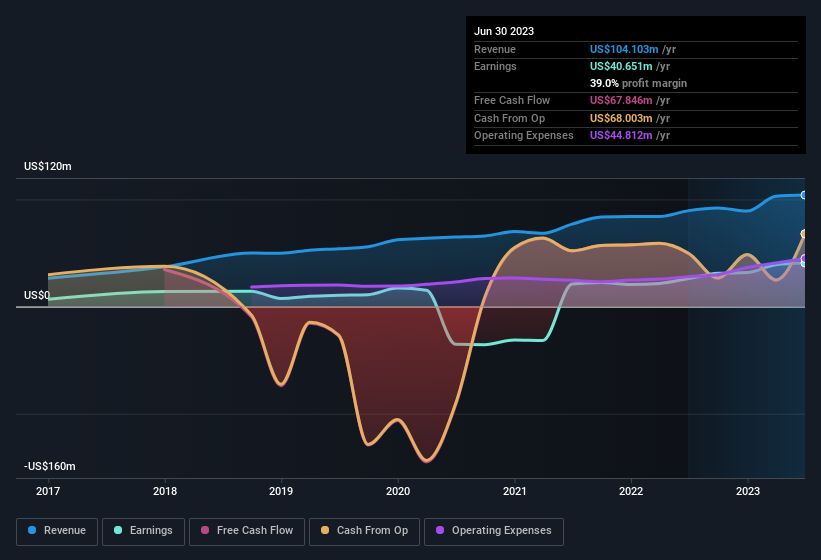

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Velocity Financial's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Velocity Financial maintained stable EBIT margins over the last year, all while growing revenue 16% to US$104m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Velocity Financial's future profits.

Are Velocity Financial Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Velocity Financial shares, in the last year. So it's definitely nice that Independent Director John Pitstick bought US$25k worth of shares at an average price of around US$8.27. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Along with the insider buying, another encouraging sign for Velocity Financial is that insiders, as a group, have a considerable shareholding. To be specific, they have US$14m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 3.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Velocity Financial Deserve A Spot On Your Watchlist?

You can't deny that Velocity Financial has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. These things considered, this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Velocity Financial that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Velocity Financial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VEL

Velocity Financial

Operates as a real estate finance company in the United States.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives