Should You Revisit Visa Shares After a 25.8% Jump and Regulatory Headlines in 2025?

Reviewed by Bailey Pemberton

Thinking of what to do with your Visa shares or whether now is the right time to start a position? You are not alone. Visa’s stock has been quite a journey this year, grabbing the attention of investors who want more than just a quick trade. Many are seeking portfolio mainstays. Over the past 12 months, the stock has soared 25.8%, and since the start of the year, it is up another 10.0%. The last week alone saw a 3.3% pop, while the past month gave investors a slight pullback of -1.2%. These moves hint at underlying confidence in the payments industry and perhaps changing risk perceptions as market developments continue to unfold.

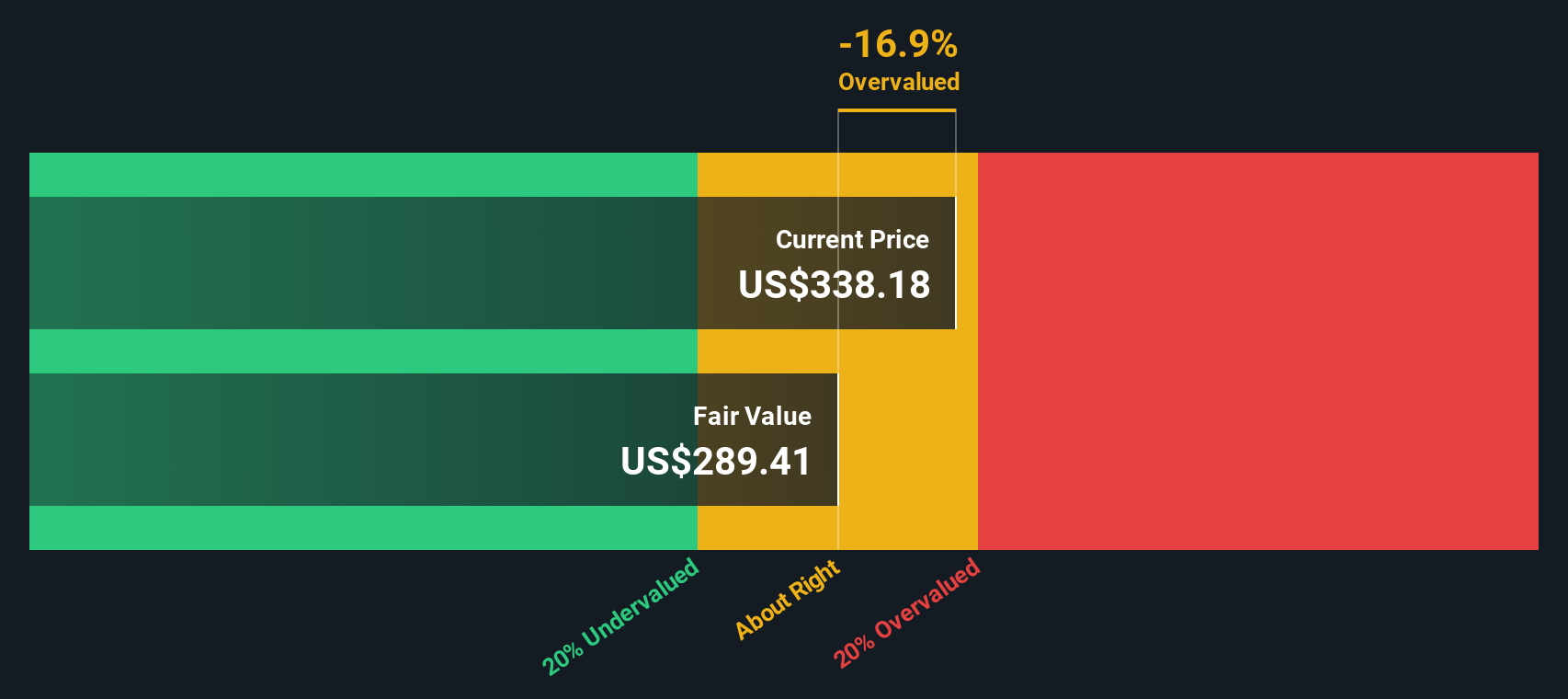

But before anyone makes a decision, it is worth stepping back and considering what all this price action means for the stock’s valuation. If we look at Visa’s value score, which is a numeric signal driven by six different valuation checks, it comes in at a 0 out of 6 right now. In other words, Visa does not currently appear undervalued on any of the main metrics analysts tend to watch.

That might sound discouraging, but numbers like these are only one piece of the puzzle. In the next section, we will break down the major approaches analysts use to value companies like Visa. If you stick with me to the end, I will share an even more useful lens for deciding what Visa is really worth.

Visa scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Visa Excess Returns Analysis

The Excess Returns model examines how effectively a company transforms invested shareholder equity into profits above the basic cost of capital. It essentially measures whether Visa is generating returns higher than investors could expect from putting their money elsewhere, adjusted for risk.

For Visa, the figures are impressive. The company posts an average Return on Equity (ROE) of 70.55%, which is an exceptionally high level that far exceeds industry norms. Its current Book Value is $19.58 per share, and analysts estimate a stable Book Value of $20.94 per share in the years ahead. Weighted projections from ten analysts put Visa's future sustainable earnings (Stable EPS) at $14.77 per share, while the Cost of Equity is $1.56 per share. The resulting Excess Return, which represents profits generated above that cost, totals $13.22 per share.

Using these inputs, the Excess Returns model estimates Visa's fair value at $324.65 per share. With Visa's recent share price running about 6.6% above this estimated value, the stock appears slightly overvalued by this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Visa's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

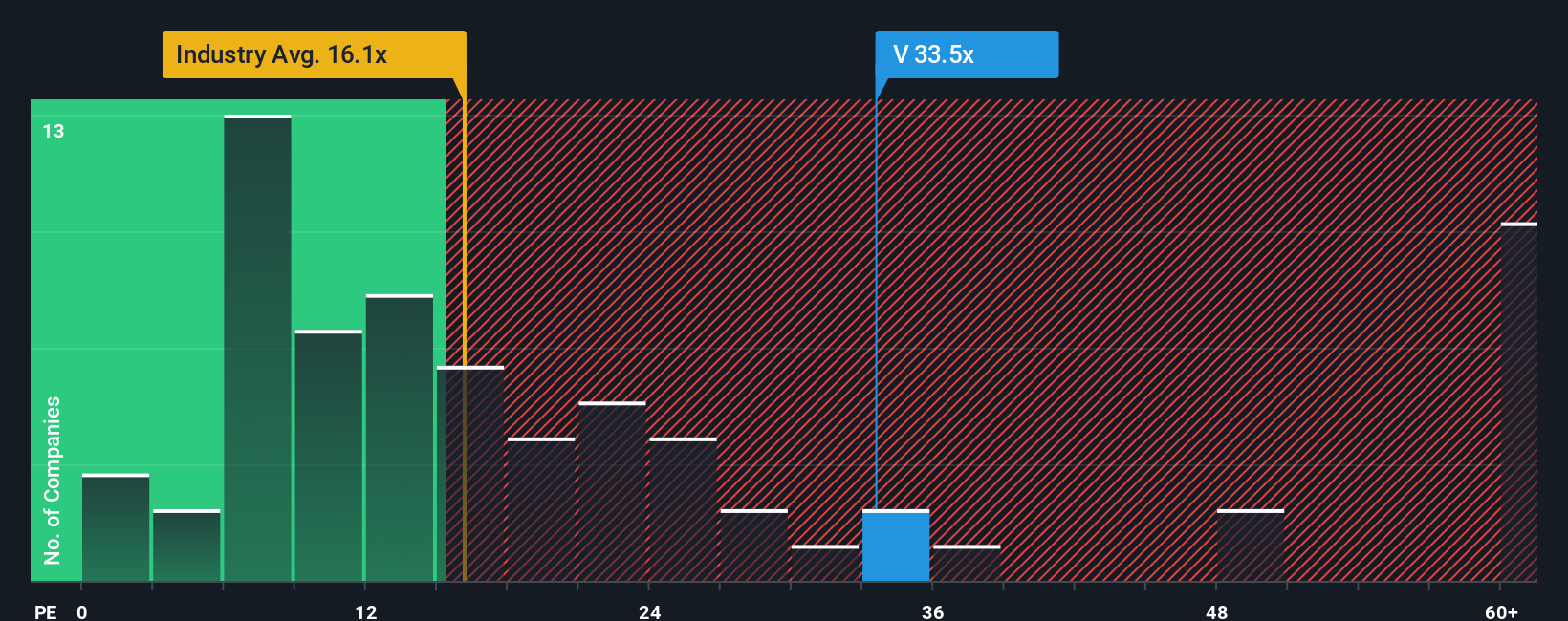

Approach 2: Visa Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is often the go-to valuation method for highly profitable companies like Visa. This metric helps investors understand how much they are paying for every dollar of the company’s earnings, making it especially useful for evaluating businesses with reliable income streams.

It is important to remember that the right P/E ratio for a company takes into account not just its profitability, but also market expectations for growth and the level of risk compared to other businesses. Higher anticipated growth and lower perceived risk generally support higher "normal" P/E levels. In contrast, slower growth or elevated risk push fair multiples down.

Currently, Visa is trading at a P/E ratio of 33.2x. That is a hefty premium compared to the Diversified Financial industry average of 16.5x, and also well above the peer average of 22.2x. While these simple comparisons suggest Visa is rich versus its sector and competitors, they do not tell the full story.

This is where the proprietary Simply Wall St "Fair Ratio" comes in. The Fair Ratio for Visa stands at 23.3x. Unlike basic peer or industry comparisons, the Fair Ratio adjusts for company-specific strengths and risks such as earnings growth, profit margins, market cap, and competitive positioning. This makes it a more nuanced and reliable benchmark for determining if a stock's valuation is justified.

With Visa’s P/E ratio at 33.2x and its Fair Ratio at 23.3x, the stock currently looks overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Visa Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative, in simple terms, is your personal investment story for a company. It is a perspective that connects your beliefs about Visa’s future (like revenue, earnings, and profit margins) directly to a financial forecast and a fair value estimate.

Narratives take the guesswork out of investing by letting you combine what you know, what you assume, and what you observe. This allows you to craft a forward-looking story that matches the numbers. On Simply Wall St’s Community page, used by millions of investors worldwide, anyone can create a Narrative or explore others. This makes professional-grade valuation accessible to everyone.

By building your own Narrative for Visa, you can compare your calculated fair value to the current stock price to see if it’s time to buy, hold, or sell. Narratives automatically update as new information comes in. If Visa announces fresh earnings or faces a regulatory change, your forecasts and fair value can adjust in real time.

For example, you might see one Narrative projecting a conservative fair value of $243 per share based on slower growth and regulatory risks. Another, more optimistic view might value Visa at over $391 by anticipating strong global e-commerce and higher margins.

For Visa, however, we’ll make it really easy for you with previews of two leading Visa Narratives:

🐂 Visa Bull CaseFair value: $391.46

Undervalued by: 11.6%

Projected revenue growth: 10.1%

- Global digital adoption, e-commerce, and expansion in emerging markets are expected to drive strong payment volumes and long-term revenue growth.

- Value-added services, cross-border solutions, and increased share buybacks are anticipated to lift margins, diversify revenue, and provide downside protection for shareholders.

- Key risks include disruptive real-time payment technologies, regulatory headwinds, and growing competition from tech and fintech companies.

Fair value: $243.09

Overvalued by: 42.4%

Projected revenue growth: 9.1%

- Visa’s growth may be limited by market maturity and heightened regulatory scrutiny, including the risk of the Credit Card Competition Act undermining its pricing power.

- Revenue growth is expected to slow as Visa captures an already large share of the global market, and profit margins are forecasted to decline modestly due to competitive and regulatory pressure.

- Despite strong buybacks and global reach, the stock is seen as trading at a premium, with future returns likely dependent on Visa defending its market position and maintaining efficiency in a shifting payments landscape.

Do you think there's more to the story for Visa? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives