- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (UWMC): Assessing Valuation After Recent Share Price Weakness and Improving Earnings

Reviewed by Simply Wall St

UWM Holdings (UWMC) has quietly slipped this month, adding to a weak past 3 months, even as its revenue and net income are growing. That mismatch is exactly what has value driven investors paying attention.

See our latest analysis for UWM Holdings.

At around $4.87, UWM Holdings’ recent slide, including a weak 90 day share price return, sits awkwardly against its improving fundamentals. This hints that sentiment has cooled faster than the underlying business, but long term total shareholder returns remain positive.

If this shift in momentum has you rethinking where to find opportunity, it could be a good moment to explore fast growing stocks with high insider ownership as a fresh hunting ground.

With revenue and earnings now climbing while the share price retreats and analysts see upside to their targets, investors face a key question: Is UWMC quietly undervalued or already reflecting the recovery the market expects?

Most Popular Narrative: 30.4% Undervalued

With UWM Holdings last closing at $4.87 against a narrative fair value of $7.00, the story frames today’s price as a sizable discount.

UWM's large scale, tech forward business model positions it to benefit from digital and regulatory transformation in mortgage markets, with its superior capital resources and automation enabled underwriting/processes likely to reinforce pricing power and net margin resilience as industry consolidation continues.

Curious how an old school mortgage lender gets valued like a digital scale player? The narrative hinges on rapid growth, fatter margins, and a rich future earnings multiple. Want to see which specific assumptions turn today’s modest profit into that much higher fair value? Dive into the full breakdown behind this projection.

Result: Fair Value of $7.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic setup could unravel if mortgage volumes stall despite heavy tech investment or if wholesale brokers migrate toward competing platforms.

Find out about the key risks to this UWM Holdings narrative.

Another View: Market Ratios Flash Caution

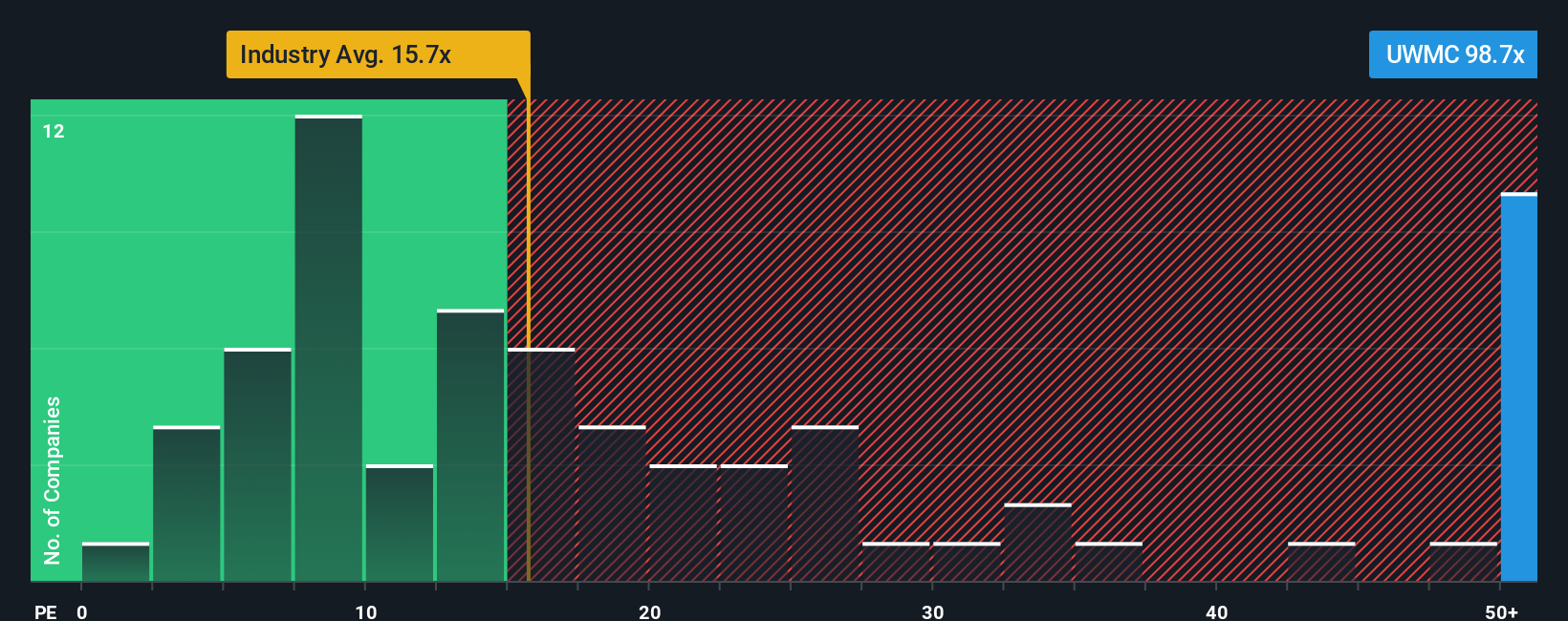

While the narrative fair value suggests upside, market ratios tell a cooler story. At a price to earnings of 73.5x versus a fair ratio of 28.7x, and well above both industry at 13.8x and peers at 10.2x, UWMC screens as richly valued, leaving little room for disappointment if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UWM Holdings Narrative

If you see the numbers differently or just prefer rolling up your sleeves, you can spin up a personalized view in minutes: Do it your way.

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall St Screener to uncover fresh opportunities that match your style, so you are not leaving potential returns on the table.

- Capture potential multi baggers early by scanning these 3635 penny stocks with strong financials that pair tiny market caps with credible financial strength.

- Position your portfolio for the next technology wave by targeting these 24 AI penny stocks powering breakthroughs in automation, data, and intelligent software.

- Identify value driven opportunities by filtering for these 913 undervalued stocks based on cash flows where strong cash flows are not yet fully recognized in current prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion