- United States

- /

- Mortgage REITs

- /

- NYSE:TWO

Is Two Harbors' Flexible Equity Offering Changing the Capital Strategy Narrative for TWO?

Reviewed by Simply Wall St

- Two Harbors Investment Corp. recently filed a prospectus supplement with the SEC to offer and sell up to 15 million shares of its common stock through an amended at-the-market equity offering program.

- This move enables Two Harbors to raise capital opportunistically but could also introduce dilution, which tends to be closely monitored by investors.

- We’ll explore how the increased flexibility to issue new shares shapes Two Harbors’ investment narrative and capital strategy.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Two Harbors Investment's Investment Narrative?

Owning Two Harbors Investment Corp. is about buying into a mortgage REIT that relies heavily on maintaining access to capital and managing portfolio risks in a challenging market. The at-the-market equity offering of up to 15 million new shares, just filed, gives the company more flexibility to shore up its balance sheet or fund opportunities as needed. For current investors, the short term catalysts remain the company's ability to stabilize earnings after recent losses and to manage dividend payments amid ongoing cash outflows like the substantial legal settlement. However, this new offering brings dilution closer to the forefront, and that risk now weighs more heavily on the investment case than it did before. With weak price action and persistent losses, the offering makes it even more important for the company to demonstrate clear paths to future profitability and sustainable dividends. Investors will be watching closely to see if this new source of capital is used productively, as the risk/reward balance could shift rapidly.

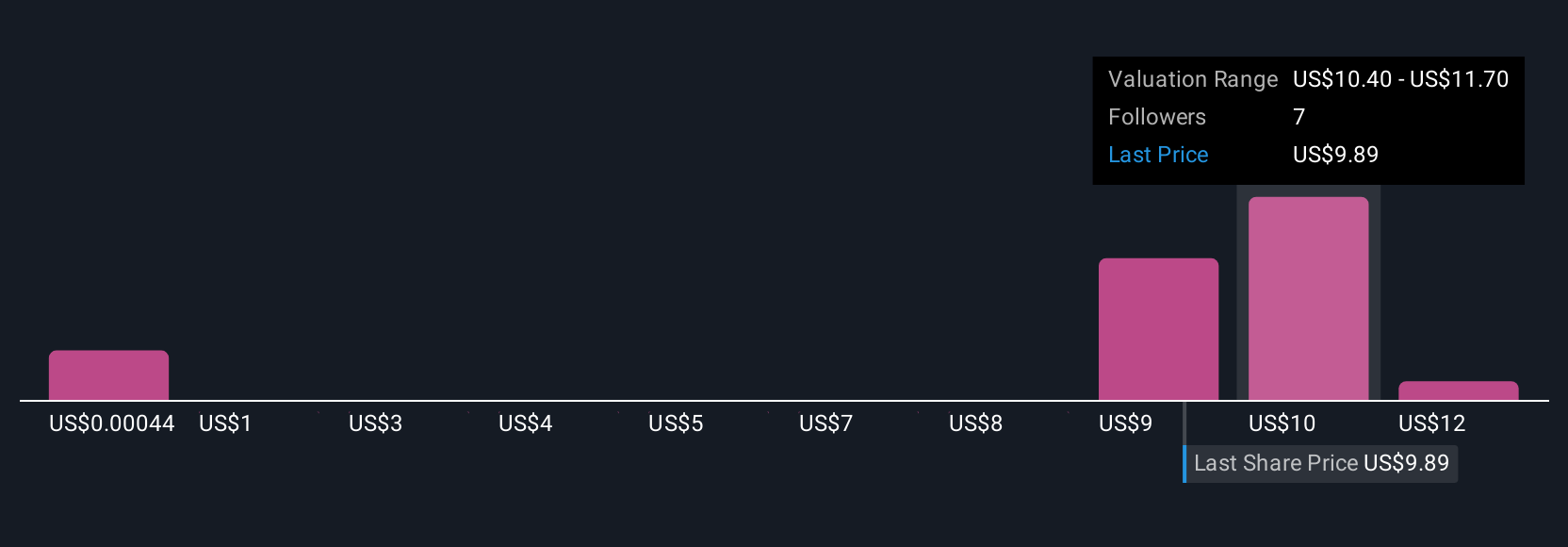

But keep in mind, dilution risk is now a more pressing concern than it was just weeks ago. Two Harbors Investment's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 5 other fair value estimates on Two Harbors Investment - why the stock might be worth as much as 31% more than the current price!

Build Your Own Two Harbors Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Two Harbors Investment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Two Harbors Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Two Harbors Investment's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Two Harbors Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWO

Two Harbors Investment

Invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives