- United States

- /

- Mortgage REITs

- /

- NYSE:TWO

Is Now the Right Time to Revisit Two Harbors Investment After Mortgage REITs Slide?

Reviewed by Bailey Pemberton

If you've been tracking Two Harbors Investment lately, you know this stock can feel like a bit of a roller coaster. Maybe you’re wondering whether this recent ride means now is the time to get in, or if you’re better off waiting on the sidelines. Over just the past week, the stock slipped by 0.7%, and over the last month, it’s down 4.1%. Zooming out further, this year has been tough with a drop of nearly 20%, and over the last year, shares are trailing by 15.5%. Looking even further back, the three-year return sits at a solid 14.1%, painting a more nuanced picture. Market sentiment has shifted in response to broader real estate trends and changing expectations for interest rates, which can swing the risk perception for mortgage-focused investments like Two Harbors.

Of course, headlines and daily blips are not the whole story. Investors often want the numbers to indicate whether this is a value play. The company currently registers a value score of 3 out of 6 on our valuation checklist, signaling it is undervalued on three separate measures. In other words, the analysis is mixed, and that is where the real work begins. Here is a look at how each valuation approach compares, and more importantly, a discussion on how investors could frame “value” when assessing Two Harbors Investment.

Approach 1: Two Harbors Investment Excess Returns Analysis

The Excess Returns model evaluates whether a company generates returns above its cost of equity by using its stable earnings, book value, and expected return on equity as key drivers. The aim is to assess how much value the business delivers above what investors require for the given risk profile.

For Two Harbors Investment, the latest estimates show a Book Value of $12.34 per share and a Stable EPS of $1.26 per share, with these figures derived from weighted future analyst expectations. The average Return on Equity stands at 10.68%, slightly trailing the Cost of Equity at $1.45 per share. As a result, the current Excess Return is $-0.19 per share. This suggests the business is not generating returns above its equity cost. The Stable Book Value is projected at $11.76 per share, indicating a mostly steady outlook, but not one where significant excess wealth is created for shareholders.

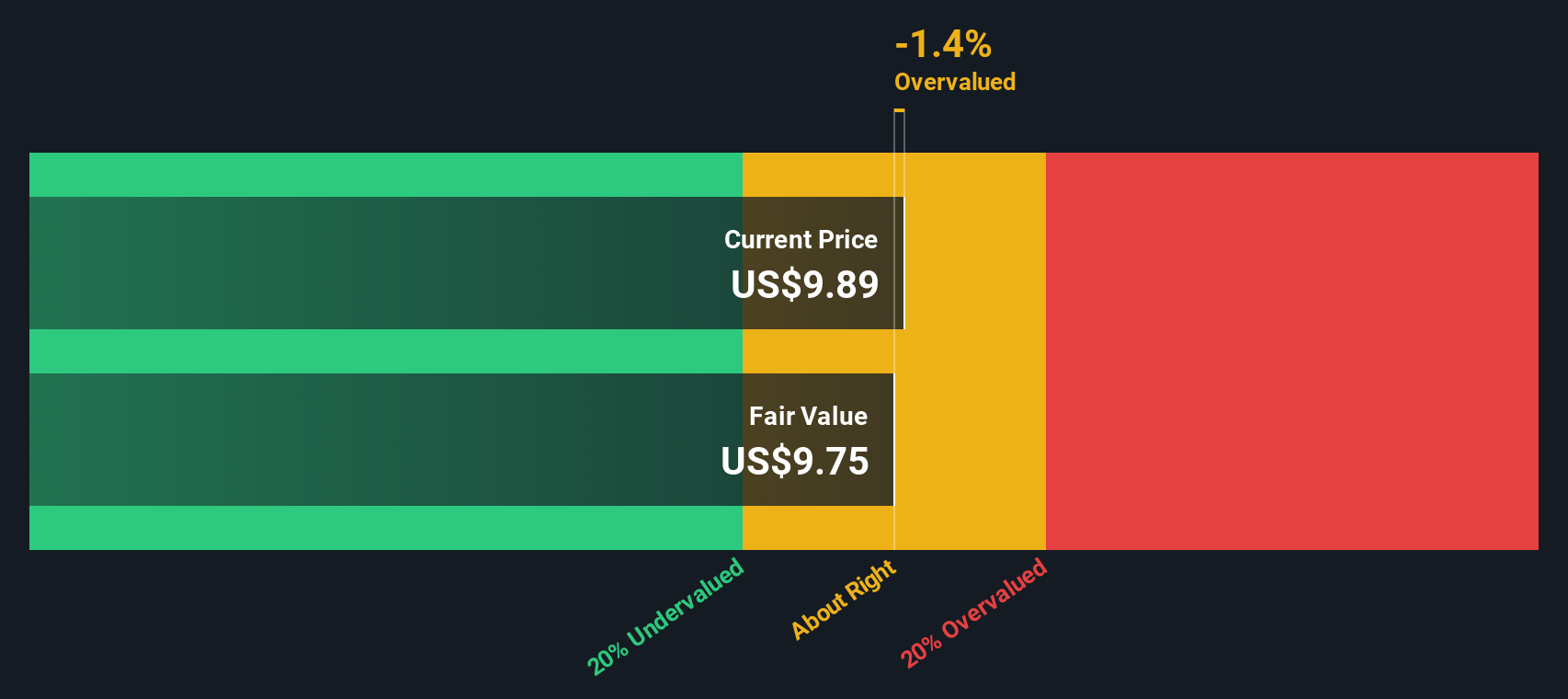

Bringing these pieces together, the Excess Returns model produces an estimated intrinsic value that is 0.6% above the current share price. This implies that Two Harbors Investment stock is trading almost exactly in line with its intrinsic value right now.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Two Harbors Investment's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Two Harbors Investment Price vs Sales

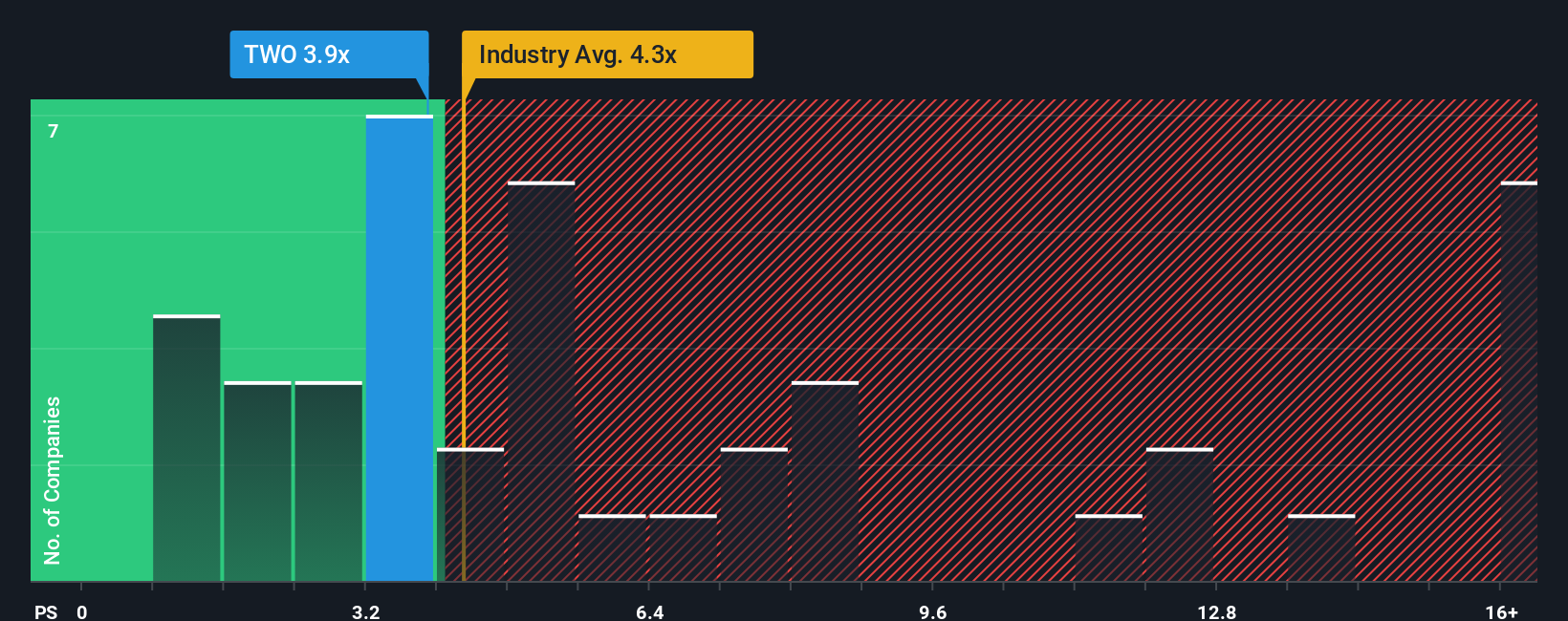

For companies like Two Harbors Investment, which are experiencing instability in profitability but still generate sizable revenue, the price-to-sales (P/S) ratio becomes a preferred metric for valuation. The P/S ratio looks past temporary earnings swings and gives investors a way to evaluate the business's value relative to its revenue base. This can be especially useful in sectors where earnings can be volatile, such as mortgage REITs.

The appropriate P/S multiple for any company depends on expectations around future growth and the risks facing the business. Higher-growth firms or those with more stable revenue streams often attract a higher P/S ratio. Businesses operating in riskier environments or with less predictable results tend toward lower multiples.

Currently, Two Harbors Investment trades at a P/S multiple of 3.89x. This is just above its direct peer group average of 3.59x, but slightly below the broader Mortgage REITs industry average of 4.28x. More importantly, Simply Wall St’s proprietary Fair Ratio for Two Harbors stands at 0.33x, which is much lower than both peer and industry benchmarks. The Fair Ratio adjusts for the company’s unique factors including its earnings growth outlook, profit margins, risk profile, industry placement, and market capitalization.

The value of the Fair Ratio lies in its comprehensive approach. It does not just look at what similar companies are doing, but asks what is justified for Two Harbors given its own opportunities and risks. This makes it a more focused tool for finding mispricings than simply comparing against industry or peer averages.

The bottom line for Two Harbors Investment is that its current P/S multiple of 3.89x is well above the Fair Ratio of 0.33x, suggesting the stock is overvalued on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Two Harbors Investment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful way for investors to build their own story about a company by connecting real-life context, their assumptions for fair value, and future expectations for things like revenue, earnings, and profit margins.

Instead of focusing solely on point-in-time numbers, Narratives allow you to link the company’s story with a transparent financial forecast and see how that translates directly to fair value. This approach is accessible to everyone through the Community page on Simply Wall St, giving millions of investors the ability to visualize and refine their thinking.

Narratives make it easy to compare your Fair Value estimates with the current market price, helping clarify when to buy or sell based on your own outlook. They are updated instantly as new information, such as news or earnings reports, emerges so your analysis always stays relevant.

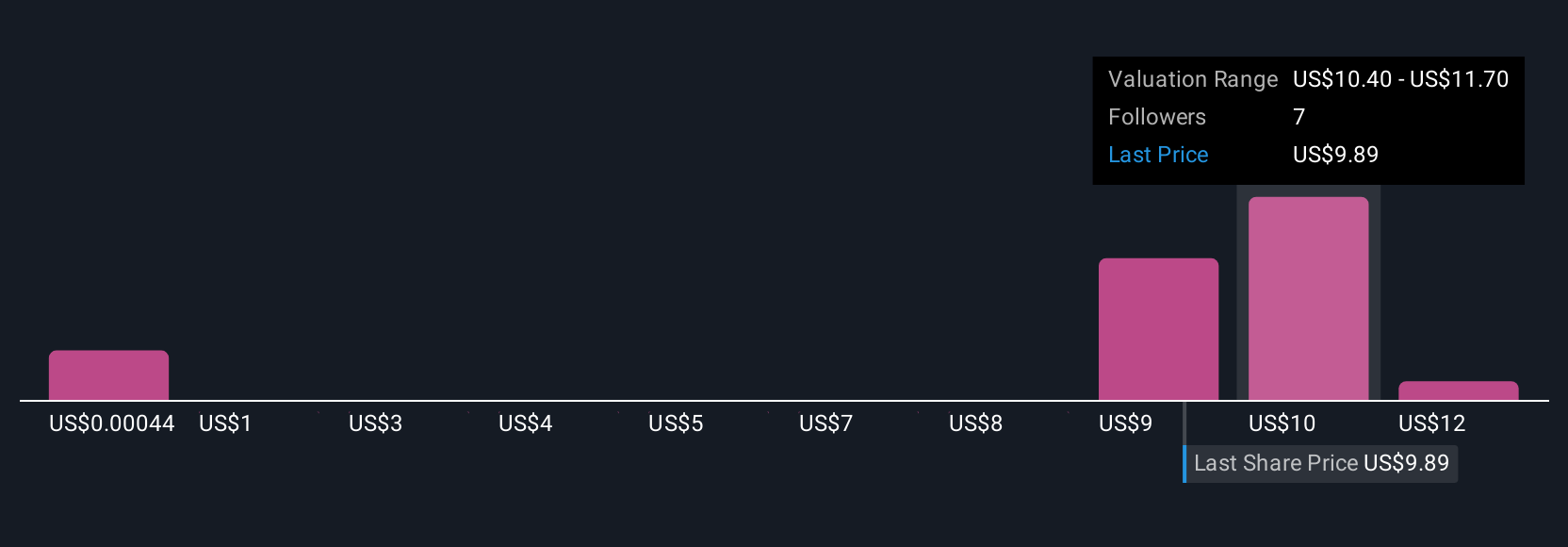

For example, within Narratives for Two Harbors Investment, some investors see long-term growth and set a high fair value, while others view the company’s risks as significant and assign the lowest fair value. This shows how different perspectives can lead to different investment decisions.

Do you think there's more to the story for Two Harbors Investment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Two Harbors Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWO

Two Harbors Investment

Invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives