- United States

- /

- Diversified Financial

- /

- NYSE:TOST

Could Toast’s (TOST) Delivery Expansion Signal a Turning Point in Platform Value Creation?

Reviewed by Sasha Jovanovic

- Earlier this month, Toast announced new partnerships with TGI Fridays and everbowl to implement its restaurant management platform across more than 100 everbowl locations and all TGI Fridays U.S. outlets, and also expanded its collaboration with Uber to broaden commission-free delivery services for restaurants.

- This series of agreements highlights Toast's focus on scalable technology and cost efficiencies, aiming to improve operational effectiveness and guest experiences for high-profile restaurant chains nationwide.

- We'll now explore how the Uber delivery expansion may influence Toast’s narrative around platform growth and value for restaurant customers.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Toast Investment Narrative Recap

To be a Toast shareholder today, you really need to believe that its integrated platform and major partnerships will keep driving higher transaction volumes and recurring software revenue, as restaurants rapidly modernize. The fresh agreements with TGI Fridays, everbowl, and Uber strengthen Toast’s brand with enterprise chains, but they do not immediately shift the biggest risk: continued pressure on gross margins from hardware costs and increasing competition for large-scale restaurant clients.

Among the recent announcements, Toast’s Uber collaboration is most directly connected to the delivery and cost-efficiency catalyst, giving restaurants commission-free access to Uber’s network and broadening Toast's fintech ecosystem. This bolsters the narrative that expanded integrations can fuel future transaction growth even as industry same-store sales trends remain soft.

But, unlike the long-term opportunity, the near-term outlook could be clouded if elevated hardware costs or margin constraints persist, something every investor should keep an eye on...

Read the full narrative on Toast (it's free!)

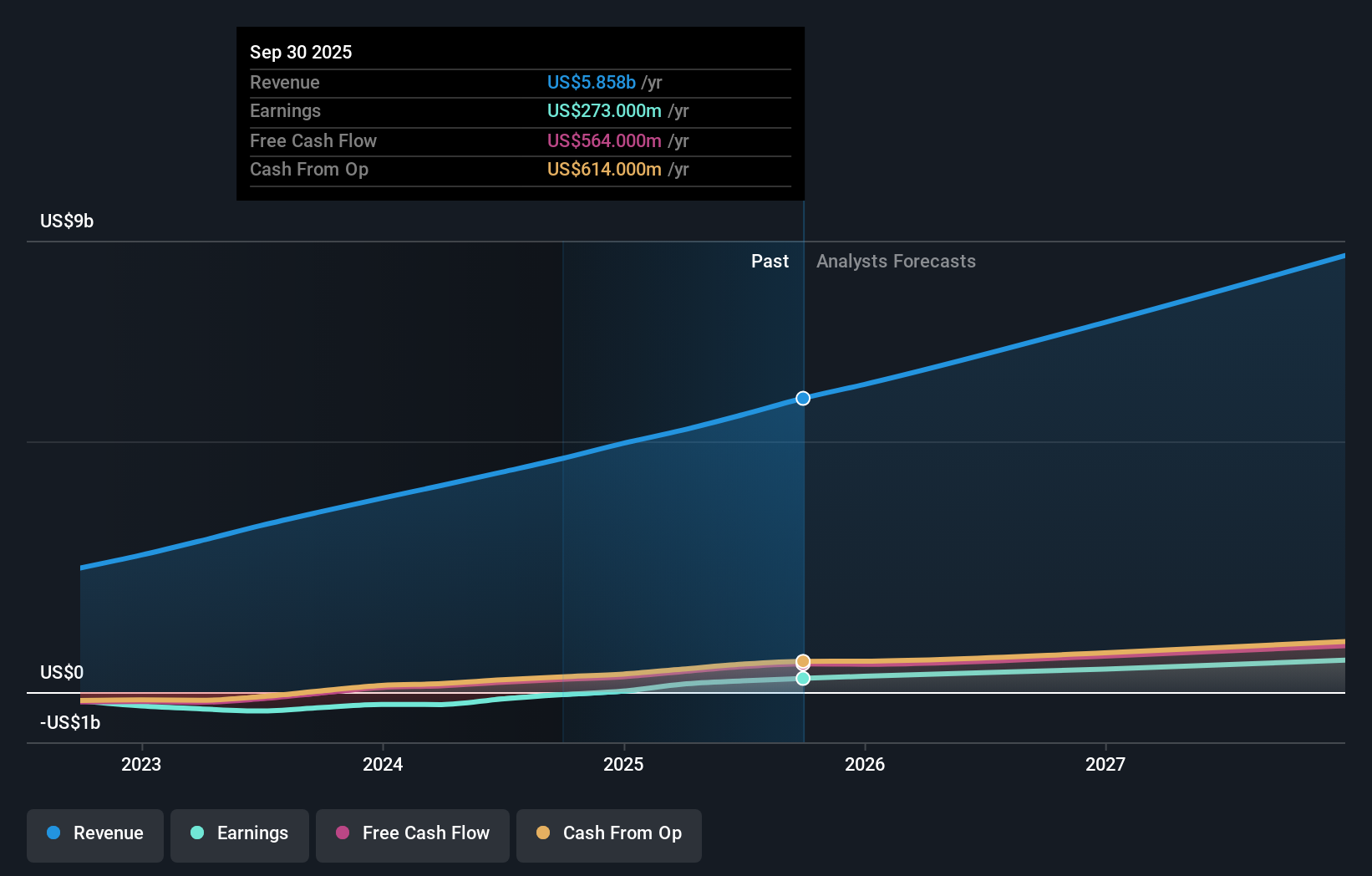

Toast's outlook projects $8.9 billion in revenue and $738.5 million in earnings by 2028. This scenario relies on a 17.3% annual revenue growth rate and an earnings increase of $514.5 million from the current $224.0 million.

Uncover how Toast's forecasts yield a $47.35 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Twelve individual fair value estimates from the Simply Wall St Community range widely from US$26.38 to US$58.86. Persistent competitive threats and the risk of margin compression remind you just how much future performance depends on Toast’s ability to sustain productivity and differentiate its offering.

Explore 12 other fair value estimates on Toast - why the stock might be worth 19% less than the current price!

Build Your Own Toast Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toast research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Toast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toast's overall financial health at a glance.

No Opportunity In Toast?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives