- United States

- /

- Diversified Financial

- /

- NYSE:TOST

A Fresh Look at Toast (TOST) Valuation as Shareholder Returns Outpace Near-Term Momentum

Reviewed by Simply Wall St

Toast (TOST) continues to attract attention from investors as its stock moves in response to broader market trends and the company's latest financial performance. With solid revenue growth over the past year, many market watchers are examining what the future may hold for Toast.

See our latest analysis for Toast.

Toast’s share price has had its ups and downs lately, with a one-day pop of 5.09% followed by more muted recent moves. This reflects how sentiment can turn on both short-term headlines and broader business momentum. Despite some bumps, total shareholder return sits at a healthy 16.66% over the past year and an impressive 90.31% over three years. This suggests long-term holders have been rewarded even as near-term momentum is still finding its footing.

If you’re on the lookout for what else is gaining ground, consider using our fast growing stocks with high insider ownership to discover new opportunities with a track record of growth.

With Toast’s share price sitting about 34% below analyst targets and steady double-digit growth, the key question for investors is whether there is overlooked value here or if the market has already factored future gains into the price.

Most Popular Narrative: 26% Undervalued

Toast's most widely followed narrative places its fair value at $48.92, which is notably higher than the most recent closing price of $36.14. This spread has investors questioning if current market caution is too severe, given Toast's future growth levers and ability to scale.

The rapid adoption of integrated digital payment and ordering solutions, including mobile and contactless experiences, continues to expand Toast's addressable market. This positions the company to capture increased transaction volume and higher recurring fintech and software revenues as restaurants upgrade from legacy systems.

Want to know the secret behind this gap? This valuation leans heavily on bold revenue targets, improving profit margins, and persistent fintech adoption. Curious how ambitious projections and analyst optimism combine to support this powerful fair value? The real drivers are revealed in the full narrative.

Result: Fair Value of $48.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are risks, such as fierce competition and potential margin pressure. These factors could challenge Toast’s strong growth narrative going forward.

Find out about the key risks to this Toast narrative.

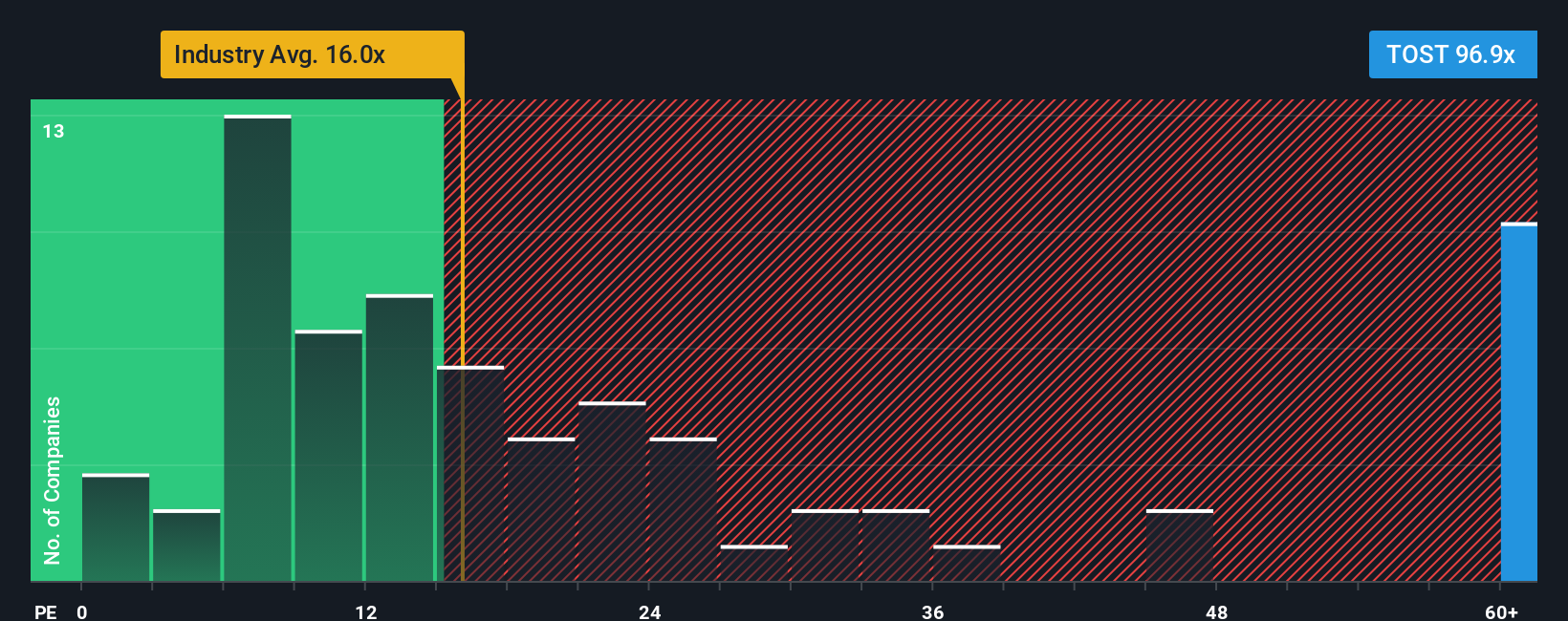

Another View: Market Multiples Paint a Pricier Picture

While analyst models suggest Toast is undervalued, the market's own multiples tell a different story. Toast trades at a price-to-earnings ratio of 94.1x, much higher than the industry average of 15.1x and its fair ratio of 23.1x. This wide premium hints at higher valuation risk if market expectations shift. This raises the question: are investors paying too much for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toast Narrative

If you see things differently or like to dive into the details yourself, you can shape your own story in just a few minutes. Do it your way

A great starting point for your Toast research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Bright Investment Ideas?

Why settle for the usual picks when you can easily zero in on stocks with standout potential? Don’t miss out; your next big winner could be waiting.

- Jump on high-yield opportunities and access reliable income streams with these 22 dividend stocks with yields > 3% for companies offering strong dividend returns and attractive yields above 3%.

- Ride the momentum of innovation and unleash your portfolio’s growth in artificial intelligence by checking out these 26 AI penny stocks pushing boundaries in automation and machine learning.

- Capitalize on under-the-radar bargains by searching these 832 undervalued stocks based on cash flows that show solid potential based on robust cash flows and favorable valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TOST

Toast

Operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives