- United States

- /

- Capital Markets

- /

- NYSE:STT

State Street Shares Surge 21.5% in 2025 After Digital Asset Partnerships: Is Value Still There?

Reviewed by Bailey Pemberton

- Wondering if State Street shares still offer real value or if you may have missed your window? You are not alone, and we are breaking down the facts you need to know.

- State Street’s stock price has gained 4.1% in the last week and is up an impressive 21.5% year to date, hinting at renewed optimism and possibly shifting risk perceptions among investors.

- Recent headlines have spotlighted State Street’s strategic moves, including new partnerships in digital assets and expanded ETF offerings. These developments are fueling positive sentiment and pushing shares higher, helping the company stay relevant in a fast-changing financial landscape.

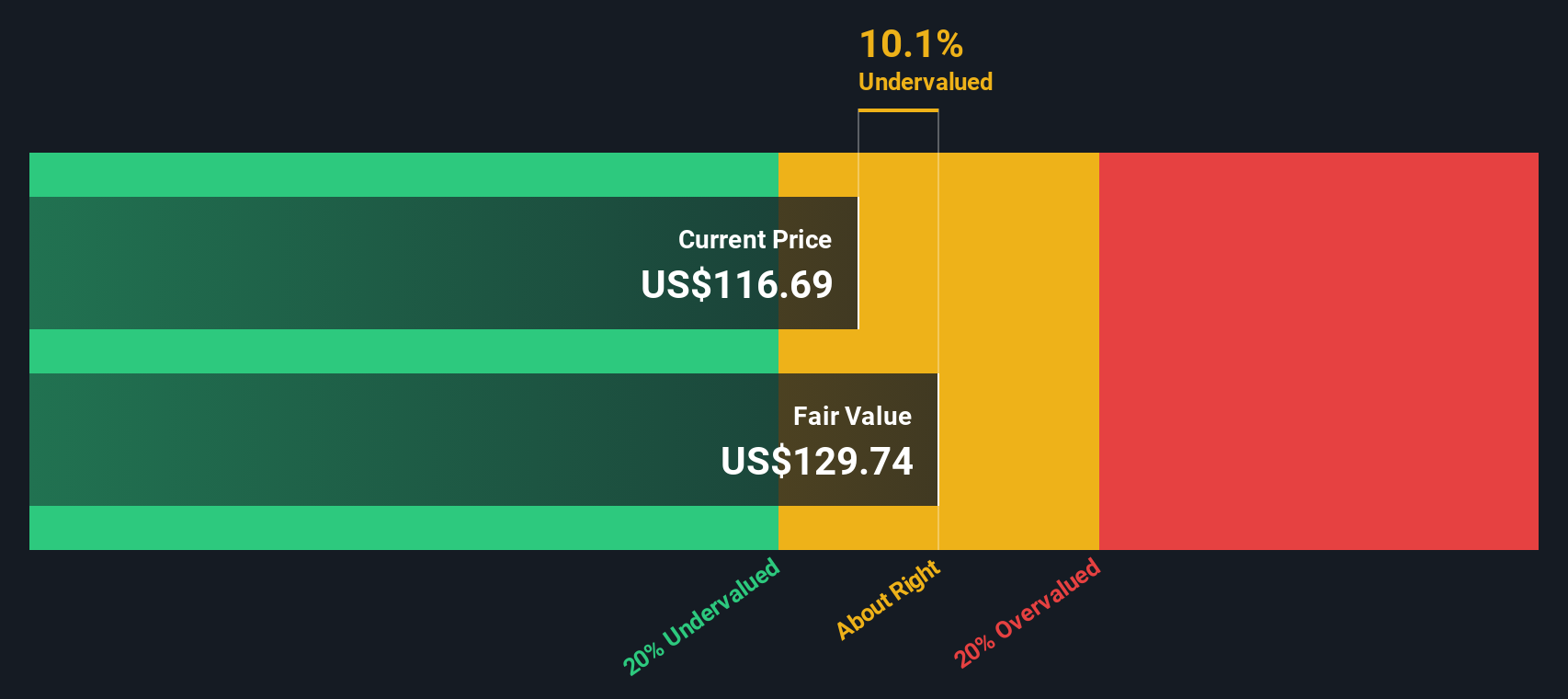

- State Street scores a 4 out of 6 on our value checks, suggesting several signs of undervaluation are present. Next, we will break down how this score is calculated using standard valuation approaches and discuss alternative ways to assess true value, so stick with us.

Approach 1: State Street Excess Returns Analysis

The Excess Returns valuation model emphasizes how much profit a company generates over and above its cost of equity capital. Put simply, it measures how efficiently State Street converts shareholders’ funds into profit, and whether this performance can create value beyond a typical investment’s required return.

For State Street, the current book value stands at $85.33 per share, with a stable earnings per share estimate of $12.04. These profits are notably higher than the company's estimated cost of equity, which sits at $9.20 per share. This positive spread leads to an excess return of $2.84 per share, showing State Street’s ability to consistently deliver returns above what investors would require for holding its shares. The average return on equity is a strong 12.82%, while the stable book value is projected to rise to $93.92 per share, based on future estimates from analysts.

Through this approach, the intrinsic value per share is calculated at $137.32, making the stock about 13.3% undervalued compared to where it currently trades. This suggests an attractive entry point for investors looking for companies that generate robust returns above their capital costs, even in a competitive sector like capital markets.

Result: UNDERVALUED

Our Excess Returns analysis suggests State Street is undervalued by 13.3%. Track this in your watchlist or portfolio, or discover 920 more undervalued stocks based on cash flows.

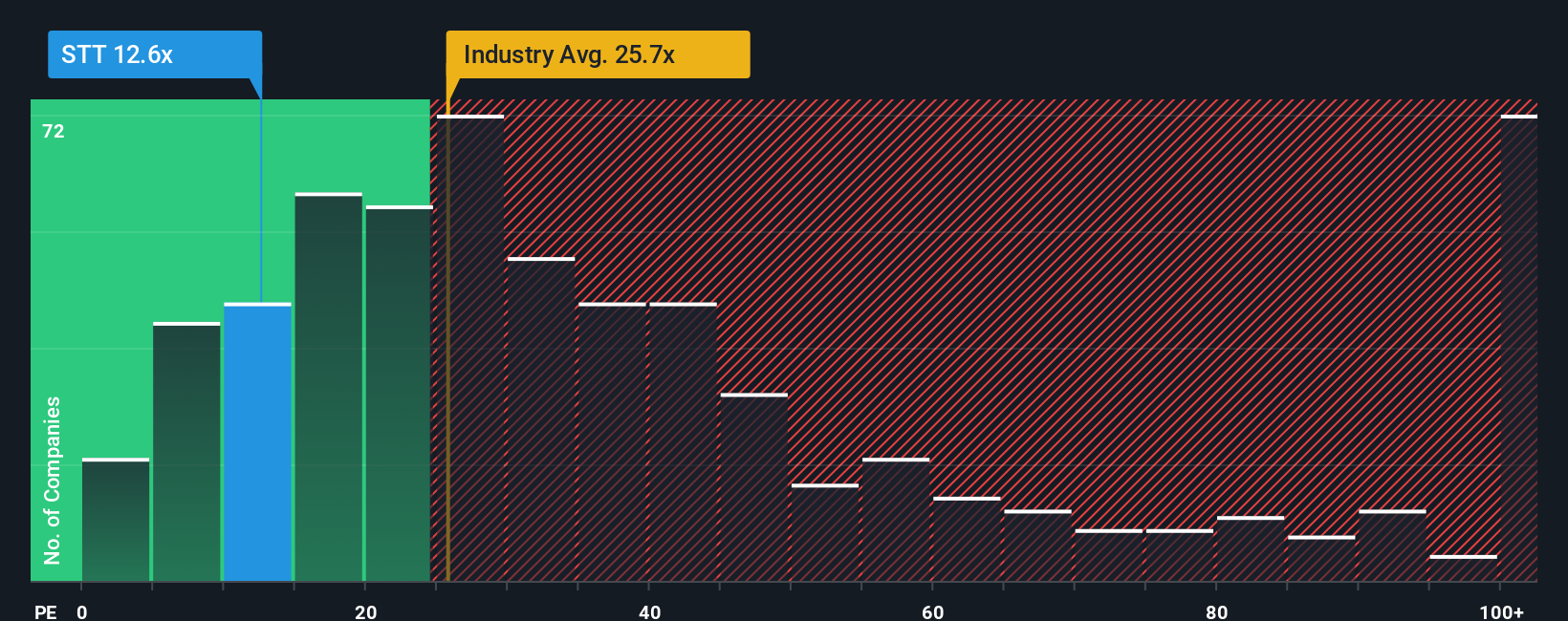

Approach 2: State Street Price vs Earnings

The price-to-earnings (PE) ratio is a widely used valuation metric, particularly effective for profitable companies like State Street, as it highlights how much investors are willing to pay for each dollar of earnings. For businesses generating reliable profits, the PE ratio provides a clear lens for comparing value across similar companies and industries.

The appropriate PE ratio for any company depends on factors such as expected earnings growth, perceived business risk, and general market conditions. Faster-growing firms or those with lower risk profiles often justify higher PE ratios, while companies facing challenges tend to trade at lower multiples.

Currently, State Street trades at a PE ratio of 12.1x. This is well below both the industry average of 23.9x and the peer group average of 16.8x, signaling potential undervaluation on a simple comparison. However, Simply Wall St's proprietary “Fair Ratio” refines this picture. It blends State Street’s specific growth outlook, risk factors, profit margins, industry dynamics, and market cap to determine a more tailored benchmark multiple. For State Street, the Fair Ratio comes in at 16.1x, offering a more nuanced perspective than peer or industry averages, since it directly reflects what investors should pay for the business given its unique circumstances.

Comparing State Street’s current PE of 12.1x to its Fair Ratio of 16.1x reveals a notable discount, suggesting that shares may be undervalued at present levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your State Street Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple and powerful investing tool that lets you describe your story of a company, combining your expectations for State Street's future growth, profitability, and fair value, with the reasoning behind them. Narratives connect your view of the business and its prospects to real financial forecasts, and then to a fair value estimate that you can easily compare to the current share price.

This approach is user-friendly and dynamic, available on Simply Wall St’s Community page, where millions of investors post, share, and react to Narratives for stocks like State Street. As the facts change, whether it’s a new earnings report or breaking news, Narratives update automatically so your assumptions and fair value stay relevant. Narratives empower you to make informed buy or sell decisions by comparing your personalized Fair Value to the latest market price, rather than following static analyst opinions.

For example, among current State Street Narratives, some investors forecast higher asset growth and estimate a fair value as high as $131.00, reflecting strong fee and technology gains. Others are more cautious, citing industry risks and setting their fair value as low as $95.00. This range highlights how Narratives let you see multiple perspectives and make smarter, story-driven decisions.

Do you think there's more to the story for State Street? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STT

State Street

Provides various financial products and services to institutional investors.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.