- United States

- /

- Capital Markets

- /

- NYSE:SF

Stifel (SF) Earnings Rebound Challenges Value Narrative as Margins Soften and Growth Slows

Reviewed by Simply Wall St

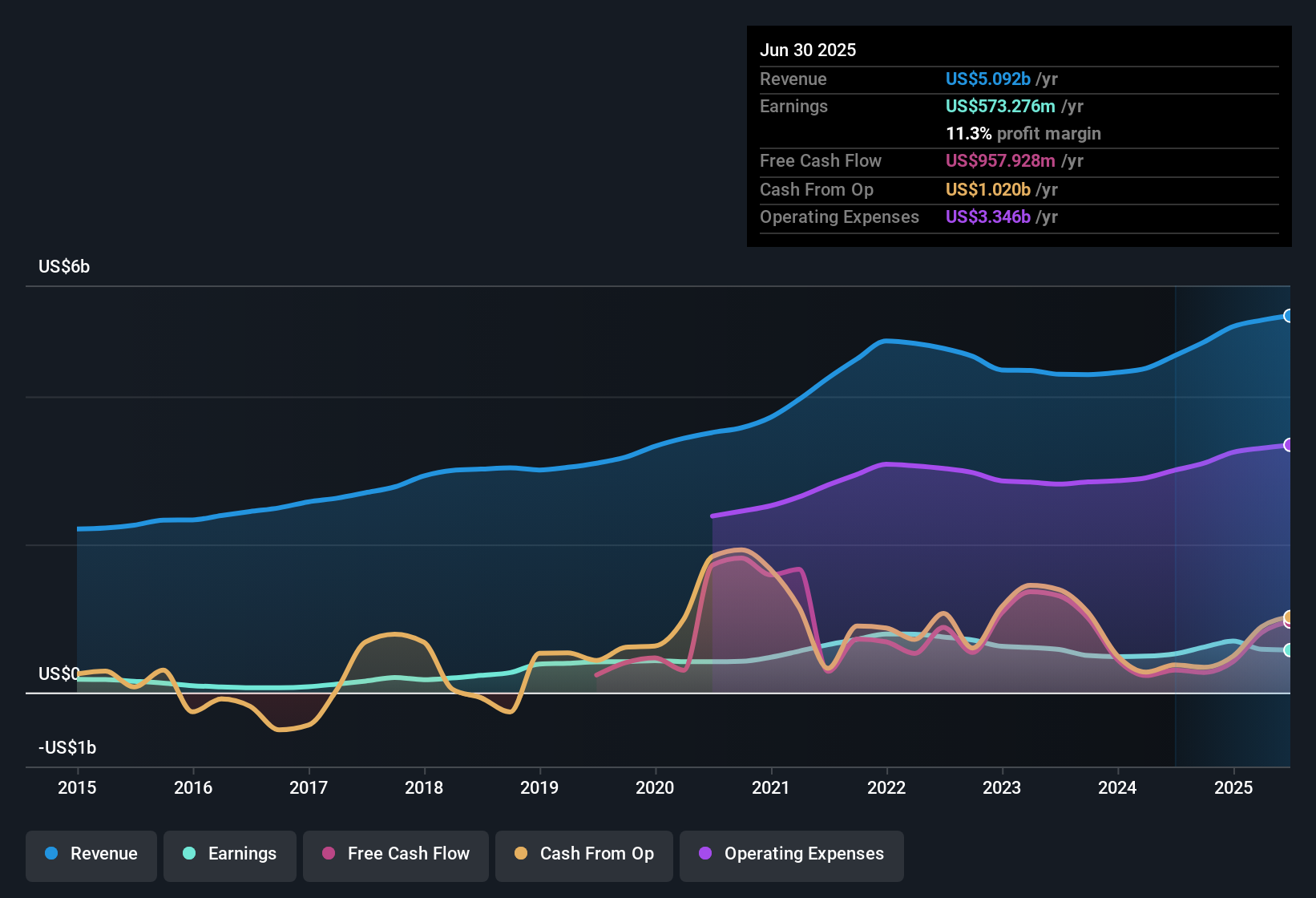

Stifel Financial (SF) delivered a 9.8% jump in earnings over the past year, reversing its 5-year average annual decline of 1.1%. Net profit margins held at 11.3%, just under last year’s 11.5%, and while revenue is forecast to grow 9.6% per year, that trails the broader US market’s 10.1% expected pace. With good value relative to peers and the capital markets industry, investors are balancing tempered growth expectations and softer margins against Stifel’s favorable multiples as they interpret this quarter’s results.

See our full analysis for Stifel Financial.Next, we will compare these headline results with the narratives that investors and analysts are watching. This is where stories meet statistics and expectations are put to the test.

See what the community is saying about Stifel Financial

Adviser Productivity Drives Margin Outlook

- Analysts expect Stifel’s profit margins to climb from 11.6% now to 19.8% by 2028, reflecting anticipated benefits from adviser team additions and new productivity tools.

- Consensus narrative highlights potential for stronger net margins if recent investments in adviser recruiting and technology pay off.

- Significant recruitment, including 36 advisers from the B. Riley acquisition, is expected to boost Global Wealth Management revenue and support long-term earnings growth.

- Analysts point out that efficiency improvements through upgraded adviser tools could drive both higher asset growth and sustained profitability going forward.

Legal Costs and Asset Outflows Create Headwinds

- Stifel faced a $180 million legal charge that pressured net profits, while the Wealth Management segment has seen modest net asset outflows. This has raised concerns about future asset management revenue if markets remain soft.

- Consensus narrative focuses on the risks to growth, citing legal issues and market volatility as factors that could limit earnings upside.

- Legal expenses have already trimmed profit margins, and ongoing proceedings could further weigh on net income in the near term.

- Weak demand for loans plus asset outflows signal potential for lower net interest income if equity markets and client appetite do not rebound.

Valuation Still Attractive vs Peers

- At a price-to-earnings ratio of 20.8x, Stifel trades below industry (26x) and peer group (21.8x) averages, even as the current share price ($116.69) sits above DCF fair value ($70.08) but under the analyst price target ($128.71).

- Analysts' consensus view suggests the market already prices in moderate revenue growth, with an 8.9% potential upside to their $128.71 price target. This makes Stifel look fairly valued relative to sector peers, though not deeply discounted.

- Although the modest gap between the share price and target implies consensus on fair valuation, strong future profit margin forecasts help support the current premium to DCF fair value.

- Stifel’s lower PE ratio relative to industry and peers is a key reason why value-focused investors remain interested despite softer growth expectations.

Skeptics say unpredictable legal liabilities and industry headwinds could topple consensus, but the story remains nuanced. Analysts’ targets highlight balance, not euphoria. 📊 Read the full Stifel Financial Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Stifel Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique outlook on the figures presented? Share your viewpoint and build your narrative in just a few minutes. Do it your way

A great starting point for your Stifel Financial research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Stifel’s outlook is clouded by modest revenue growth, thinner margins, and unpredictable legal costs. These factors could cap future performance if conditions remain challenging.

If you’re looking for stocks with more consistent results and dependable growth, use our stable growth stocks screener (2092 results) to uncover companies delivering steady earnings through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives