- United States

- /

- Capital Markets

- /

- NYSE:SF

Is Now the Right Moment for Stifel Financial After Mixed Returns in 2025?

Reviewed by Bailey Pemberton

If you are eyeing Stifel Financial and wondering whether it still has room to run, you are not alone. The stock has delivered impressive results over the long haul, up more than 120% in three years and 188% over the past five. More recently, though, performance has been a bit choppier, with a gain of 2.9% in the past week, but a slip of 3.4% over the past month. Year-to-date, Stifel Financial is up 3.8%, and the one-year return sits at a respectable 9.7%. These swings reflect broader shifts in market sentiment and evolving expectations around financial sector risk, which often work their way into share prices as investors react to headlines and macro trends.

With the stock price sitting at $110.20 at last close, value-focused investors are asking an important question: does Stifel Financial still offer a good deal, or has it already had its run? Looking at the numbers, the company currently earns a valuation score of 3 out of a possible 6, meaning it screens as undervalued in 3 of the standard valuation checks used by analysts. This mix of optimism and caution is exactly what makes analyzing its valuation both timely and worthwhile.

In the next section, we will walk through the most common valuation methods used to evaluate a stock like Stifel Financial, and consider what each might be telling us about the company. But stick around, because we will ultimately reveal a smarter way to think about valuation that goes beyond just checking the usual boxes.

Approach 1: Stifel Financial Excess Returns Analysis

The Excess Returns model evaluates a company based on how much value it generates above the required return for its shareholders, known as the cost of equity. In simpler terms, it tells us whether Stifel Financial is earning enough on its investments to justify its current market value.

For Stifel Financial, the current book value per share stands at $48.07, and its stable earnings per share are estimated at $6.43, sourced from the median return on equity over the past five years. The company’s cost of equity is $4.74 per share. This means it generates an excess return of $1.69 per share. Its average return on equity is a healthy 11.65 percent, and analysts project a stable book value of $55.23 per share moving forward.

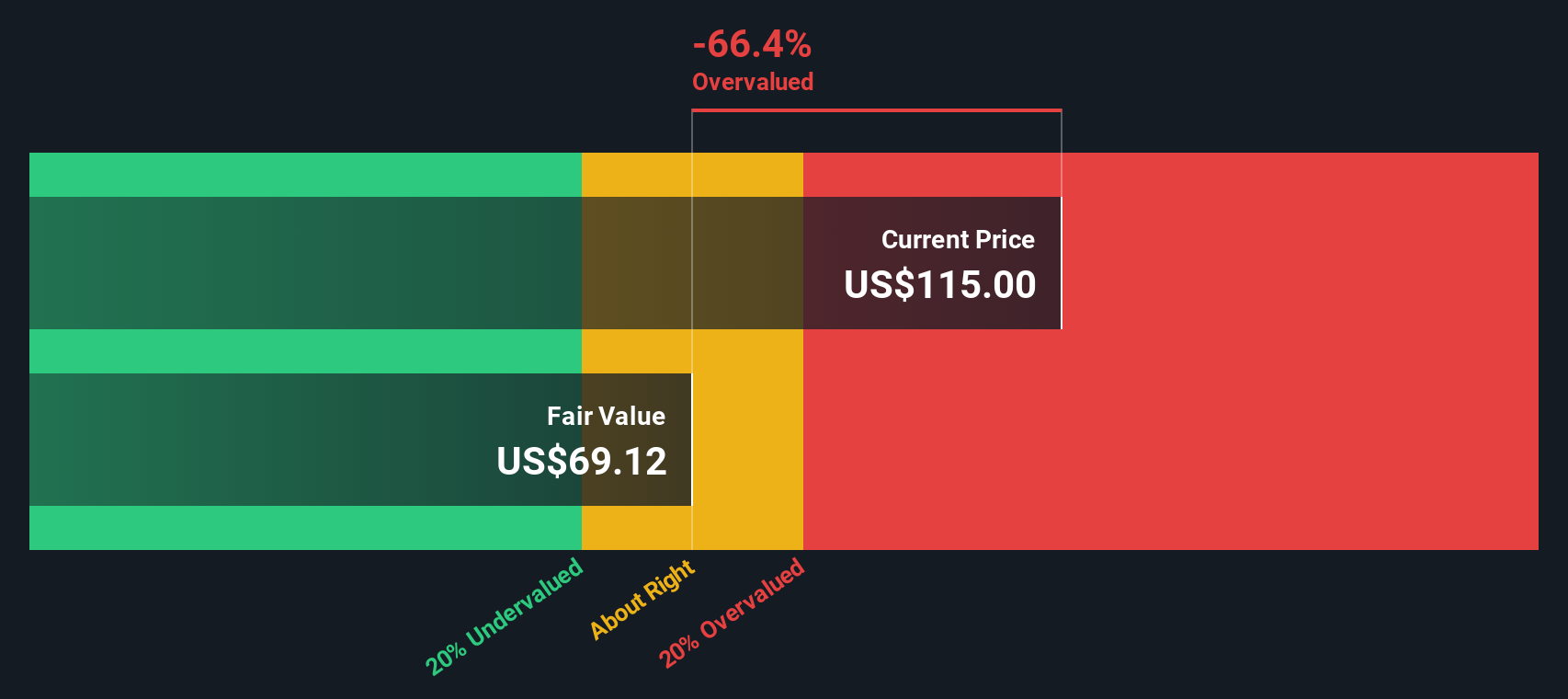

When these numbers are analyzed, the Excess Returns model indicates an intrinsic value of about $85.99 per share. With shares recently closing at $110.20, the stock is trading roughly 28.2 percent above what this method suggests is fair value. This implies that the market is currently overpricing the company’s excess returns prospects.

Result: OVERVALUED

Our Excess Returns analysis suggests Stifel Financial may be overvalued by 28.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Stifel Financial Price vs Earnings

The price-to-earnings (PE) ratio is often considered the go-to metric for valuing stable, profitable companies like Stifel Financial. This is because the PE ratio gives a direct read on how much investors are paying for each dollar of the company’s current earnings, making it an intuitive way to assess whether the stock’s price is justified by its profits.

Of course, what counts as a "fair" PE ratio is not set in stone. Growth prospects, risk profile, and the broader industry environment all influence what investors consider normal. Companies expected to grow rapidly or with less perceived risk often command higher PE multiples, while slower growth or riskier businesses usually trade at lower ratios.

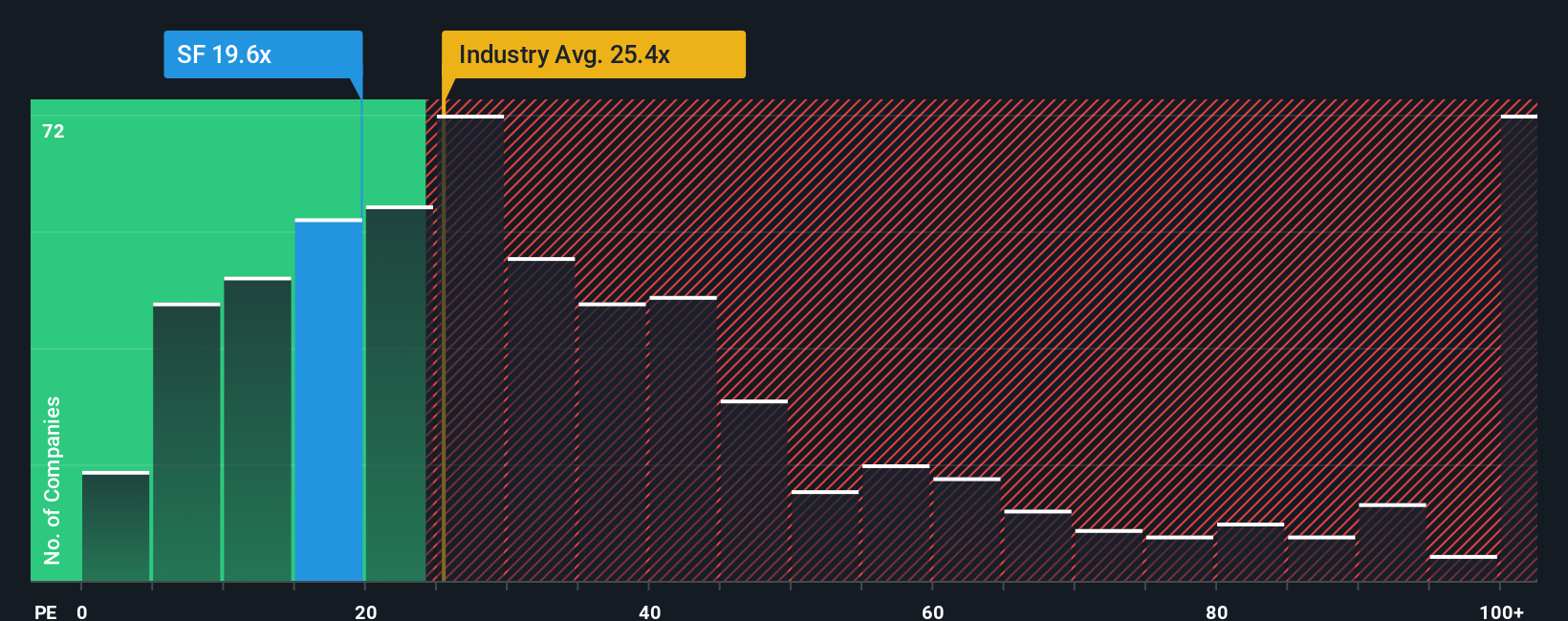

Currently, Stifel Financial trades at a PE ratio of 19.6x. For context, that is a bit below the Capital Markets industry average of 25.1x, and also under the 21.3x average of its immediate peers. More importantly, Simply Wall St calculates a proprietary “Fair Ratio” for Stifel at 23.3x, which goes beyond blunt peer and industry comparisons. The Fair Ratio factors in a company’s individual growth outlook, risks, profit margins, and even market capitalization, aiming for a more holistic and tailored assessment.

In this case, Stifel’s actual PE of 19.6x is about 3.7 points lower than its Fair Ratio of 23.3x, suggesting the stock may be undervalued relative to what a fair multiple would look like for its profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Stifel Financial Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a game-changing approach that connects your view of a company’s future with what its shares are really worth.

A Narrative lets you tell a story behind the numbers, combining your personal assumptions about Stifel Financial’s future growth, margins, and risks with a financial forecast that leads to a fair value you can actually understand and test.

Narratives do not just crunch numbers. They link the company's story to meaningful forecasts, allowing you to build, visualize, and revisit your logic when things change. All of this is made easy and accessible on Simply Wall St's platform, where millions of investors use the Community page to share and refine their investment perspectives.

With Narratives, deciding when to buy or sell becomes clearer because you can see how your Fair Value (driven by your expectations) compares instantly to the current market Price and understand why you might disagree with consensus.

Even better, every Narrative stays up to date as fresh news, analyst targets, or real financial results arrive. This saves you time and helps you stay in control as things evolve.

For example, one investor might write a bullish Narrative for Stifel Financial, believing technology upgrades will boost earnings and estimate a fair value of $132.00 per share. Another investor, focused on legal risks and slowing capital flows, may land on a more conservative $105.00. This way, you can compare different stories, challenge your own view, and act with confidence.

Do you think there's more to the story for Stifel Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives