- United States

- /

- Mortgage REITs

- /

- NYSE:RPT

Rithm Property Trust (RPT): Five-Year Loss Acceleration Spurs Fresh Doubts Over Elevated Valuation

Reviewed by Simply Wall St

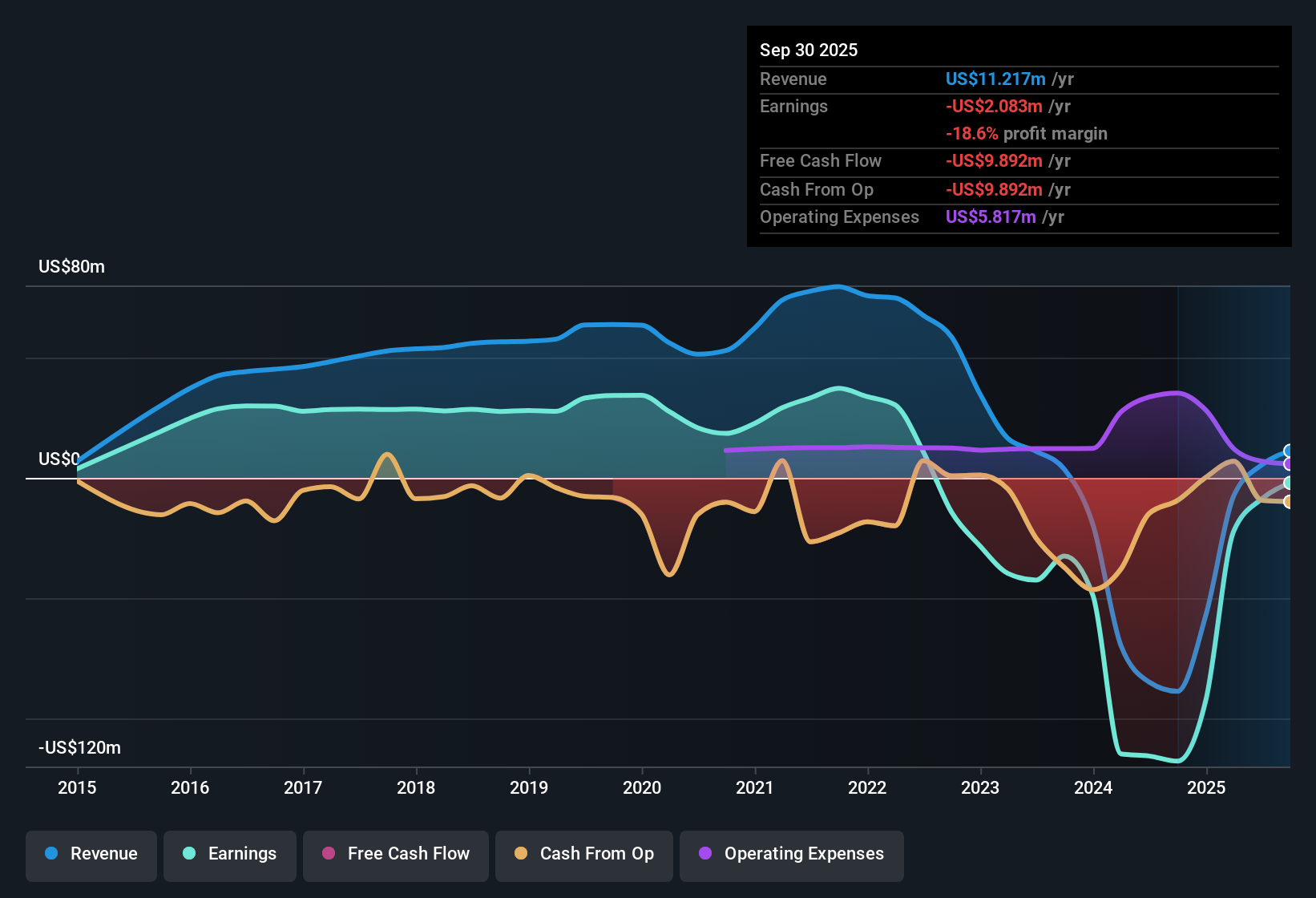

Rithm Property Trust (RPT) remains unprofitable, with reported losses that have accelerated over the past five years at a steep annual rate of 60.3%. The company currently trades at a price-to-sales multiple of 22.2x, substantially above both the US Mortgage REITs industry average of 4.2x and the peer group’s 7x multiple. There is no sign of net profit margin improvement or evidence of quality earnings emerging from recent performance.

See our full analysis for Rithm Property Trust.Let’s see how these headline figures line up with the consensus narratives circulating in the market, and where today’s results might force a rethink.

See what the community is saying about Rithm Property Trust

Analysts Expect 148% Revenue Growth

- Sell-side analysts project that Rithm Property Trust's annual revenue will climb by an impressive 148.2% over the next three years. This projection follows a period in which losses have accelerated at an average rate of 60.3% per year.

- According to the analysts' consensus view, the optimism comes from two core expectations:

- Prudent capital deployment into a $2 billion investment pipeline is seen as the backbone for multi-year top-line growth and improving net earnings.

- Operational efficiencies and management's focus on non-dilutive capital strategies are highlighted as reasons that profit margins could rise from -158.9% today to a positive 27.6% within three years.

See how analysts are weighing this surge in growth potential against persistent risks in the full consensus narrative. 📊 Read the full Rithm Property Trust Consensus Narrative.

Persistent Discount to Book Value

- Rithm shares are currently trading at $2.67, which is around half of book value (book value per share: $5.37). This signals investor doubt that management can turn around losses despite industry tailwinds.

- Consensus narrative notes this deep discount is rooted in two linked concerns:

- There are worries that execution risk in capital deployment could limit returns. Rithm's small $300 million equity base may make meaningful earnings growth difficult.

- The reliance on commercial real estate assets and ongoing uncertainty in office and retail demand challenge investor confidence in asset values and future profitability.

High Valuation Amid Lack of Profits

- With a price-to-sales ratio of 22.2x, Rithm stands well above both the US Mortgage REITs sector average (4.2x) and the peer group (7x), despite remaining unprofitable and showing no net margin improvement.

- Consensus narrative flags two main points of tension for investors:

- Bulls might see the premium multiple as justified by aggressive revenue growth forecasts, while bears can point to zero evidence of sustainable profitability so far.

- The analysts' price target of $3.00 remains just 12.4% above current levels, which suggests the upside is modest given the operational and market risks outlined in filings.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rithm Property Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on the numbers? Share your take and craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your Rithm Property Trust research is our analysis highlighting 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Rithm Property Trust continues to trade at a large premium to peers despite persistent losses, uncertain profitability, and doubts about long-term value.

If you want more attractive valuations and less risk of overpaying, focus instead on these 833 undervalued stocks based on cash flows to uncover stocks priced below their fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RPT

Rithm Property Trust

Operates as a mortgage real estate investment trust in the United States.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion