- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (RKT) Is Up 6.0% After Mortgage Rate Outlook Shifts Following Inflation Report - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Following the September inflation report, mortgage rates were set to move lower, sparking renewed activity in mortgage originators and home construction firms.

- This shift in the interest rate outlook holds particular significance for mortgage-focused businesses such as Rocket Companies, which are closely linked to housing market conditions.

- With mortgage rates projected to ease, we'll explore how this potential tailwind could influence Rocket Companies' investment appeal amid ongoing housing challenges.

Find companies with promising cash flow potential yet trading below their fair value.

Rocket Companies Investment Narrative Recap

To take a position in Rocket Companies, an investor needs to believe that improving mortgage affordability and housing market stability will boost demand for Rocket’s broad digital origination and servicing platform. The prospect of lower mortgage rates following the September inflation report provides a clear short-term catalyst, potential for rising home loan applications, but persistent affordability issues and macroeconomic uncertainty remain the biggest risks and may limit the extent of any rebound.

The recent completion of Rocket’s acquisition of Mr. Cooper stands out, directly relevant to any uptick in mortgage activity. Uniting the largest home loan originator with the largest mortgage servicer, this move could expand Rocket’s reach, customer base, and operational leverage, key strengths should mortgage demand strengthen in the wake of easing rates.

However, it’s important to remember that while falling rates may boost near-term demand, persistent housing affordability pressure could still limit Rocket’s upside potential...

Read the full narrative on Rocket Companies (it's free!)

Rocket Companies' narrative projects $8.7 billion revenue and $3.2 billion earnings by 2028. This requires 19.3% yearly revenue growth and a $3.2 billion increase in earnings from -$308,000 currently.

Uncover how Rocket Companies' forecasts yield a $18.50 fair value, in line with its current price.

Exploring Other Perspectives

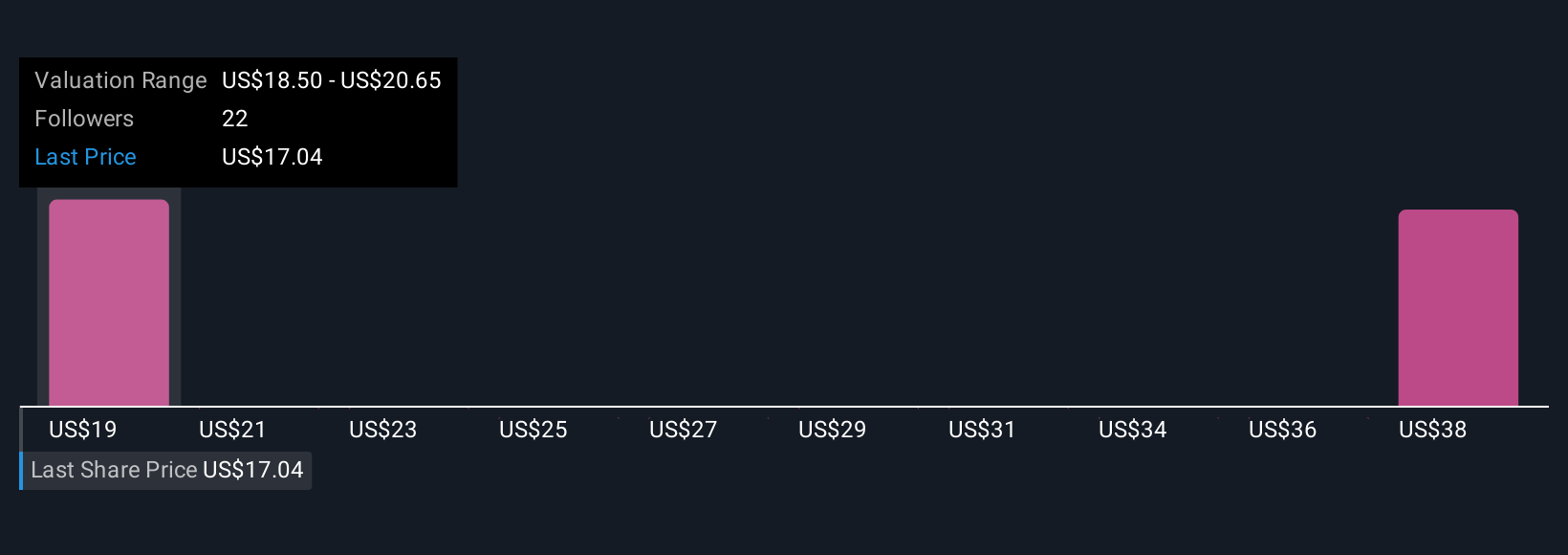

Seven community-led fair value estimates for Rocket Companies currently range from US$18.50 to US$40 per share, illustrating substantial variation in outlooks on future performance. The uncertain impact of housing affordability trends remains front of mind as you compare these diverse perspectives and consider where the balance of risks lies.

Explore 7 other fair value estimates on Rocket Companies - why the stock might be worth over 2x more than the current price!

Build Your Own Rocket Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Rocket Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rocket Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives