- United States

- /

- Consumer Finance

- /

- NYSE:PRG

PROG Holdings (PRG): Profit Margin Surge Challenges Bearish Narratives Despite $184M One-Off Loss

Reviewed by Simply Wall St

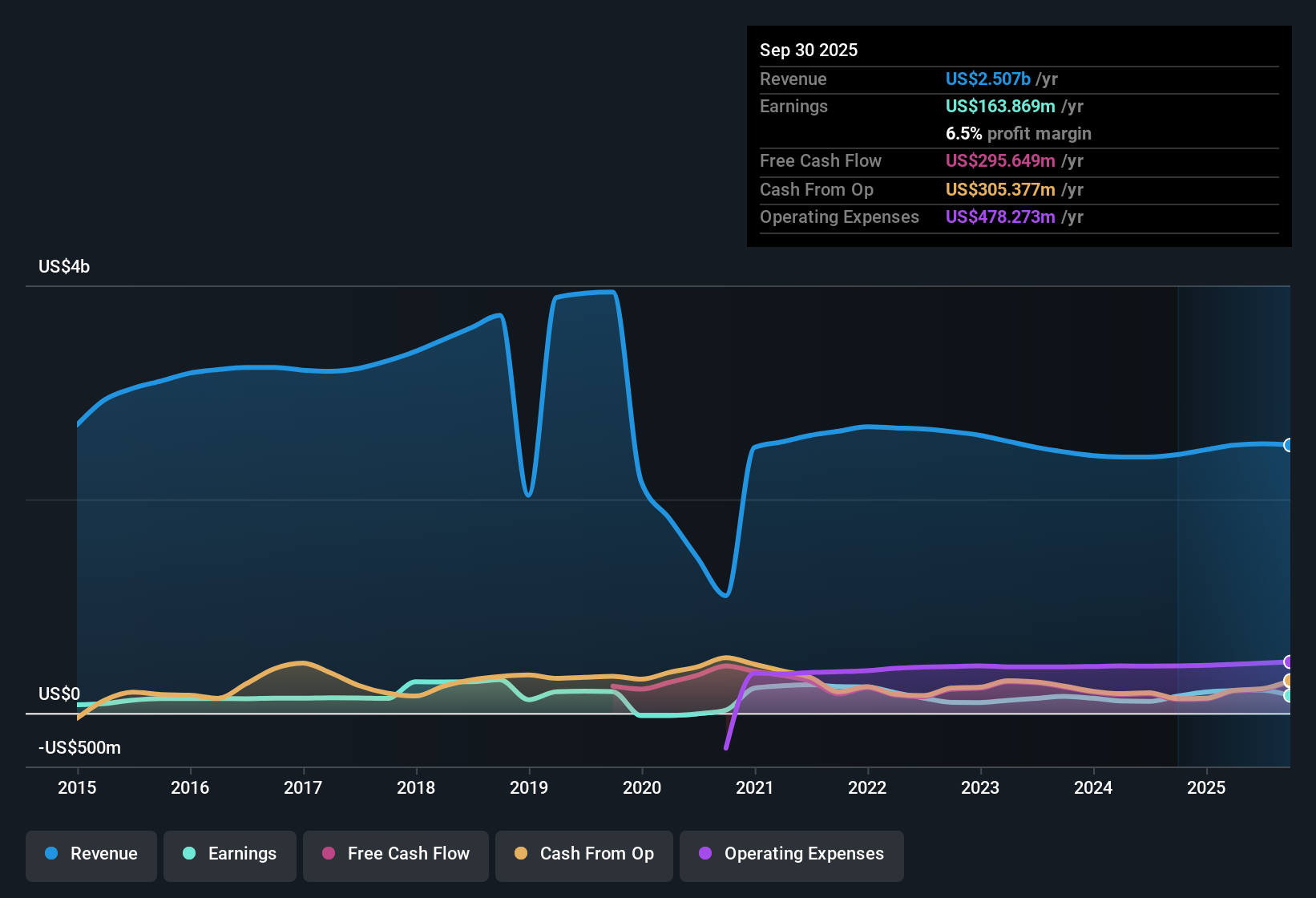

PROG Holdings (PRG) reported a net profit margin of 8.5%, up significantly from last year’s 4.6%. Earnings surged 96.4% year over year and reversed the company’s longer-term declining trend. Although revenue and earnings are projected to grow at 3.4% and 5.8% per year, both figures trail the broader US market. For investors, this combination of improving profitability and discounted valuation metrics could prove compelling despite some ongoing concerns about financial quality and sustainability.

See our full analysis for PROG Holdings.Next, we will see how these numbers compare to the current narratives that investors and analysts use to frame the PROG Holdings story.

See what the community is saying about PROG Holdings

Digital Payments Propel Omnichannel Growth

- Partnerships in digital payment channels have pushed e-commerce gross merchandise value (GMV) to an all-time high of 21%. This signals a real shift toward online and omnichannel sales.

- Analysts' consensus view highlights that expanding digital and flexible payment options, such as Buy Now, Pay Later through Four Technologies, positions PROG Holdings to benefit from ongoing demand for consumer-friendly payment methods.

- Sustained triple-digit GMV and revenue growth in Four Technologies supports the company’s push for more stable, recurring revenues.

- Consensus notes that new omnichannel partnerships and initiatives like PROG Marketplace stand out as catalysts for continued top-line growth, even as traditional retail partners face soft demand.

- Recent analytics enhancements and the ramp-up of retailer partnerships are seen as powerful tools to improve credit quality and diversify the company’s future earnings streams.

Profit Margins Face Forecasted Decline

- Despite the current net profit margin of 8.5%, analysts expect it to shrink to 5.2% over the next three years. This means future profitability could fall even as revenue remains steady.

- Consensus narrative highlights the challenge that persistent soft demand and competitive BNPL markets pose for maintaining high profit margins.

- The risk that credit write-offs could climb again, particularly for the subprime customer base, would weigh on net margins and could potentially offset gains made through recent operational efficiency improvements.

- Analysts caution that regulatory scrutiny on lease-to-own products and partner concentration may create additional headwinds. These could materialize as shrinking margins despite the current momentum.

Shares Trade Below Industry Fair Value

- With a price-to-earnings ratio of 6x, which is deeply discounted compared to the industry average of 10.1x, the current share price of $32.58 also sits well below consensus analyst price target of $38.57 and DCF fair value of $46.22.

- Consensus narrative underscores that, even with slower forecast growth, ongoing profitability and a valuation discount could attract investors as the market pricing reflects skepticism about long-term sustainability.

- The significant gap between current share price and both analyst targets and fair value signals that upside is possible if the company can address financial quality and dividend sustainability concerns.

- However, the large $184.2 million one-off loss and stagnant dividend outlook reinforce why investors remain cautious even with the low valuation.

- Bulls and bears may be divided, but the persistently discounted valuation raises the stakes for how future results change the narrative.

- To see how analysts and the market are interpreting this valuation gap, check out the full consensus narrative for PROG Holdings. 📊 Read the full PROG Holdings Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PROG Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking for a fresh perspective on the latest numbers? Jump in and share your take. Craft a unique narrative in just minutes. Do it your way

A great starting point for your PROG Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While PROG Holdings shows improving profitability, concerns remain over shrinking profit margins, a stagnant dividend outlook, and rising financial quality risks.

Prefer sturdier finances? Try solid balance sheet and fundamentals stocks screener (1980 results) to spot companies with stronger balance sheets and healthier liquidity, designed for resilience through shifting markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRG

PROG Holdings

A financial technology holding company, provides payment options to consumers in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion