- United States

- /

- Mortgage REITs

- /

- NYSE:PMT

PennyMac Mortgage Investment Trust (PMT): Evaluating Valuation After Strong Third Quarter Earnings Growth

Reviewed by Simply Wall St

PennyMac Mortgage Investment Trust (PMT) just released its third quarter earnings, reporting strong year-over-year gains in net income and earnings per share. The results highlight clear progress in the company’s operating performance.

See our latest analysis for PennyMac Mortgage Investment Trust.

PennyMac Mortgage Investment Trust has built some positive momentum following its third quarter results, with a 6.6% share price gain over the past week and a 4.8% total shareholder return in the past year. This reinforces a steadily improving long-term picture.

If you’re looking for more opportunities with strong growth potential and insider backing, now is a great time to check out fast growing stocks with high insider ownership

With shares ticking higher after a strong third quarter, investors are left to wonder if PennyMac Mortgage Investment Trust remains undervalued or if the recent momentum is a sign that markets have already priced in future growth.

Most Popular Narrative: 6% Undervalued

PennyMac Mortgage Investment Trust's most-followed narrative suggests its fair value sits slightly above the current share price, indicating modest potential upside if the projections hold. This invites a closer look at which business catalysts might drive the stock higher from here.

Ongoing digital transformation and the ability to organically create securitizations through technology-enabled processes are enabling PMT to efficiently structure and retain higher-yielding credit-sensitive non-agency MBS and CRT assets, which could drive net margin expansion as operational efficiencies scale.

Want to know what really fuels this optimistic valuation? The secret sauce behind the number is bold profit margin growth and next-level operational leverage. The narrative points to a significant financial transformation powered by both margins and business model shifts. Think the current price already reflects this? Explore further to uncover the fundamental forecasts that could upend expectations.

Result: Fair Value of $13.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent exposure to interest rate swings and reliance on non-agency loans could pressure earnings and challenge the optimistic outlook for PennyMac Mortgage Investment Trust.

Find out about the key risks to this PennyMac Mortgage Investment Trust narrative.

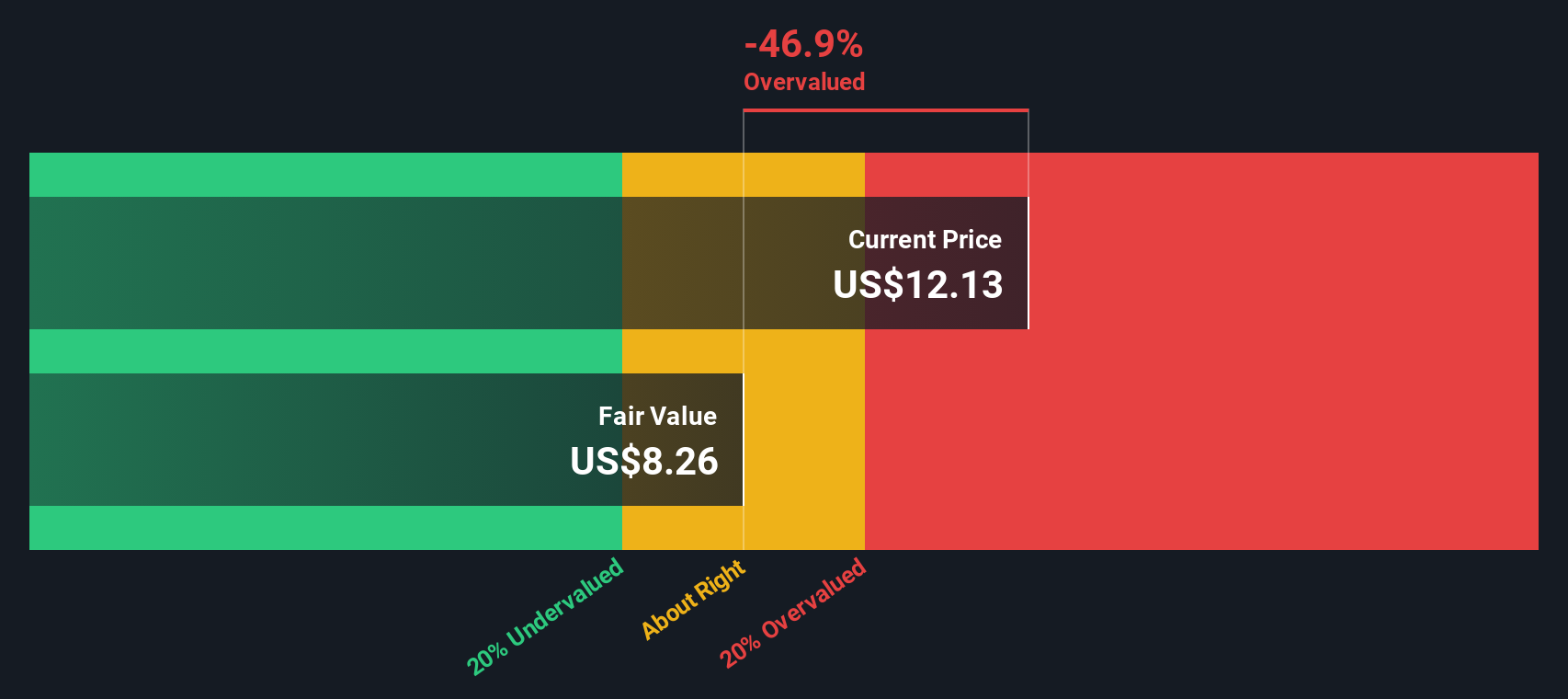

Another View: Our DCF Model Tells a Different Story

While analysts see modest upside ahead, our SWS DCF model points in the opposite direction. This suggests PennyMac Mortgage Investment Trust may be trading above its intrinsic value right now. With the current price exceeding the model's fair value estimate, is there more risk here than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PennyMac Mortgage Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PennyMac Mortgage Investment Trust Narrative

If you have your own take or want to test the numbers for yourself, it takes just a few minutes to build your own outlook. Do it your way

A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for what you know? There are smart opportunities waiting that could shift your portfolio in new directions, and you don’t want to miss out.

- Unlock the growth that comes with tomorrow’s technology by exploring these 27 AI penny stocks, which are setting the pace in artificial intelligence and automation advances.

- Collect dependable income streams by tapping into these 17 dividend stocks with yields > 3% to see which companies consistently deliver strong yields above 3%.

- Target value potential with these 872 undervalued stocks based on cash flows, where overlooked stocks may be trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PMT

PennyMac Mortgage Investment Trust

Through its subsidiary, primarily invests in residential mortgage-related assets in the United States.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives