- United States

- /

- Capital Markets

- /

- NYSE:PJT

Is PJT Partners’ (PJT) Consistent Dividend Growth Signaling a Shift in Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

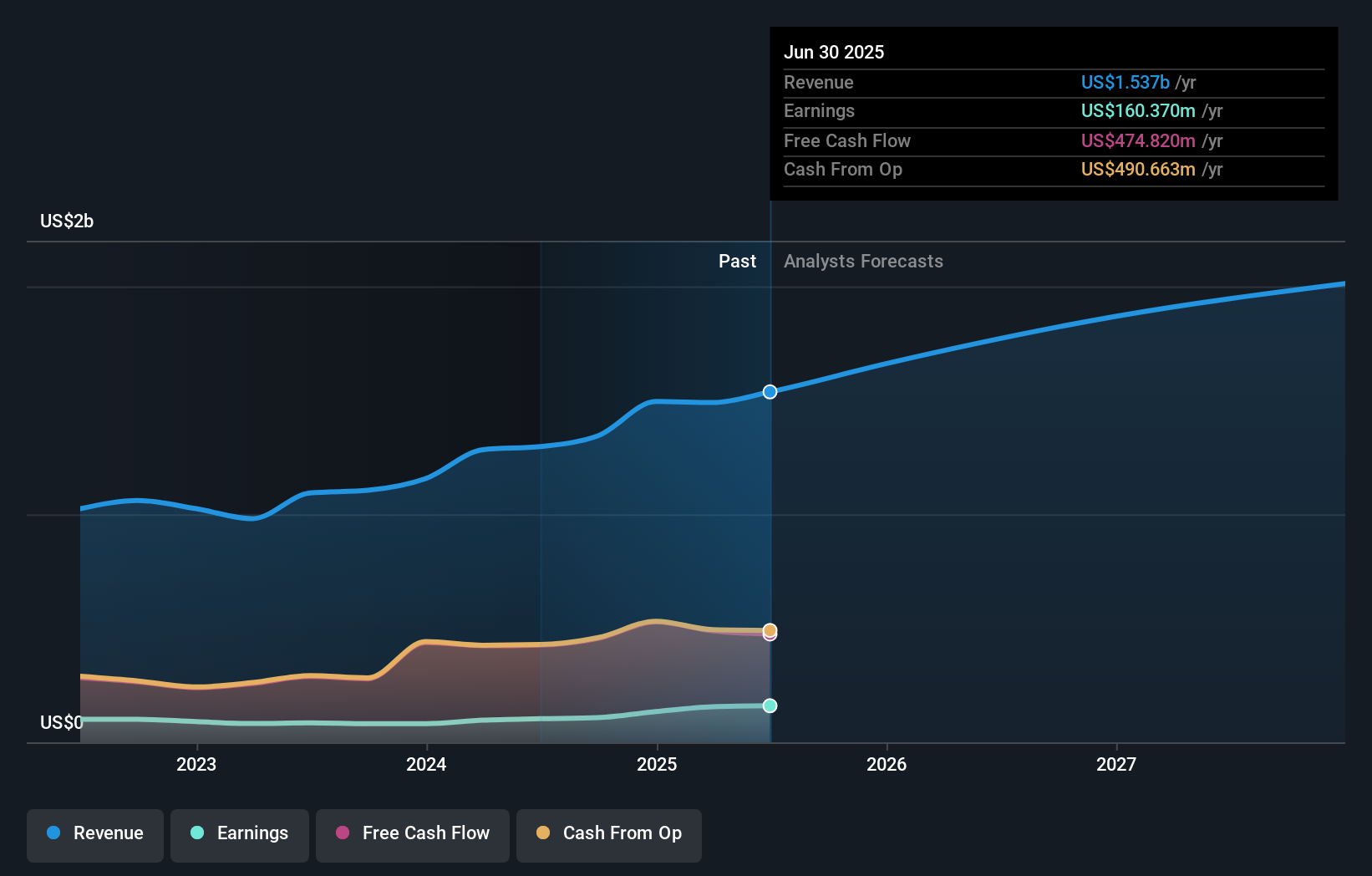

- PJT Partners reported a strong set of third-quarter and nine-month results, with revenue reaching US$447.09 million and net income at US$39.84 million for the third quarter ended September 30, 2025, both up compared to the previous year.

- Alongside the earnings, the company declared a US$0.25 per share dividend and provided an update that no shares were repurchased this quarter under its ongoing buyback program.

- We'll examine how PJT Partners’ income growth and continued dividend payments contribute to the company's evolving investment case.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is PJT Partners' Investment Narrative?

To stand behind PJT Partners as a shareholder, it’s important to believe in the firm’s capacity to deliver consistent financial performance, maintain disciplined capital returns, and navigate trends in global advisory and restructuring services. The latest quarterly update, featuring robust top- and bottom-line growth and steady dividends, supports the company's reputation for high-quality earnings and management's track record. However, this momentum comes amid muted buyback activity, which could slightly temper near-term capital return expectations and has coincided with a decline in the share price over recent months. The primary catalysts remain PJT’s ability to capture new deals and capitalize on market dislocations, but risks, like softer client demand or changes in dealmaking activity, should not be ignored. This quarter's strong outcomes have narrowed the gap on short-term questions, though sustained growth will be watched closely. In contrast, the recent pause on buybacks is an important signal investors should be aware of.

PJT Partners' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on PJT Partners - why the stock might be worth less than half the current price!

Build Your Own PJT Partners Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PJT Partners research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free PJT Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PJT Partners' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives