- United States

- /

- Capital Markets

- /

- NYSE:PIPR

Surging Earnings and Dividend Affirmation Could Be a Game Changer for Piper Sandler (PIPR)

Reviewed by Sasha Jovanovic

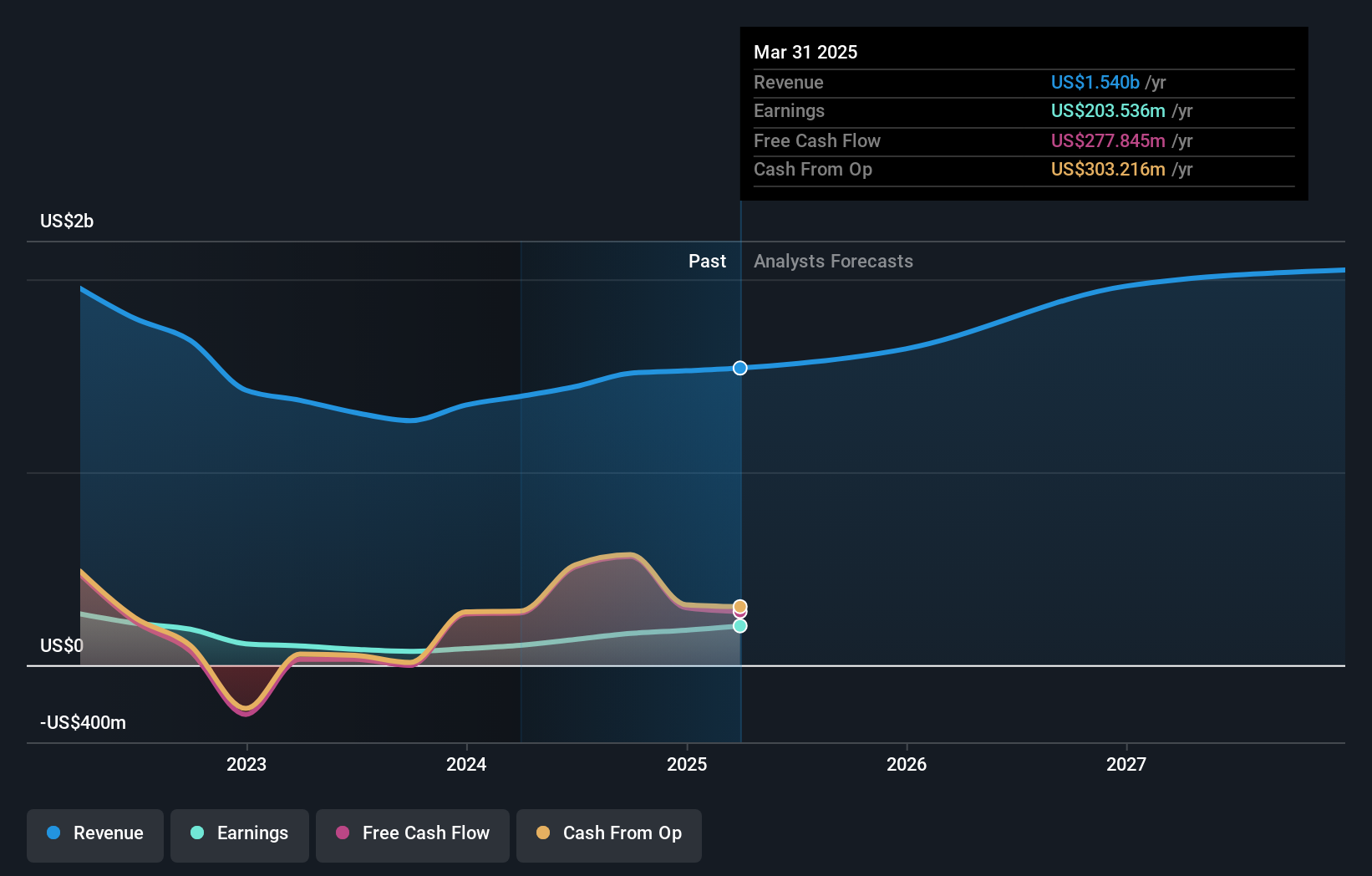

- Piper Sandler Companies recently announced third quarter 2025 results, posting revenue of US$480.09 million and net income of US$60.27 million, both up substantially from the same period last year, along with a quarterly dividend affirmation and an update on its share repurchase program.

- The company’s sharp growth in earnings per share highlights an acceleration in profitability, despite not executing any new share repurchases during the quarter.

- Given the strong earnings improvement, we’ll explore what this means for Piper Sandler’s investment narrative and future expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Piper Sandler Companies' Investment Narrative?

To be comfortable as a Piper Sandler Companies shareholder, you need to have confidence in its ability to continually generate and grow strong earnings through market cycles, as well as in management’s judgment when it comes to capital allocation. The company’s most recent results delivered a clear short-term catalyst: revenue and net income both climbed substantially year over year, coupled with sharply higher earnings per share, which supports fresh optimism about profitability. Affirming the dividend gives reassurance of commitment to shareholder returns. However, the pause in share repurchases last quarter suggests management may be balancing priorities in a volatile market or reassessing the best ways to return value. While recent price moves have been steady but not surging, the swift earnings growth could temper some immediate risks, but investors still need to weigh longer-term concerns such as earnings quality, a relatively high price-to-earnings ratio, and whether faster growth can persist if capital market activity cools. Overall, the news strengthens the company’s narrative but doesn’t erase the underlying risks that remain. Yet, despite the earnings leap, future revenue growth remains exposed to shifts in capital market activity.

Piper Sandler Companies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Piper Sandler Companies - why the stock might be a potential multi-bagger!

Build Your Own Piper Sandler Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Piper Sandler Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piper Sandler Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PIPR

Piper Sandler Companies

Operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives