- United States

- /

- Capital Markets

- /

- NYSE:PIPR

Piper Sandler (PIPR): Valuation Check After Goldman Sachs Upgrade on M&A Momentum and Growth Outlook

Reviewed by Simply Wall St

Piper Sandler Companies (PIPR) received a boost after Goldman Sachs upgraded the stock. The upgrade was attributed to the company’s expanding lead in mid-cap M&A as well as a sharp increase in its deal backlog since early 2024.

See our latest analysis for Piper Sandler Companies.

Piper Sandler’s recent momentum is hard to ignore, with the share price up 9.7% year-to-date as optimism builds around its surging M&A backlog, robust quarterly results, and a forward-looking management hire. While the latest 1-year total shareholder return is a modest 1.0%, longer-term holders have seen exceptional rewards, with a 140% total return over three years and more than 310% over five years. This highlights the company’s growth trajectory and ability to navigate shifting market cycles.

If the market’s response to Piper Sandler’s M&A push has you curious, this might be the perfect moment to discover fast growing stocks with high insider ownership

With shares up nearly 10% this year and analyst upgrades driving momentum, investors are left to wonder if Piper Sandler is still undervalued or if the stock already reflects all of its future growth prospects.

Price-to-Earnings of 24.6x: Is it justified?

Piper Sandler is trading on a price-to-earnings ratio (P/E) of 24.6x, which sits just below the US Capital Markets industry average of 25.4x. This positions the company as roughly in line with sector pricing, despite its recent rally and impressive backlog of M&A deals.

The price-to-earnings ratio compares the company’s current share price to its per-share earnings, serving as a yardstick for how much the market expects Piper Sandler to generate in future profits. For a financial services company experiencing strong earnings acceleration, the P/E is often viewed as an indicator of how much investors are willing to pay for each dollar of profit.

Piper Sandler’s multiple suggests the market recognizes its above-market earnings growth, yet does not assign a significant premium relative to peers. The fact that its P/E is slightly below the sector average may imply the stock is fairly valued given its size and current profit trajectory.

Compared to the broader industry, this valuation looks reasonable. The company’s P/E is marginally lower than the Capital Markets benchmark, highlighting market confidence in its growth but without excessive exuberance. Investors might watch for shifts in earnings momentum or market sentiment that could move this ratio in the future.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.6x (ABOUT RIGHT)

However, sudden shifts in market conditions or a slowdown in deal activity could quickly temper Piper Sandler’s strong momentum and challenge its valuation case.

Find out about the key risks to this Piper Sandler Companies narrative.

Another View: SWS DCF Model Flashes Caution

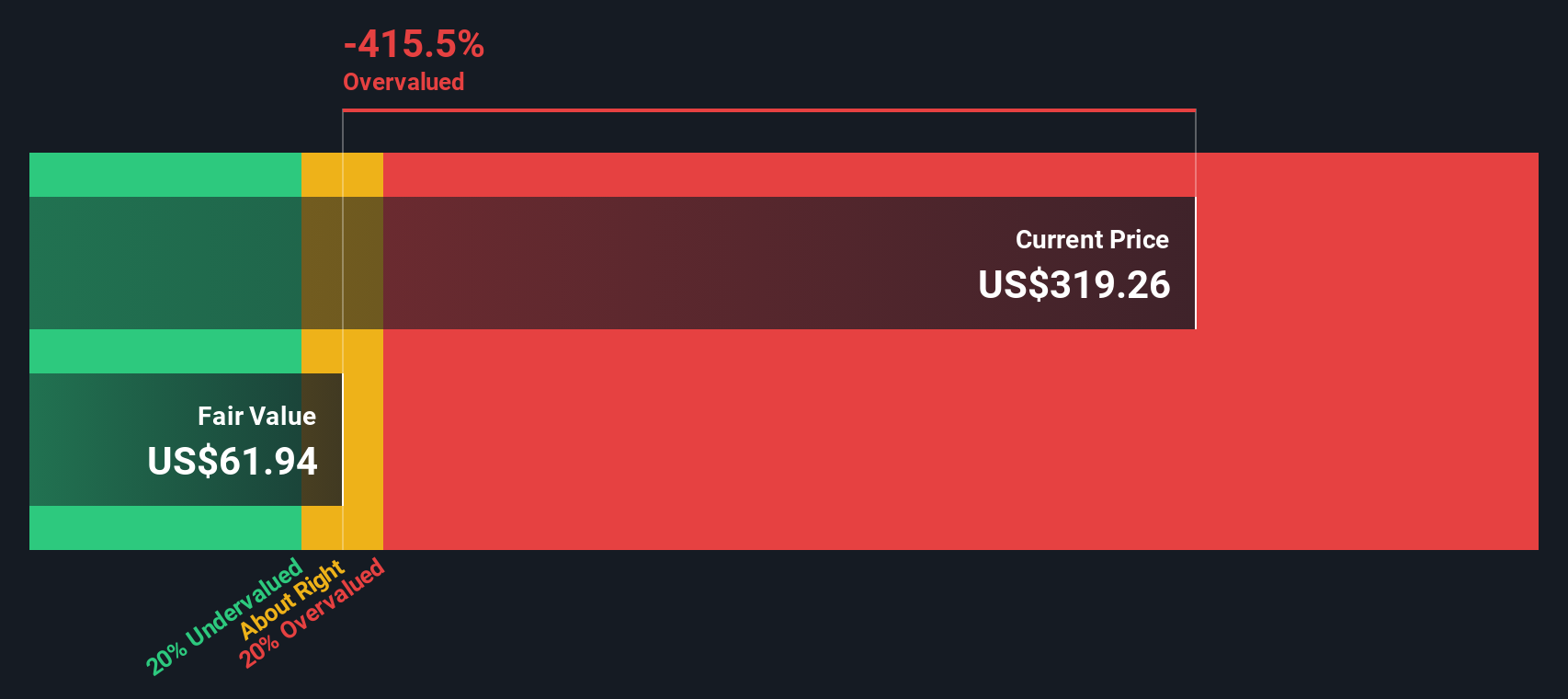

While the market’s price-to-earnings ratio suggests Piper Sandler is fairly valued, our DCF model paints a more cautious picture. The SWS DCF model estimates fair value at $60.75, which is far below the recent share price and implies the stock could be significantly overvalued if these cash flow assumptions hold true. Does this create a risk investors should be watching, or is the market factoring in something our model cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Piper Sandler Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Piper Sandler Companies Narrative

If you have a different perspective or want to investigate more deeply, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Piper Sandler Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at just one stock. Make your portfolio work harder by exploring investment opportunities that only the most resourceful investors know about. See how much smarter your next move could be.

- Capture reliable income streams by checking out these 15 dividend stocks with yields > 3% that consistently deliver yields above 3% for your portfolio.

- Capitalize on rapid growth in artificial intelligence by researching these 26 AI penny stocks with both innovation and upside potential.

- Strengthen your holdings with these 876 undervalued stocks based on cash flows, featuring stocks trading below their intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PIPR

Piper Sandler Companies

Operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives