- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

Will PennyMac's (PFSI) New Leadership Team Shape Its Strategic Edge in a Shifting Mortgage Market?

Reviewed by Sasha Jovanovic

- PennyMac Financial Services and PennyMac Mortgage Investment Trust recently announced several significant executive appointments, including the addition of Kevin Ryan as Senior Managing Director and Chief Strategy Officer, as well as promotions for Marshall Sebring to Chief Investment Officer and Shiva Iyer to Chief Enterprise Risk Officer.

- The new executive team brings extensive backgrounds in finance, investment management, and risk oversight, which investors may interpret as strengthening the company’s approach to future challenges and opportunities.

- We'll examine how the introduction of an experienced Chief Strategy Officer could influence PennyMac's investment narrative and future competitive positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PennyMac Financial Services Investment Narrative Recap

PennyMac Financial Services appeals to investors who believe in the company's ability to manage risk and drive efficiency in a highly cyclical, interest-rate sensitive mortgage market. The recent leadership appointments, while emphasizing renewed focus on investment and risk oversight, do not materially change the short-term catalysts or the most immediate risk: volatility in mortgage servicing right valuations tied to interest rates.

Among the latest updates, Kevin Ryan's appointment as Chief Strategy Officer is especially relevant. His industry experience could bolster PennyMac’s integration of new technology platforms and support the expansion of its automation initiatives, a key potential catalyst for margin improvement as loan volumes shift with market cycles.

However, even experienced leadership cannot fully offset the ongoing risk that rising interest rates pose to servicing valuations and reported earnings, making it important for investors to keep in mind that...

Read the full narrative on PennyMac Financial Services (it's free!)

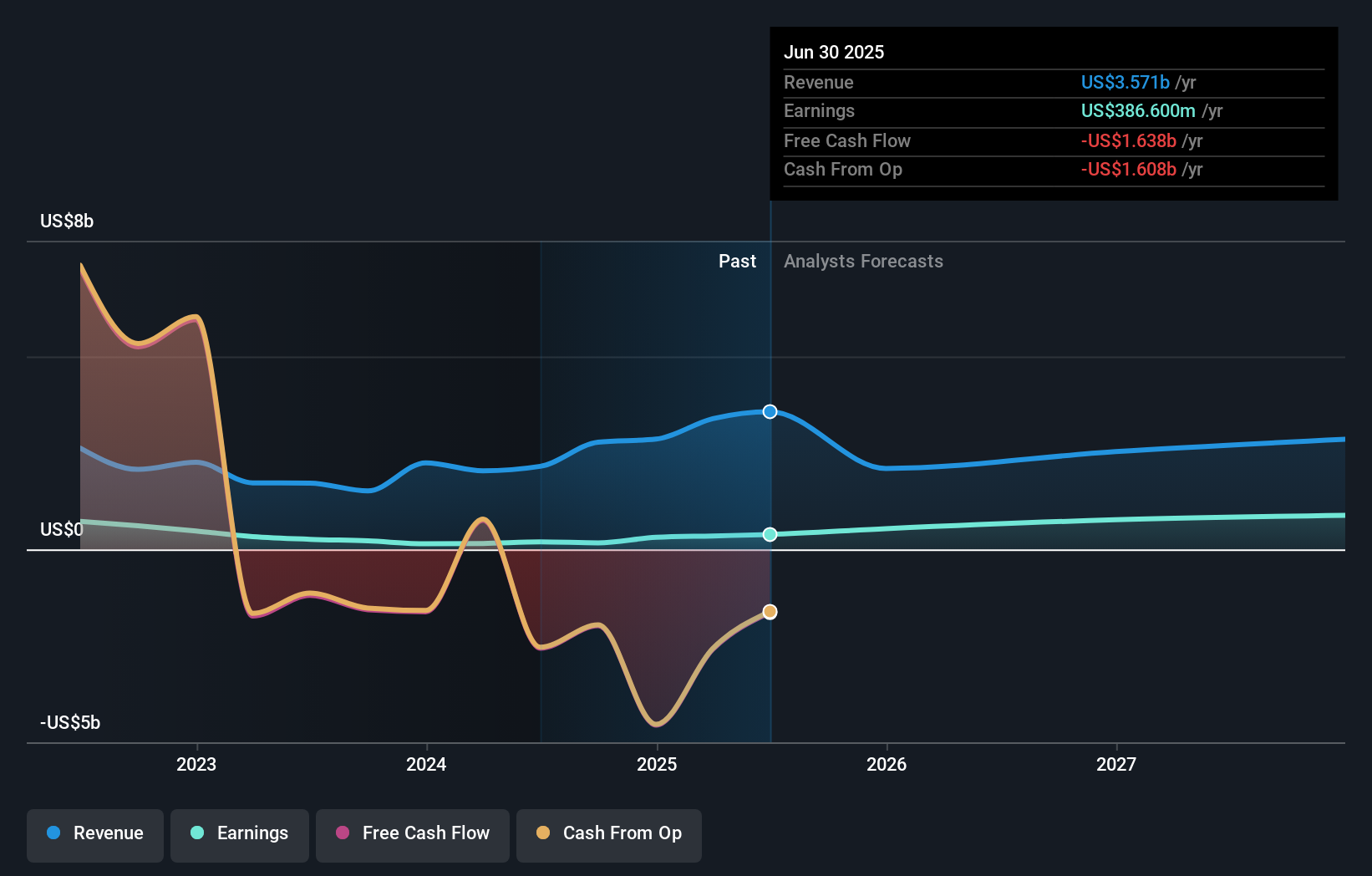

PennyMac Financial Services is expected to reach $2.5 billion in revenue and $1.1 billion in earnings by 2028. This reflects an annual revenue decline of 11.0% but a $713.4 million increase in earnings from the current $386.6 million.

Uncover how PennyMac Financial Services' forecasts yield a $125.86 fair value, a 5% upside to its current price.

Exploring Other Perspectives

A single member of the Simply Wall St Community estimates PennyMac’s fair value at US$125.86, below analyst consensus. As opinions vary, consider how recent executive shifts could interact with interest rate pressures and shape the company’s performance.

Explore another fair value estimate on PennyMac Financial Services - why the stock might be worth as much as $125.86!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives