- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

PennyMac Financial Services (PFSI): Profit Margin Surge Challenges Bearish Earnings Narratives

Reviewed by Simply Wall St

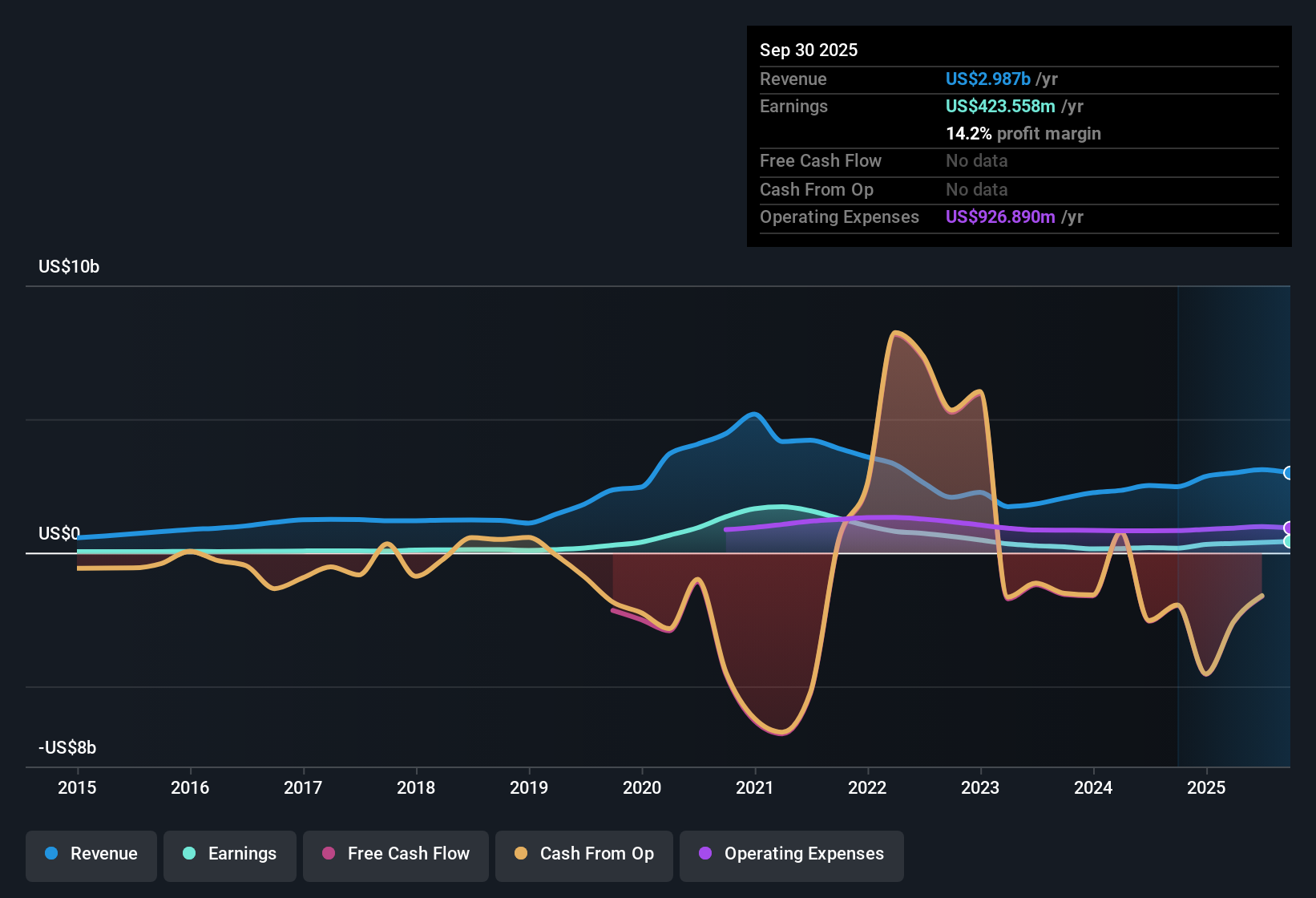

PennyMac Financial Services (PFSI) delivered a dynamic set of numbers in its latest earnings report. While revenue is projected to decline by 0.4% per year over the next three years, earnings are expected to surge at a robust 26.7% per year, notably outpacing the broader US market's 15.5% growth forecast. The company’s net profit margin stands at 15.8%, outperforming last year’s 6.1%, and annual earnings growth recently hit an impressive 193.2%, a sharp contrast to its five-year average decline of 42.7% per year. With shares trading at $129.57, above the estimated fair value of $119.08, investors are weighing short-term profitability and valuation advantages against a backdrop of past earnings declines and some questions around financial strength.

See our full analysis for PennyMac Financial Services.With the headline numbers in hand, it's time to see how this performance compares to the dominant narratives driving the discussion and where expectations might be getting shaken up.

See what the community is saying about PennyMac Financial Services

Servicing Portfolio Drives Recurring Revenue Base

- PennyMac manages a massive servicing portfolio totaling $700 billion in unpaid principal balance (UPB), providing a robust stream of recurring revenue as these loans are serviced over time.

- Analysts' consensus view highlights that this large servicing base positions PennyMac for significant earnings expansion when market conditions improve.

- Strong demographic tailwinds, especially Millennials and Gen Z entering peak home-buying years, are expected to support higher loan origination volumes over the next several years.

- Analysts see this portfolio plus favorable demographic shifts as creating a foundation for outsized refinancing and origination earnings in a more accommodative rate environment.

Sharply Increasing Profit Margins Signal Operating Leverage

- PennyMac's net profit margin rose to 15.8%, up from 6.1% last year, with analysts projecting margins to surge to 43.2% over the next three years.

- The analysts' consensus view contends this boosts the company's ability to withstand slower top-line growth by improving overall return on equity.

- Continuous investment in AI and process automation is projected to cut costs and lift efficiency ratios, directly backing the margin-expansion narrative.

- Analysts believe the combination of operating leverage, technology upgrades, and growing origination scale will sustain high margins if cost controls are maintained.

Valuation Gap Narrows Despite Industry Discount

- PennyMac trades at a Price-to-Earnings multiple of 13.5x, below both its industry average of 16.5x and peers at 32.6x, but above its DCF fair value of $119.08 (recent share price: $129.57).

- The analysts' consensus perspective suggests the narrow 1.2% gap between current share price and the consensus price target ($133.00) signals that, even after a solid profitability rebound, the stock is seen as fairly valued in relation to near-term earnings expectations.

- Consensus analysis notes that industry discounts reflect investor caution about longer-term earnings durability and potential volatility in servicing asset values.

- This tension between stronger near-term profits and a cautious valuation echoes calls for investors to weigh short-term upside against uncertain longer-term growth.

If you're curious how this blend of rebound profitability and recurring revenue factors into top analyst forecasts, the full consensus narrative lays it out in detail. 📊 Read the full PennyMac Financial Services Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PennyMac Financial Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh angle on these figures? Take just a few minutes to shape your perspective and tell your own story: Do it your way.

A great starting point for your PennyMac Financial Services research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PennyMac’s rebound in profit margins is promising, but questions remain about longer-term earnings durability and the sustainability of valuation premiums.

If you want to focus on companies judged to be truly undervalued based on their fundamentals, check out our handpicked list of these 874 undervalued stocks based on cash flows that could offer stronger value and growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives