- United States

- /

- Diversified Financial

- /

- NYSE:PFSI

PennyMac Financial Services: Assessing Valuation After Leadership Reshuffle and Strategic Appointments

Reviewed by Kshitija Bhandaru

PennyMac Financial Services has introduced several senior leadership changes, bringing in a new Chief Strategy Officer and elevating existing executives in investment and risk roles. The moves come as the company navigates ongoing revenue challenges.

See our latest analysis for PennyMac Financial Services.

The senior leadership shake-up arrives at a time when momentum in PennyMac’s shares has actually been building. The stock has delivered a robust 16% share price return over the past 90 days, pushing its year-to-date gain to nearly 18%. In addition, the three-year total shareholder return stands out at 174%, highlighting significant value creation for investors despite lingering revenue headwinds and muted earnings growth. Strategic moves like these often fuel optimism about new directions or improved execution, though market reaction can be swift if results do not follow through.

If leadership changes have you thinking about where else opportunity might be bubbling up, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares climbing and analyst price targets not far above current levels, the question investors face now is whether PennyMac is trading at a bargain or if future growth has already been reflected in the current price.

Most Popular Narrative: 6.7% Undervalued

Compared to PennyMac's last close at $117.43, the most popular narrative assigns a fair value of $125.86, suggesting moderate upside based on forward-looking assumptions. This perspective digs into the impact of cost-saving technology, market dynamics, and demographic shifts to support its appraisal.

PennyMac's AI-driven technology platform and continuous investment in process automation are expected to deliver significant cost reductions and expanded operating efficiencies, positioning the company to improve net margins and return on equity as loan volumes scale.

Curious how much of this optimistic valuation leans on ambitious margin expansion, big earnings jumps, or scalable tech? The full narrative reveals the bold projections driving this fair value. See what is fueling the analyst consensus now.

Result: Fair Value of $125.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high interest rates or disruptions from digital fintech competitors could quickly challenge PennyMac's bullish case and limit its growth potential.

Find out about the key risks to this PennyMac Financial Services narrative.

Another View: What Does the Market Multiple Say?

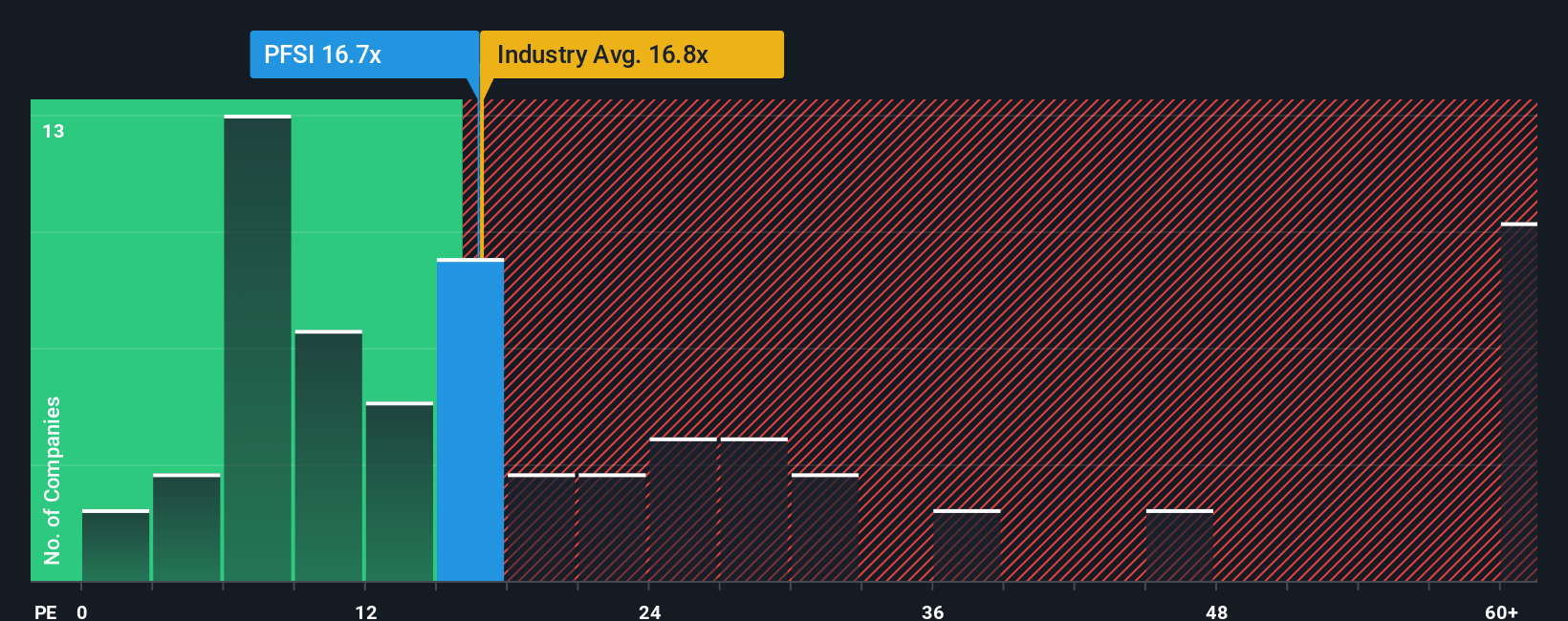

While the most popular narrative sees upside based on future potential, looking at the price-to-earnings ratio tells a more cautious story. PennyMac trades at 15.7x earnings, much higher than the average peer at 7.8x and even the wider industry average of 15.9x. This means investors are paying a premium for growth in a sector that often punishes optimism when results disappoint. Meanwhile, the fair ratio the market could move toward sits notably higher at 19.9x, suggesting some may see more headroom. However, it also signals a valuation risk if performance falters. Which story will the market believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PennyMac Financial Services Narrative

If the story so far doesn’t fit your perspective, or if you’d rather form your own view, the tools are ready for you to quickly craft your own assessment in just a few clicks, Do it your way

A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for just one stock idea when there are so many exciting markets catching investor attention now? Make your next move count by exploring more approaches using expert stock screens.

- Maximize your income potential by tapping into these 20 dividend stocks with yields > 3%, which offers impressive yields to give your portfolio a steady boost.

- Accelerate your portfolio's innovation edge by targeting artificial intelligence trends through these 24 AI penny stocks, which stand out for their growth and disruptive potential.

- Sharpen your value strategy by uncovering tomorrow’s winners among these 873 undervalued stocks based on cash flows, which are priced below what their financials suggest they’re worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFSI

PennyMac Financial Services

Through its subsidiaries, engages in the mortgage banking and investment management activities in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives