- United States

- /

- Diversified Financial

- /

- NYSE:PAY

Is Earnings Momentum and Insider Alignment Shifting the Investment Case for Paymentus Holdings (PAY)?

Reviewed by Sasha Jovanovic

- Paymentus Holdings recently reported a substantial 71% year-on-year gain in earnings per share and a 49% increase in revenue, reaching US$1.00 billion, while maintaining stable EBIT margins.

- An interesting aspect is that insiders hold a significant 28% stake and the CEO’s pay is well below the industry median, reinforcing strong internal alignment with broader shareholder interests.

- We’ll explore how this surge in earnings growth and strong insider alignment could influence Paymentus Holdings’ investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Paymentus Holdings Investment Narrative Recap

To be a Paymentus Holdings shareholder, an investor needs to believe in continued digital transformation driving robust demand for automated bill payment solutions, and count on the company’s ability to win and retain large enterprise clients without eroding profit margins. The recent surge in earnings and revenue affirms operational progress, but its near-term effect on the top catalyst, expanding enterprise adoption, appears incremental, with ongoing margin pressure from volume discounts still the key risk.

The most relevant recent announcement is Paymentus' Q2 2025 results, which showed both earnings and revenue growth while maintaining EBIT margins. This performance signals resilience amid client mix shifts, reinforcing enterprise wins as an ongoing growth catalyst, but does not eliminate the lingering risk of margin compression as large customers demand lower pricing.

By contrast, investors should be aware that while growth has accelerated, Paymentus’ growing reliance on large, high-volume enterprise clients means sudden contract changes or pricing concessions could quickly shift...

Read the full narrative on Paymentus Holdings (it's free!)

Paymentus Holdings' narrative projects $1.8 billion in revenue and $125.3 million in earnings by 2028. This requires 19.0% yearly revenue growth and a $69.2 million earnings increase from the current $56.1 million.

Uncover how Paymentus Holdings' forecasts yield a $39.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

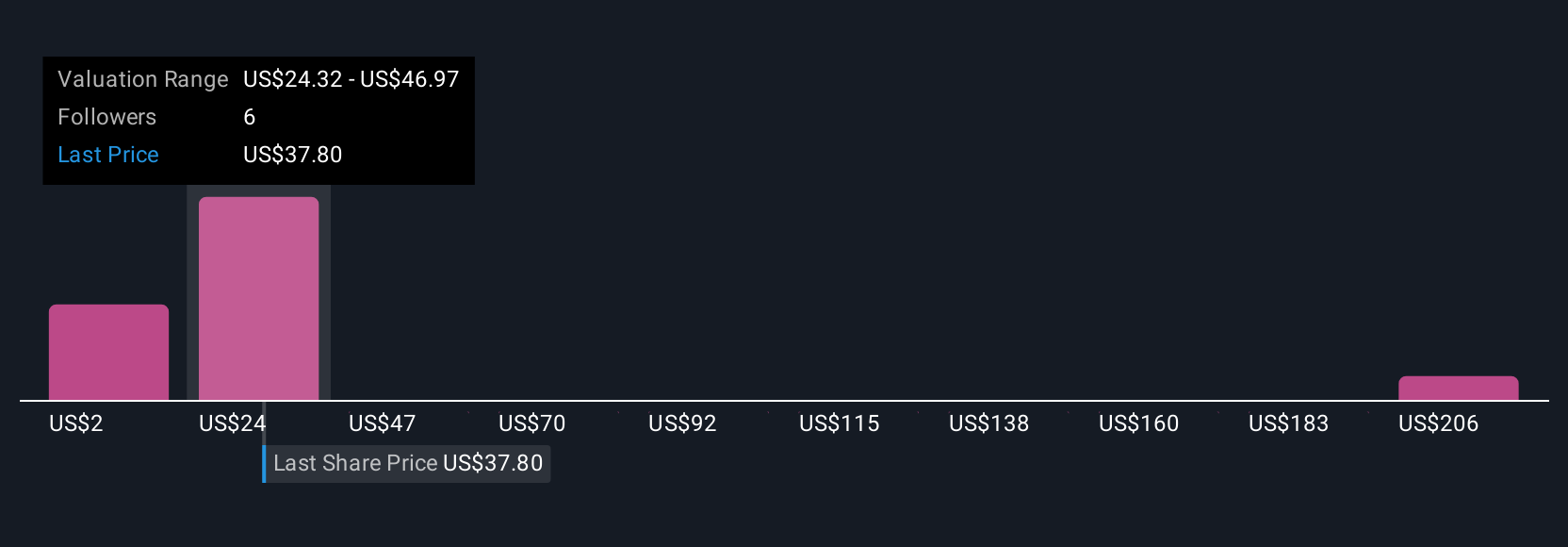

Five fair value estimates from the Simply Wall St Community span a US$1.71 to US$228.15 range, reflecting wide divergence among retail outlooks. While many expect sizable growth, concerns remain about whether operating margins can withstand ongoing customer pricing demands as Paymentus scales.

Explore 5 other fair value estimates on Paymentus Holdings - why the stock might be worth less than half the current price!

Build Your Own Paymentus Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paymentus Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Paymentus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paymentus Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAY

Paymentus Holdings

Provides cloud-based bill payment technology and solutions in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives