- United States

- /

- Diversified Financial

- /

- NYSE:PAGS

Does the Recent Price Drop Offer Opportunity in PagSeguro Digital in 2025?

Reviewed by Bailey Pemberton

If you hold shares in PagSeguro Digital, or you are wondering if now is the right time to make a move, you are not alone. The past few months have been anything but calm for the stock, with the price dropping 18.3% in the last month and another 4.5% over the past week. Still, if you zoom out, things get a bit more interesting: the stock is up 36.8% year-to-date, even though it has struggled over the past three and five years. This roller coaster might feel confusing, but it is exactly what makes PagSeguro Digital such a fascinating company to analyze right now.

Much of the recent volatility ties back to shifts in Brazil's macroeconomic landscape and competitive payment processing sector. As new fintech entrants shake things up, investors continuously reassess both risks and growth prospects. With all eyes on the evolving payments market, understanding whether PagSeguro Digital's current share price reflects true value is more important than ever.

When it comes to valuation, there is a lot to unpack. On a classic scoring system, where a higher score means the company appears more undervalued, PagSeguro Digital clocks in at a 5 out of 6. That is a clear signal to dig deeper. Coming up, I will break down the nuts and bolts of these valuation checks so you can see how the numbers stack up today. But first, let us make sense of the methods themselves and hint at a more powerful way to look at value further on in the article.

Approach 1: PagSeguro Digital Excess Returns Analysis

The Excess Returns Model values a company by comparing the profits it earns to the minimum returns required by investors. It focuses on how much value is created over and above the expected cost of equity. This method is especially effective when assessing businesses with steady profitability and thoughtful capital allocation, such as PagSeguro Digital.

For PagSeguro Digital, the model’s key metrics are compelling. The company’s Book Value stands at $49.97 per share, with analysts projecting a Stable EPS of $9.11 per share (based on future Return on Equity estimates from 10 analysts). The Cost of Equity is $6.24 per share, meaning PagSeguro Digital is expected to generate an Excess Return of $2.87 per share above this threshold. Its Average Return on Equity is 16.00%. The Stable Book Value is forecasted at $56.91 per share, based on estimates from 6 analysts.

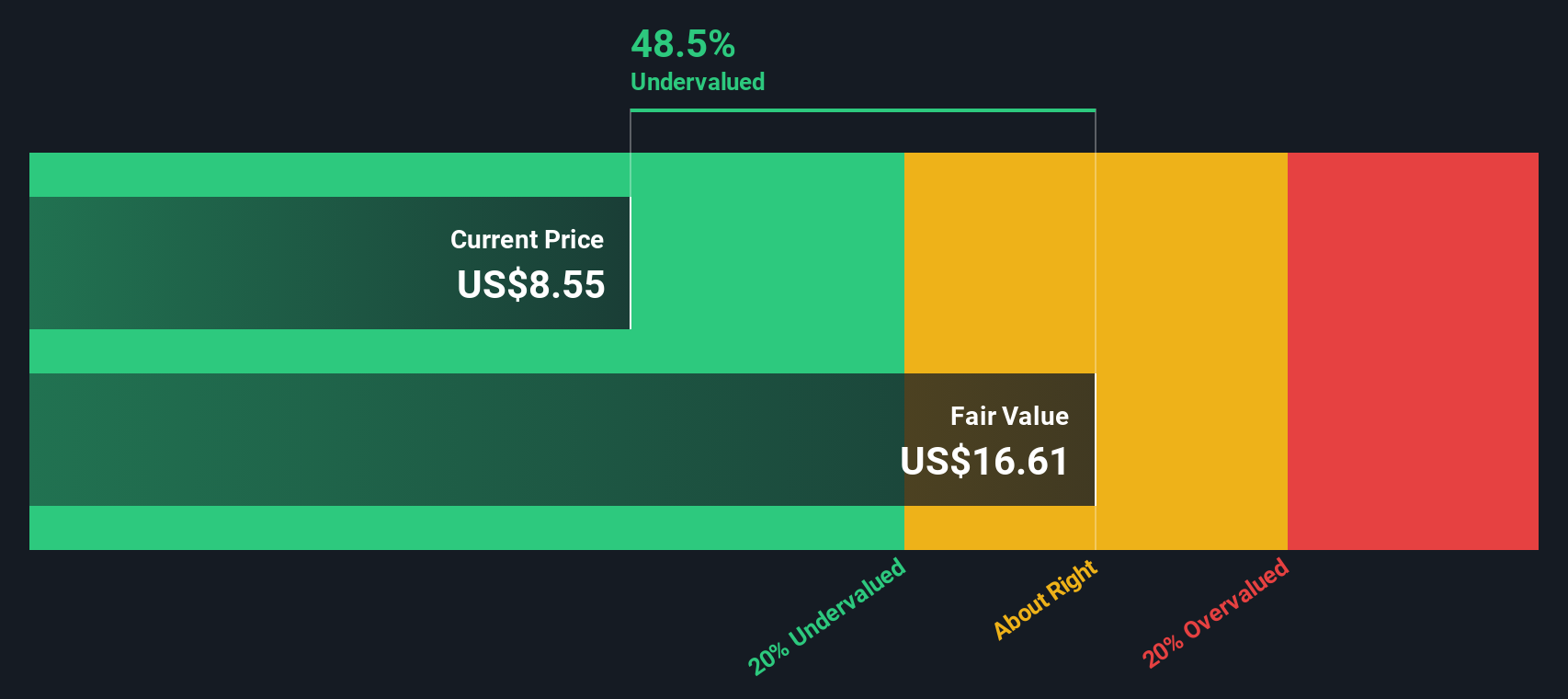

According to the Excess Returns Model, these figures translate into an intrinsic value of $17.14 per share. Compared to the current market price, this suggests the stock is approximately 48.8% undervalued. The data points to meaningful upside potential for investors focused on long-term returns and operational efficiency.

Result: UNDERVALUED

Our Excess Returns analysis suggests PagSeguro Digital is undervalued by 48.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: PagSeguro Digital Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested metric for valuing profitable companies like PagSeguro Digital. It works particularly well here because PagSeguro has a positive earnings track record, making it relevant to assess how much investors are willing to pay for each dollar of earnings today.

What counts as a “fair” PE ratio depends on factors such as how fast a company is expected to grow and the level of risk investors associate with it. Generally, companies with stronger growth prospects or lower risk deserve higher PE ratios, while slower growers or riskier businesses typically trade at a discount to the market or sector average.

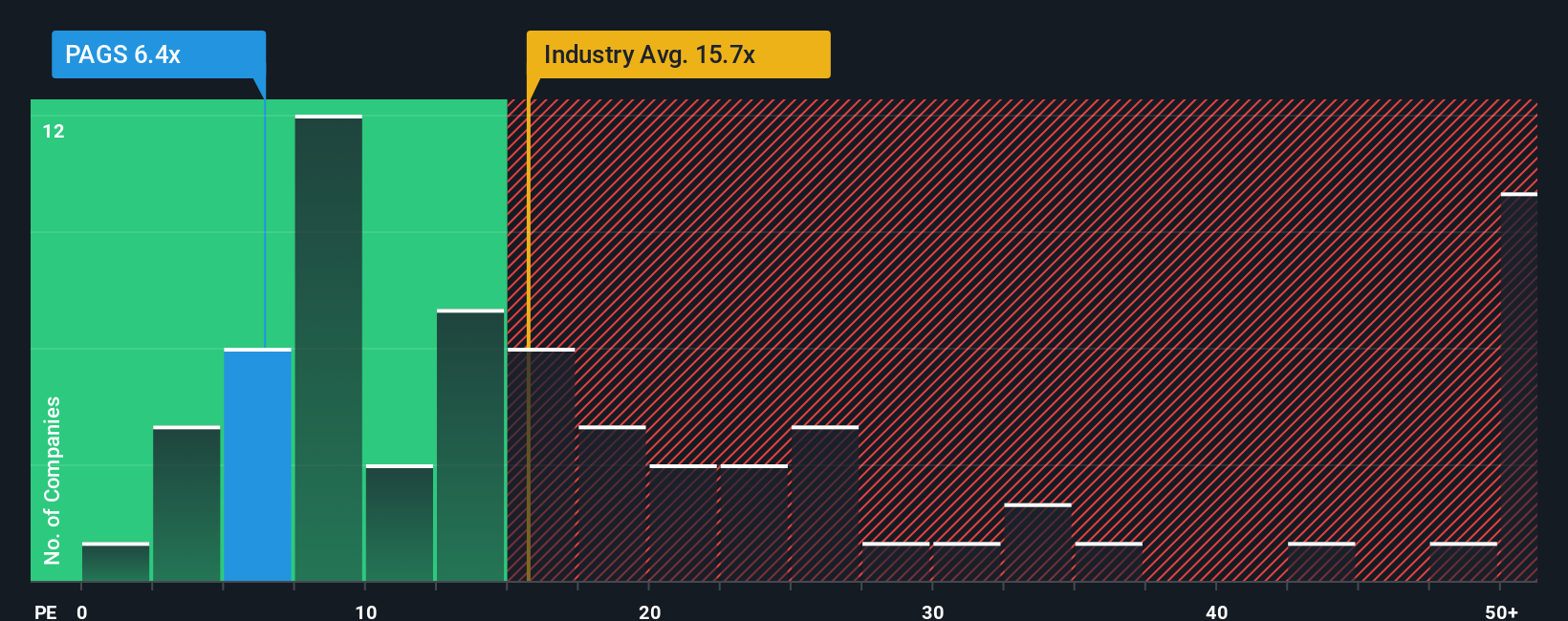

PagSeguro Digital currently trades at a PE of 6.36x. For context, the Diversified Financial industry averages 15.90x, and the peer group sits at 12.03x. Simply Wall St’s Fair Ratio is an advanced benchmark that incorporates factors like PagSeguro’s profits, expected growth, market cap, risk profile, and industry landscape, and lands at 14.92x. Unlike a simple comparison to industry or peers, the Fair Ratio paints a fuller picture by reflecting company-specific details that truly influence value.

Given PagSeguro Digital’s current 6.36x PE versus a Fair Ratio of 14.92x, the stock appears meaningfully undervalued based on earnings fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PagSeguro Digital Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your unique story for a company, linking your perspective to numbers by outlining your expectations for PagSeguro Digital’s future revenue, earnings, and margins. These elements are then connected to a fair value.

On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive tool to map out these stories and forecasts. Narratives let you decide when to buy or sell by comparing your personalized Fair Value to the latest Price. They automatically update when news or earnings are released, so your view always reflects the most recent information.

For example, when it comes to PagSeguro Digital, some investors may see strong revenue growth and margin expansion, arriving at a fair value of $13.98 per share. More cautious users might forecast lower earnings and see a fair value as low as $5.17 per share. This makes Narratives a dynamic and accessible way for you to form opinions, visualize scenarios, and invest with greater confidence.

Do you think there's more to the story for PagSeguro Digital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAGS

PagSeguro Digital

Engages in the provision of financial and payment solutions for consumers, individual entrepreneurs, micro-merchants, and small and medium-sized companies in Brazil and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives