- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital’s $3B Data Center Bet: A Fresh Lens on Valuation After OpenAI Investment

Reviewed by Simply Wall St

Blue Owl Capital (NYSE:OWL) just revealed a $3 billion investment in a New Mexico data center supporting OpenAI’s Stargate AI project. This move signals Blue Owl’s drive to increase its footprint in technology and digital infrastructure.

See our latest analysis for Blue Owl Capital.

Blue Owl’s $3 billion push into AI infrastructure arrives on the heels of several notable moves, including a new home equity securitization and a fresh quarterly dividend. Despite this momentum, the stock’s share price return is down 36% year-to-date, while the three-year total shareholder return remains a robust 42%. This illustrates a story of recent pressure but longer-term gains that keep the outlook interesting.

If you’re keeping an eye on how capital is driving shifts in tech, this is a perfect time to discover See the full list for free.

With Blue Owl’s share price tumbling this year despite bold bets on AI and steady dividend growth, investors are left pondering a key question: is this an overlooked value play, or is the market already factoring in future upside?

Most Popular Narrative: 36.5% Undervalued

Blue Owl Capital’s narrative fair value of $23.73 implies significant upside from the recent $15.08 close, dramatically outpacing current market sentiment. The stage is set for a deeper look at the structural drivers and assumptions behind this bullish narrative.

Structural shifts away from traditional bank lending toward private lenders, combined with robust demand for alternative credit and asset-backed finance, are enabling large pipeline growth and high deployment opportunities. This is directly supporting future AUM growth and an upward trajectory in revenues. The broadening of access to private market products, recent partnerships for retirement plans (401(k) channel), international expansion, and consistently strong fundraising in both institutional and private wealth channels all expand the total addressable market. This supports long-term, sustainable increases in fee-related earnings.

What is really fueling this valuation? The narrative leans on powerful growth projections, ambitious margin expansion, and an earnings trajectory that would surprise even most industry optimists. Explore which financial leap of faith underpins the current fair value. The answer may upend your assumptions.

Result: Fair Value of $23.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story is not without challenges. Blue Owl’s rapid expansion and reliance on steady capital inflows could quickly shift the risk-reward balance.

Find out about the key risks to this Blue Owl Capital narrative.

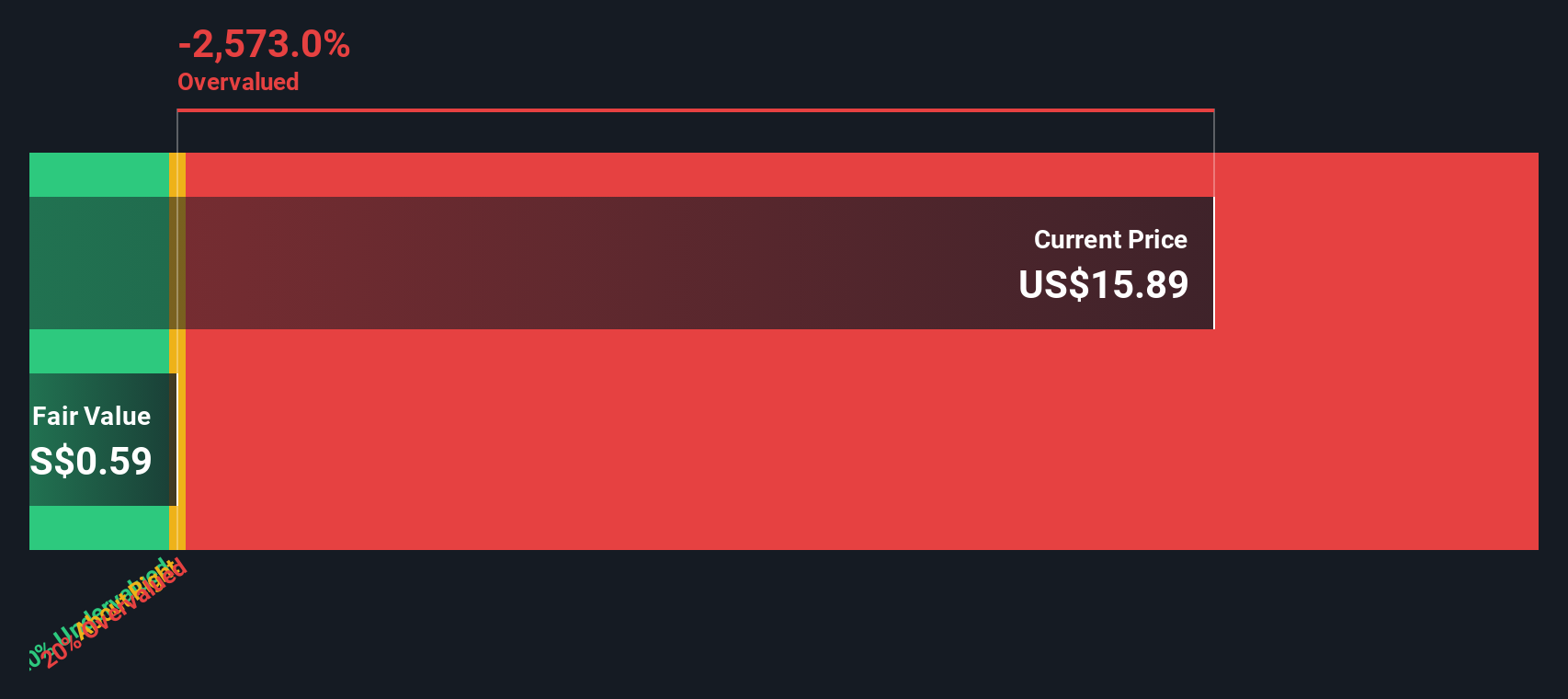

Another View: Not All Models Agree

While narrative-based fair value implies Blue Owl is meaningfully undervalued, our SWS DCF model tells a very different story. According to this approach, the shares are actually trading well above their estimated fair value. How should investors weigh these sharply conflicting signals? Are the risks or rewards being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Blue Owl Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Blue Owl Capital Narrative

If the current story doesn’t fit your perspective, or you trust your own analysis more, you’re only a few minutes away from building and sharing your own view. Do it your way

A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at a single opportunity. Broaden your horizons with strategies built to uncover tomorrow’s winners and unlock your next potential outperformance.

- Spot overlooked potential and seize the moment with these 3576 penny stocks with strong financials, which are on the verge of delivering outsized returns.

- Access steady income opportunities by tapping into these 14 dividend stocks with yields > 3%, which consistently reward shareholders year after year.

- Embrace technological change by targeting these 25 AI penny stocks, pushing the boundaries of artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives