- United States

- /

- Capital Markets

- /

- NYSE:OWL

Blue Owl Capital (OWL): Assessing Valuation After Recent Price Fluctuations

Reviewed by Simply Wall St

Blue Owl Capital (NYSE:OWL) saw its shares edge up by about 2% today, drawing investor attention as market participants consider the factors driving recent price movement. Over the past month, the stock’s performance has been somewhat mixed, prompting questions about its valuation and future prospects.

See our latest analysis for Blue Owl Capital.

Blue Owl Capital’s recent share price volatility is playing out against a backdrop of fading momentum, with a year-to-date share price return of -29% and a 1-year total shareholder return of -25%. Despite these declines, the company remains well above its level from three years ago, supported by a strong 86% total shareholder return over that longer period.

If the ups and downs in the financial sector have you looking further afield, consider broadening your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets and mixed recent performance, the key question emerges: is Blue Owl Capital currently undervalued, or are investors already incorporating its future growth prospects into the share price?

Most Popular Narrative: 30.3% Undervalued

Blue Owl Capital’s most-followed narrative points to a fair value far above the last close of $16.68, suggesting current prices lag behind upbeat forecasts. These optimistic projections reflect a markedly different outlook from the recent dip in share price and raise intrigue about what could unlock value ahead.

Structural shifts away from traditional bank lending toward private lenders, combined with robust demand for alternative credit and asset-backed finance, are enabling large pipeline growth and high deployment opportunities. This directly supports future AUM growth and an upward trajectory in revenues.

Want to know the kind of expansion story that could drive a valuation this high? The growth forecast isn’t just steady. It focuses on a seismic market change and some bold margin moves behind the scenes. What are the specific assumptions about future profits and business mix powering this projection? Click to see what numbers truly built this case.

Result: Fair Value of $23.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid expansion through acquisitions, combined with a slowdown in capital inflows, could challenge Blue Owl’s growth and impact future earnings and margins.

Find out about the key risks to this Blue Owl Capital narrative.

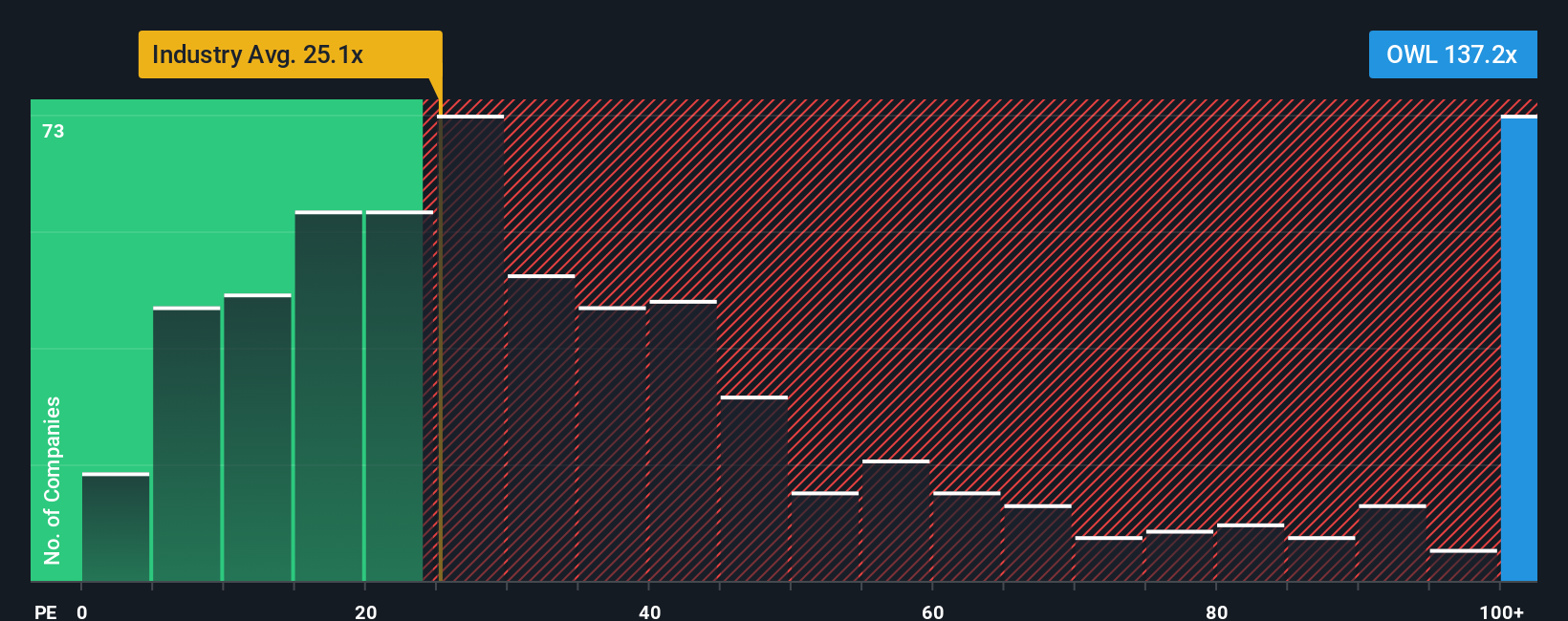

Another View: Looking at the Price-to-Earnings Ratio

Our second lens focuses on the standard price-to-earnings ratio, which puts Blue Owl Capital at 144x. This is well above the US Capital Markets average of 26.6x, its peer group at 13.6x, and even our regression-based fair ratio of 52.2x. This significant gap raises questions about whether today's valuation may be running hot, increasing risk if expectations disappoint. Which story will play out for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blue Owl Capital Narrative

If you see the numbers differently, or want to investigate your own angles, you can build your own Blue Owl Capital story in under three minutes with Do it your way.

A great starting point for your Blue Owl Capital research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investment journey by seeing what other opportunities are poised to outperform. Your next winning idea could be just a click away.

- Capitalize on high yields by browsing these 17 dividend stocks with yields > 3% offering strong income potential well above market averages.

- Spot tomorrow’s tech trailblazers when you tap into these 27 AI penny stocks making remarkable progress at the forefront of AI innovation.

- Find value gems others have missed by scanning these 877 undervalued stocks based on cash flows that trade far below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives