- United States

- /

- Capital Markets

- /

- NYSE:OWL

Are Shifting Views on AI and Private Credit Reshape Blue Owl (OWL)'s Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- Blue Owl Capital has recently faced increased scrutiny as investor sentiment towards private credit fund managers turned more cautious, primarily fueled by skepticism over artificial intelligence data centre investments and challenges in merging its credit funds.

- Despite leadership reassurances and ongoing participation in major financing deals, including Clio's US$1 billion vLex acquisition, market apprehensions remain focused on the long-term viability of Blue Owl's private credit and AI strategies.

- We'll now explore how these shifting perceptions around AI data centre investments and private credit are influencing Blue Owl Capital's investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Blue Owl Capital Investment Narrative Recap

To be a Blue Owl Capital shareholder today, you need to believe in the momentum of private credit and alternative investment platforms, as well as the company's position as a leader in AI-related digital infrastructure. Recent scrutiny on private credit managers and skepticism about AI data centre investments has increased market anxiety, but these factors have not materially altered the core catalyst for Blue Owl: continued growth in permanent capital vehicles. The biggest risk remains potential fundraising slowdowns during adverse market cycles.

Among the recent announcements, Blue Owl’s US$350 million role in the financing of Clio’s US$1 billion vLex acquisition offers a timely reminder that the firm is still actively participating in high-profile deals, despite market concerns. Such transactions reinforce Blue Owl’s platform strength, even as ongoing doubts about the private credit and AI strategies persist.

But in contrast to management’s reassurances, investors should be aware of the possible consequences if Blue Owl’s ambitious expansion and acquisitions fail to deliver the expected synergies or efficiencies...

Read the full narrative on Blue Owl Capital (it's free!)

Blue Owl Capital's narrative projects $4.2 billion in revenue and $5.1 billion in earnings by 2028. This requires 17.5% yearly revenue growth and an earnings increase of about $5.0 billion from current earnings of $75.4 million.

Uncover how Blue Owl Capital's forecasts yield a $21.40 fair value, a 43% upside to its current price.

Exploring Other Perspectives

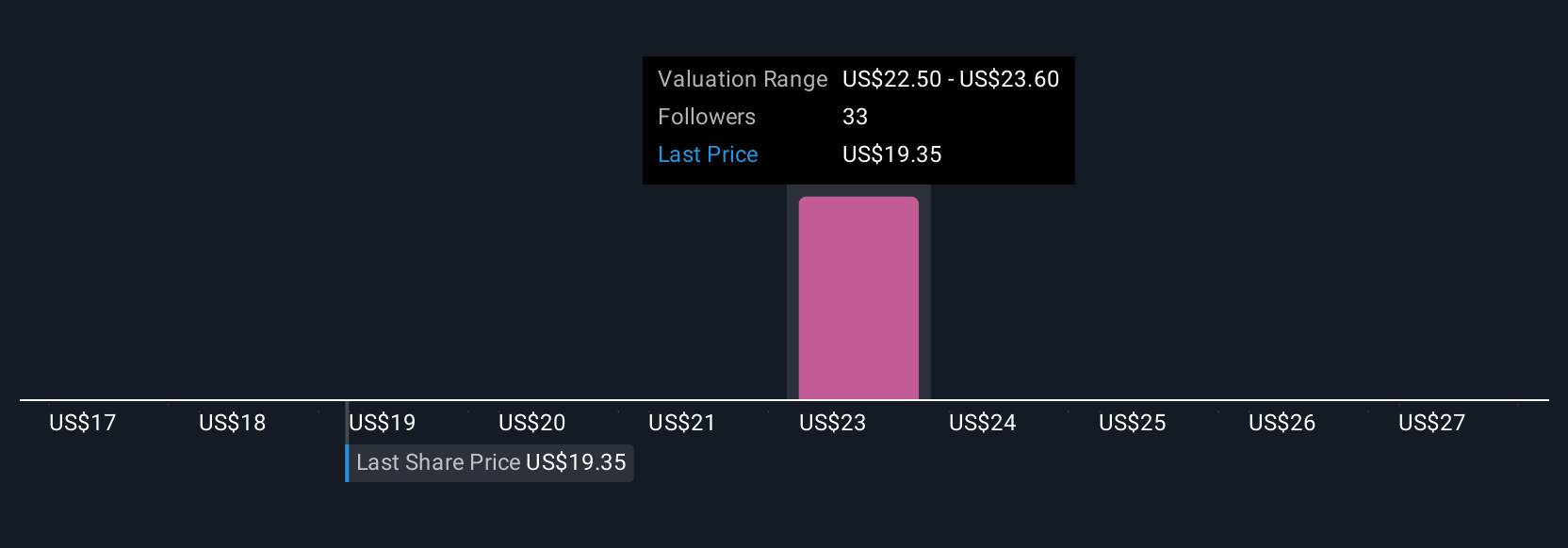

Six fair value estimates by the Simply Wall St Community for Blue Owl Capital range from US$0.54 to US$28, reflecting strong differences in how future earnings potential is assessed. This wide spread comes as ongoing caution about private credit fundraising could impact the fundamental drivers believed to support management fee growth, prompting you to weigh multiple viewpoints before drawing firm conclusions.

Explore 6 other fair value estimates on Blue Owl Capital - why the stock might be worth less than half the current price!

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026