- United States

- /

- Mortgage REITs

- /

- NYSE:ORC

Orchid Island Capital (ORC): Evaluating Valuation Following Strong Quarterly Results and Renewed Investor Optimism

Reviewed by Simply Wall St

Orchid Island Capital reported its third quarter results, showing higher than expected net income and solid liquidity. Management pointed to stable interest rates and prudent risk management as factors strengthening confidence among investors.

See our latest analysis for Orchid Island Capital.

Following the upbeat quarterly results and ongoing share buybacks, Orchid Island Capital’s share price has shown renewed momentum in recent weeks. The 1-month share price return is nearly 10%, and the 1-year total shareholder return is 17%. The combination of strong earnings, rising dividends, and consistent capital returns appears to be attracting investors seeking both income and growth potential, setting a more optimistic tone for the months ahead.

If you’re looking for new ideas beyond the typical picks, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

Yet with such strong earnings and upbeat analyst ratings already fueling a double-digit monthly return, investors must ask whether Orchid Island Capital is undervalued at current levels or if the market is already pricing in future growth.

Most Popular Narrative: 4.5% Undervalued

Comparing the narrative fair value of $8.00 to the company’s last close price of $7.64, the valuation case sees room for upside. This sets the stage for a potent argument around future drivers of Orchid Island Capital's returns.

The confluence of historically wide mortgage spreads over swaps (circa 200 bps on production coupons) and low market volatility presents a rare opportunity for Orchid Island Capital to acquire high-carry, attractively priced assets and hedge effectively. This positions the company for margin expansion and sustained earnings growth as spreads eventually normalize.

Curious where the next profit boom could emerge? A bold projection of skyrocketing margins and extraordinary bottom-line growth underpins this estimate. But what stunning financial maneuvers and strategic bets make this narrative so confident? Unlock these details and discover the numbers that could change everything.

Result: Fair Value of $8.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or equity dilution could quickly temper this optimism and put Orchid Island Capital’s growth prospects at risk.

Find out about the key risks to this Orchid Island Capital narrative.

Another View: A Look at Market Multiples

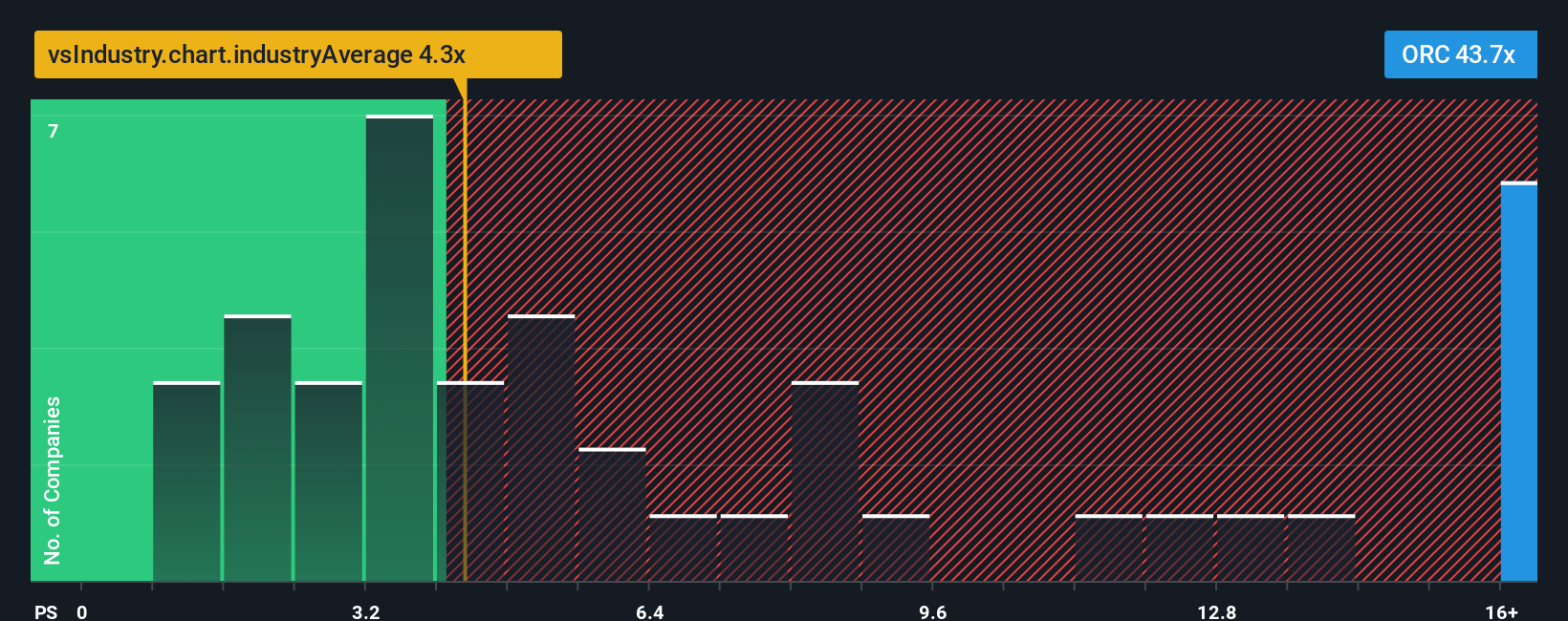

While analysts point to an undervalued fair value versus Orchid Island Capital’s current price, the market’s pricing tells a different story. The price-to-sales ratio sits at 47.8x, vastly higher than both the industry average of 4.3x and peers at 5x. Such a wide gap suggests investors may be paying a hefty premium today. Could this signal future risk if expectations do not play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orchid Island Capital Narrative

If you see things differently or want to dive deeper into the facts yourself, you can build your own take in just a few minutes with Do it your way.

A great starting point for your Orchid Island Capital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Let’s make sure you’re not missing smarter opportunities. Use Simply Wall Street’s free screener to spot high-potential stocks before others catch on.

- Uncover unique value by reviewing these 870 undervalued stocks based on cash flows that the market might be overlooking and get ahead of the next big upswing.

- Capture recurring income by scanning for these 17 dividend stocks with yields > 3% with robust yields and proven payout records.

- Boost your portfolio’s tech edge by tapping into these 27 AI penny stocks, where artificial intelligence and innovation fuel tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORC

Orchid Island Capital

A specialty finance company, invests in residential mortgage-backed securities (RMBS) in the United States.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives