- United States

- /

- Mortgage REITs

- /

- NYSE:ORC

How Investors Are Reacting To Orchid Island Capital (ORC) Beating Earnings Expectations and Boosting Share Buybacks

Reviewed by Sasha Jovanovic

- Orchid Island Capital reported third-quarter 2025 earnings that exceeded analyst expectations, with net income rising to US$72.08 million and basic earnings per share from continuing operations reaching US$0.53, alongside revenue significantly above consensus forecasts.

- An important insight is that the company paired this strong performance with robust liquidity, ongoing share repurchases, and confirmation of its monthly dividend, reinforcing management's focus on capital return and financial flexibility amid evolving market conditions.

- We'll examine how Orchid Island Capital's stronger-than-expected earnings and active buyback program influence its investment outlook and potential growth trajectory.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Orchid Island Capital Investment Narrative Recap

To be a shareholder in Orchid Island Capital, you must believe in the company’s ability to generate enduring returns from its agency RMBS portfolio, supported by disciplined capital management and effective interest rate risk controls. The latest strong earnings report is encouraging, but the most important short-term catalyst, potential for margin expansion from wide mortgage spreads, remains largely driven by broader market conditions, while the biggest risk from persistent rate volatility has not materially changed.

Among recent developments, Orchid Island’s substantial share repurchase, over 14 million shares bought back in just a few months, stands out, providing meaningful support for the stock and signaling management’s focus on shareholder value during a period of robust earnings. This aggressive buyback could bolster per-share results and help mitigate the risk of dilution, but its benefit is still tied to prevailing market spreads and the company's ongoing access to favorable funding.

On the other hand, investors should keep in mind the company’s continued exposure to interest rate volatility and the impact this could have on Orchid Island’s book value, since...

Read the full narrative on Orchid Island Capital (it's free!)

Orchid Island Capital's narrative projects $401.3 million revenue and $397.4 million earnings by 2028. This requires 154.8% yearly revenue growth and a $391 million earnings increase from $6.4 million currently.

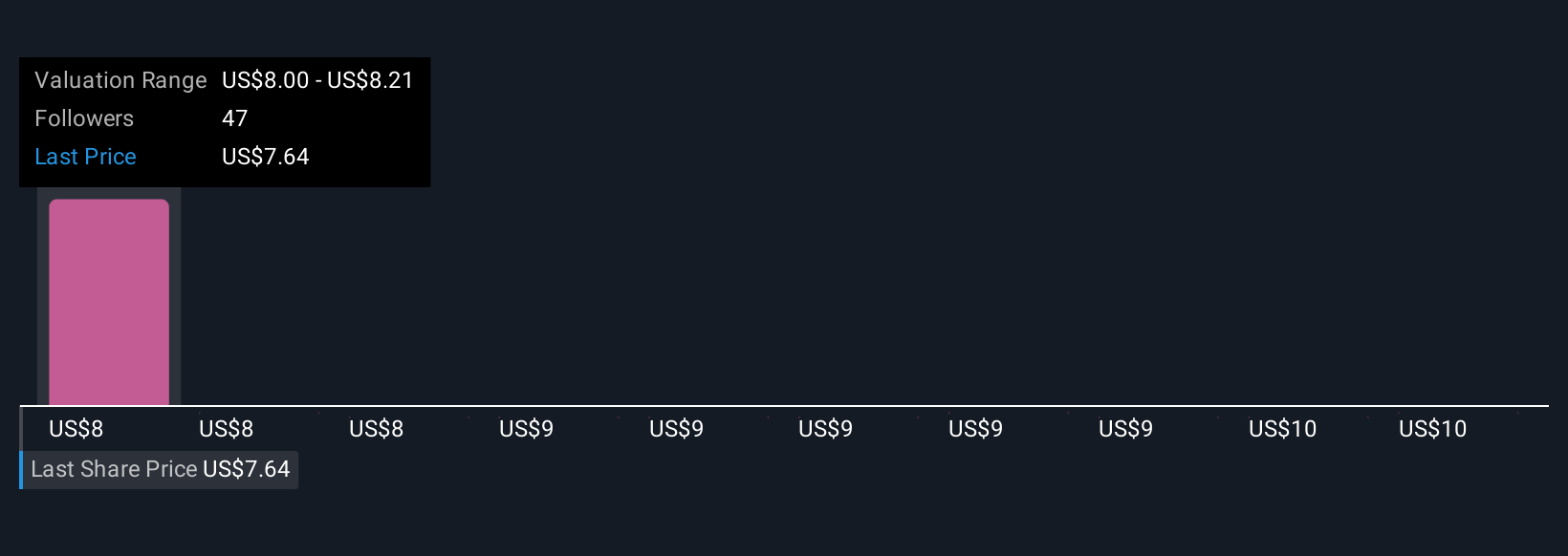

Uncover how Orchid Island Capital's forecasts yield a $8.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members estimate Orchid Island Capital’s fair value between US$8.00 and US$10.14 per share, revealing diverse personal models. Despite these perspectives, the risk of mortgage spread volatility remains a critical factor worth considering for anyone evaluating future performance.

Explore 6 other fair value estimates on Orchid Island Capital - why the stock might be worth as much as 33% more than the current price!

Build Your Own Orchid Island Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orchid Island Capital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Orchid Island Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Orchid Island Capital's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORC

Orchid Island Capital

A specialty finance company, invests in residential mortgage-backed securities (RMBS) in the United States.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives