- United States

- /

- Capital Markets

- /

- NYSE:OPY

Oppenheimer Holdings Inc.'s (NYSE:OPY) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Oppenheimer Holdings Inc. (NYSE:OPY) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 67%.

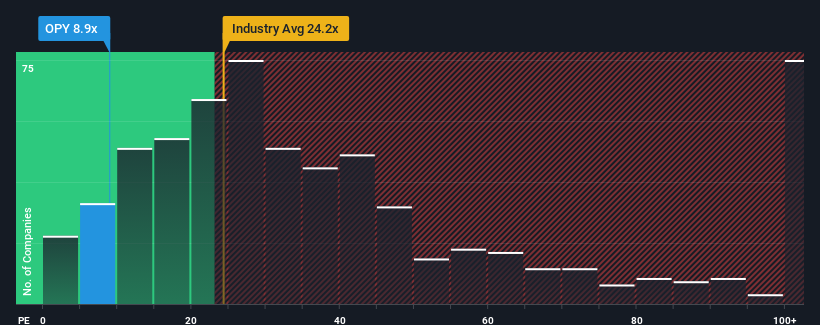

Although its price has surged higher, Oppenheimer Holdings' price-to-earnings (or "P/E") ratio of 8.9x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 36x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, Oppenheimer Holdings has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Oppenheimer Holdings

How Is Oppenheimer Holdings' Growth Trending?

In order to justify its P/E ratio, Oppenheimer Holdings would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 83% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 51% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's an unpleasant look.

With this information, we are not surprised that Oppenheimer Holdings is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Oppenheimer Holdings' P/E?

Oppenheimer Holdings' recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Oppenheimer Holdings maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Oppenheimer Holdings that we have uncovered.

You might be able to find a better investment than Oppenheimer Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OPY

Oppenheimer Holdings

Operates as a middle-market investment bank and full-service broker-dealer in the Americas, Europe, the Middle East, and Asia.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives