- United States

- /

- Consumer Finance

- /

- NYSE:OPFI

OppFi (OPFI): Net Margin Falls to 1.2%, Challenging Growth Story Despite High Valuation

Reviewed by Simply Wall St

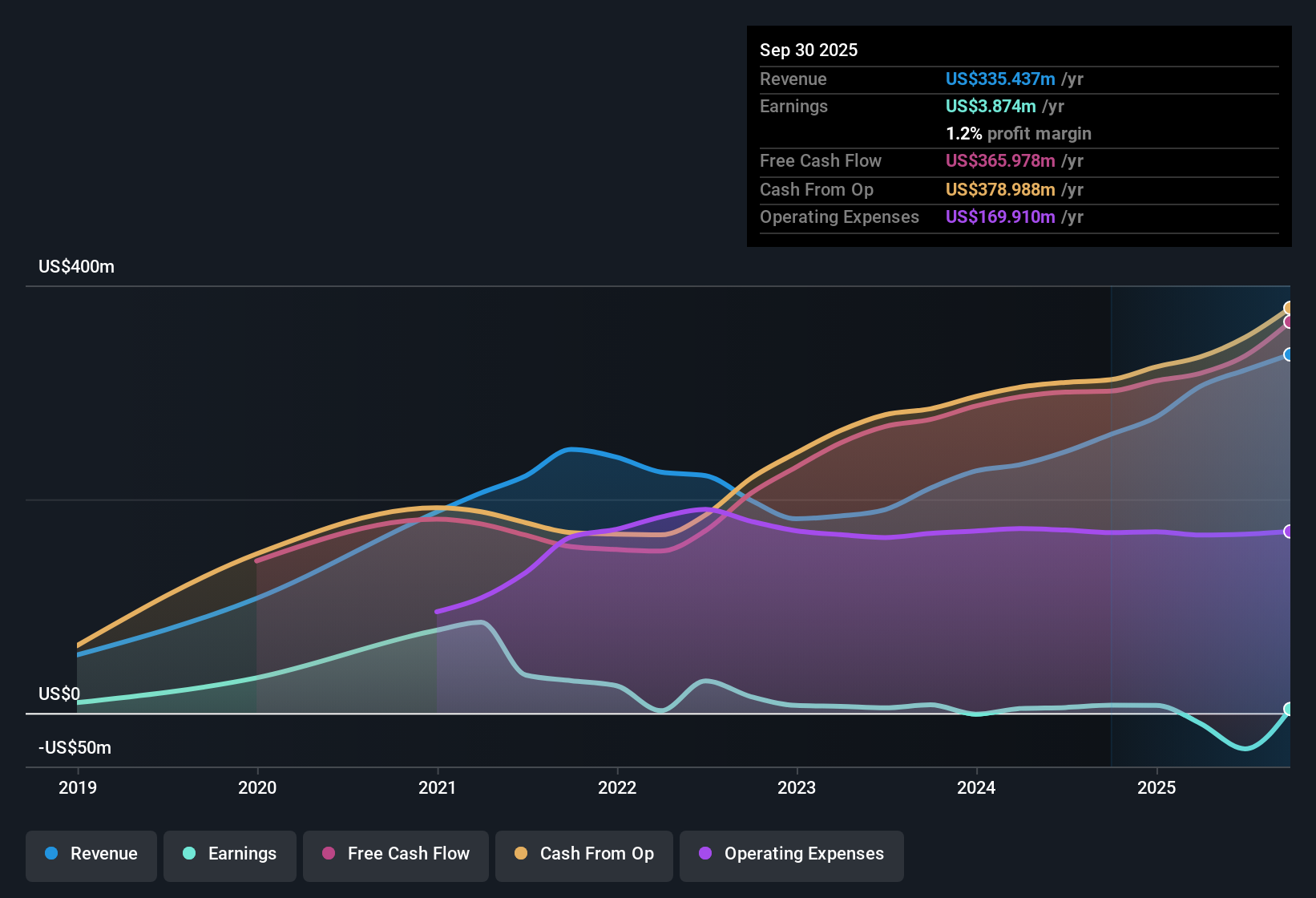

OppFi (OPFI) reported its net profit margin at 1.2%, down from last year’s 2.8%, and has seen earnings decline by an average of 72.6% per year over the past five years. Still, analyst forecasts project annual earnings growth of 123.7% and revenue growth of 28.4% going forward, positioning future results well above typical U.S. market expectations.

See our full analysis for OppFi.Next up, we will see how these headline figures match up with the market consensus and narrative, and whether the story around OppFi really holds up to the numbers.

See what the community is saying about OppFi

PE Ratio at 71.9x Signals Expensive Growth Bet

- OppFi’s current P/E ratio of 71.9x is dramatically higher than both the consumer finance industry average of 10x and its peer group average of 1.7x. This reflects aggressive market expectations for future earnings expansion.

- According to the analysts' consensus view, this steep valuation is only justified if rapid earnings growth continues as projected. Points of tension include:

- Forecasts expect profit margins to swing from -10.4% today to 17.9% over the next three years, supporting the idea of significant operational turnaround.

- However, if these dramatic gains fall short or market competition heats up, current shareholders face substantial downside from today’s premium versus both peers and the DCF fair value of $2.29, which is a sharp gap relative to the $9.75 share price.

To see how the consensus narrative plays out as OppFi’s valuation evolves, check out the full analyst breakdown and long-term forecast in the consensus narrative link below. 📊 Read the full OppFi Consensus Narrative.

Analyst Targets 45% Higher Than Market Price

- The latest analyst average price target stands at $14.17, about 45% above OppFi’s current share price of $9.75, pointing to significant upside potential if forecasts materialize.

- Consensus narrative highlights robust projected growth and margin expansion, emphasizing:

- Revenue is expected to climb at a 40.5% annual pace, while profit is forecast to reach $159.4 million by 2028, indicating substantial scaling relative to recent years.

- Delivering on these growth rates would require OppFi to overcome challenges around scale, rising competition, and regulatory risks that have constrained peers in the sector.

Net Margins Remain Thin at 1.2%

- Net profit margin has slipped to just 1.2%, well below last year’s 2.8% and lagging the projected future margin of 17.9% cited in analyst models.

- The consensus narrative draws attention to this weak profitability today. Even as technology improvements and digital adoption are set to drive margin expansion, investors must weigh:

- Operating expense discipline and AI-driven underwriting are reducing costs as a percent of sales but haven’t yet substantially improved bottom-line margins.

- Sustaining future margin gains will depend on scaling up origination while diversifying product lines and holding off regulatory and industry headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OppFi on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the data that stands out? Share your perspective and craft your own narrative in just a few minutes. Do it your way

A great starting point for your OppFi research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

OppFi’s lofty valuation and thin profit margins highlight a company that is struggling to justify its premium price, given recent weak bottom-line performance.

If you want companies where the numbers and price align, check out these 834 undervalued stocks based on cash flows to find strong opportunities trading at more reasonable valuations right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OPFI

OppFi

A tech-enabled digital finance platform, provides financial products and services for banks in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives