- United States

- /

- Consumer Finance

- /

- NYSE:OMF

OneMain Holdings (OMF): Valuation Insights Following Strong Q3 Results and Major Capital Return Initiatives

Reviewed by Simply Wall St

OneMain Holdings (OMF) saw its stock make strong moves after a busy quarterly update. The company’s third quarter brought higher-than-expected earnings, a new $1 billion buyback program, and a 1% dividend bump, all signs of management’s confidence.

See our latest analysis for OneMain Holdings.

After surging on impressive third-quarter results and news of a fresh $1 billion buyback, OneMain Holdings has recorded a 1-month share price return of 9.2% and a year-to-date gain of 18.4%. The real highlight, however, is its notable 32.2% total shareholder return over the past year and an even more striking 165.6% total return across five years. This suggests momentum is building and long-term holders have been well rewarded.

If you’re interested in other stocks showing strong momentum and aligned management interests, now is a great time to discover fast growing stocks with high insider ownership

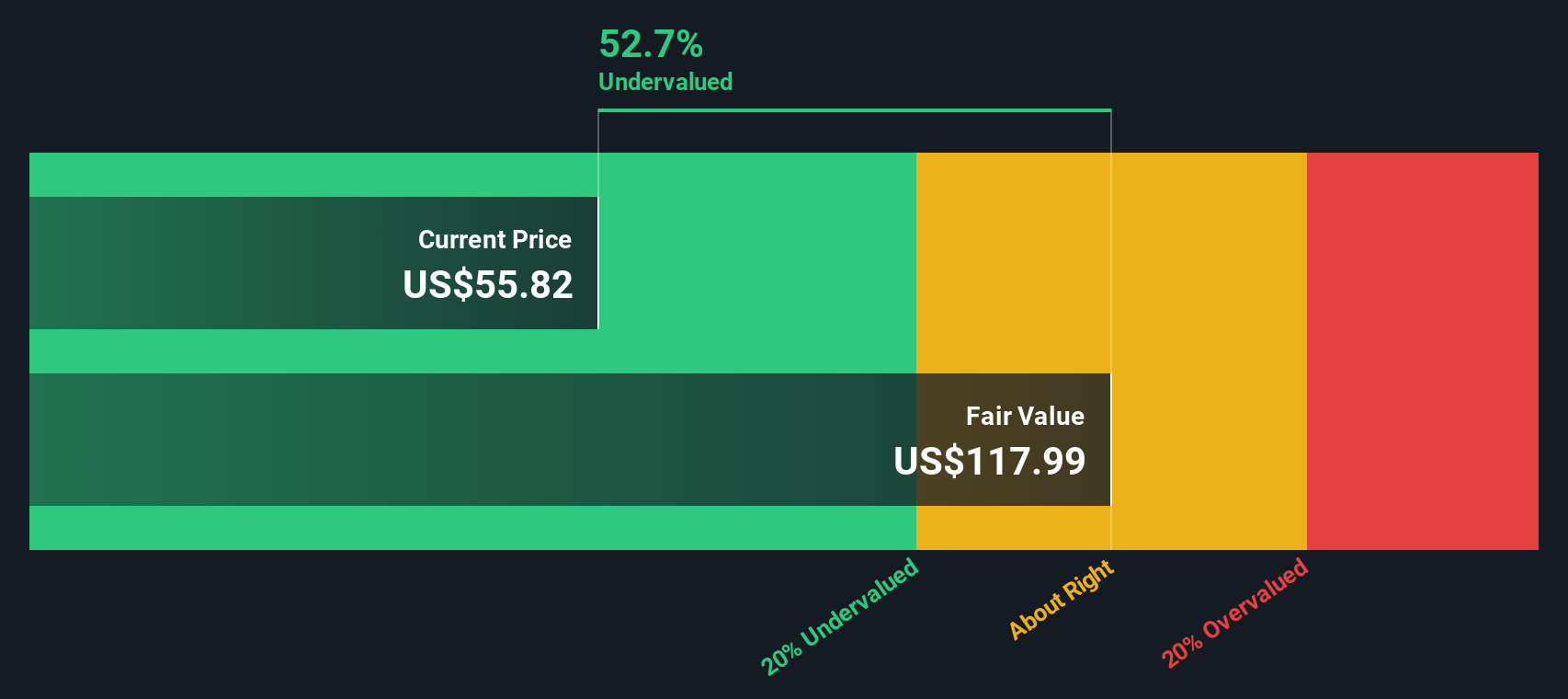

With these upbeat results and an active capital return program, the big question now emerges: is OneMain Holdings undervalued after its rally, or is the market already pricing in all of the company’s future growth?

Most Popular Narrative: 4.4% Undervalued

With OneMain Holdings last closing at $61.38 and the most followed narrative estimating a fair value at $64.21, the current price sits just below this consensus. Investors are now watching closely to see if projected growth can justify a continued push higher.

The accelerating digitization of financial services and OneMain's investment in its omni-channel lending platform, including enhanced digital offerings, automation of income verification, and cross-selling via mobile apps, reduces acquisition costs, widens customer reach, and is likely to support higher operating leverage and improved net margins.

Want the real story behind these optimistic numbers? Analysts are betting on a major shift in how this lender grows and manages costs, but you’ll need to see for yourself what kind of expansion and efficiency gains are fueling this price target. Could the future narrative reveal surprises hiding in plain sight?

Result: Fair Value of $64.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic headwinds and increased strain on low-income borrowers could challenge OneMain’s growth prospects and put recent credit quality gains at risk.

Find out about the key risks to this OneMain Holdings narrative.

Another View: Looking Through the SWS DCF Lens

While analyst consensus points to OneMain Holdings as slightly undervalued, our SWS DCF model draws a different line, showing the current share price of $61.38 is trading just above the estimated fair value of $59.96. This presents a subtle disconnect in expectations. Could the future be less certain than multiples suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OneMain Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OneMain Holdings Narrative

If you see things differently or want to dig deeper into the numbers, you can build your own perspective in minutes, your way with Do it your way

A great starting point for your OneMain Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Keep your edge by finding untapped potential beyond OneMain Holdings. Track tomorrow’s winners and get ahead with fresh strategies that put you in control.

- Uncover cash-rich companies reshaping industries by starting with these 839 undervalued stocks based on cash flows, your shortcut to stocks trading below their true worth.

- Fuel your income strategy with these 18 dividend stocks with yields > 3%, bringing reliable, high-yielding picks directly to your radar.

- Seize unique growth chances in technology by checking out these 27 AI penny stocks, delivering innovation in AI and setting new standards for market performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMF

OneMain Holdings

A financial service holding company, engages in the consumer finance and insurance businesses in the United States.

Exceptional growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives